While uranium has been oscillating between $35-$40/lb this year, uranium stocks have performed relatively poorly as the broader energy space has remained under pressure. However, things may be on the verge of undergoing a significant shift very soon:

Cameco (CCJ)

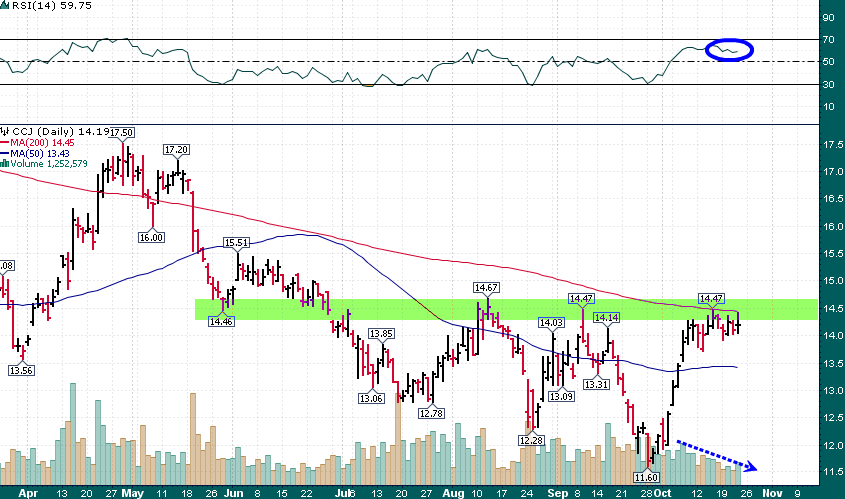

For the past couple of weeks the benchmark name in the uranium sector, Cameco (CCJ), has been forming a very tight ‘flag’ pattern at an important support/resistance level. Volume (declining) and price action (rangebound) have been characteristic of a textbook bullish flag. Moreover, with the relative strength index (RSI-14) coiled near the 60 level conditions are ripe for a breakout.

The more times a level is tested, especially within a relatively short period of time, the more likely the level is to be broken through. The $14.50 level which happens to intersect with the flattening 200-day moving average (key indicator of long-term trend) is the key nut to crack and a breakout above this level could quickly target a move up to the ~$17 area.

In addition to keeping a close eye on CCJ over the coming weeks, savvy investors will also want to put a handful of smaller uranium names (DML.TO, EFR.TO, FCU.TO, KIV.V, NXE.V, etc.) on their watch lists due to the potential for a sector wide rally.