Precious metals have had an awful month of November thus far with both silver and gold suffering significant declines while posting record losing streaks. Most notably silver has posted a record 14 consecutive losing sessions and is currently working on a 15th as I write this:

Silver (Daily)

Several things stand out to me regarding silver here:

- The recent decline has been steady and it has taken place on fairly average volume which indicates a scarcity of buyers, not super aggressive sellers.

- As volume picked up in recent days the rate of the decline slowed considerably which indicates buyers have been stepping in near support.

- Silver still has not breached its August low.

- We saw a significant speculative capitulation in the most recent CoT data and i’m sure that this week’s report will show more of the same:

Large speculators (hedge funds, CTAs, etc.) capitulated (cut net long exposure to silver) to the tune of roughly $1.5 billion during the week ending November 10th.

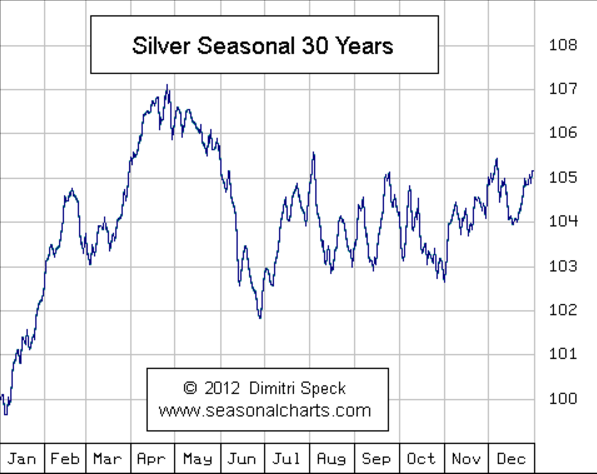

- Silver is now in a bullish seasonal period for the next few weeks (through the first week of December) and January is historically a very bullish month for silver:

Call me crazy but all of this adds up to a fairly attractive long entry point in this beaten down metal. For short term traders placing a stop just below the $13.90 level (in December silver) limits your risk to barely more than 1% with the potential to easily capture 5-10% of mean reversion should the seasonal tailwinds kick in.