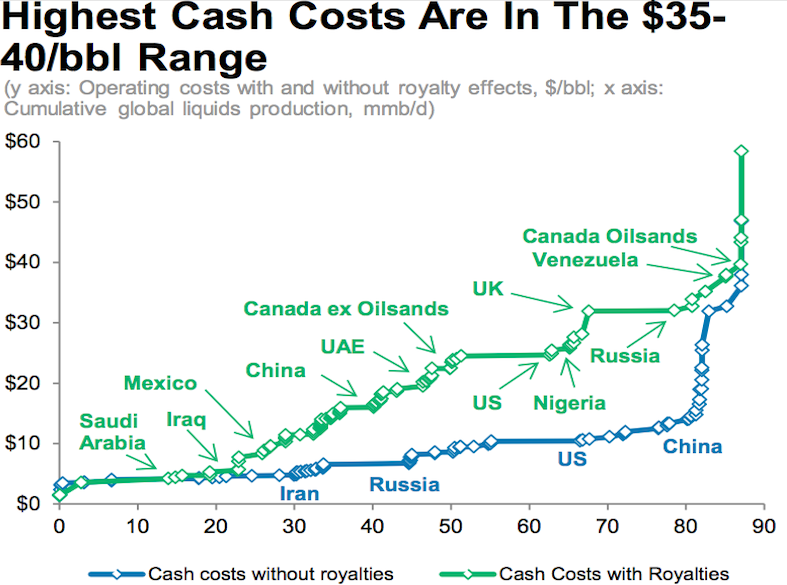

Remember this chart that was passed around quite a bit earlier in the year?

This chart has become important again as crude oil prices flirt with the $40/barrel level. Cash costs (variable operating costs) are distinct from the overall cost of an oil project because they are the costs associated with producing an additional barrel of oil from an existing project. Whereas ‘all-in costs’ include comprehensive costs including finding & developing costs etc.

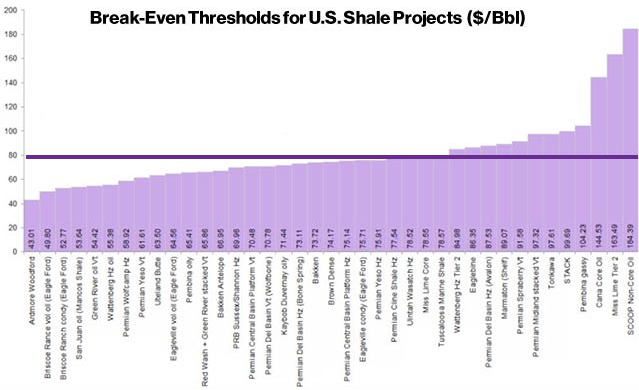

Higher cost Canadian Oilsands heavy oil and Venezuelan heavy oil are now at risk of coming off-line should crude prices fall much further. Moreover, not a single U.S. shale oil project is profitable on an all-in cost basis with oil below $40/barrel:

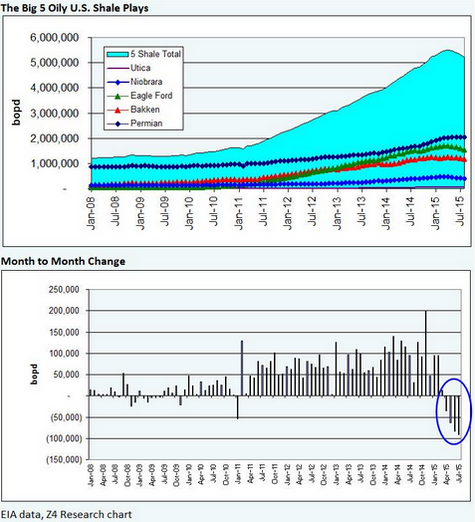

We have already begun to see a significant amount of production come off-line in the last few months and that trend is likely to have accelerated further in recent weeks:

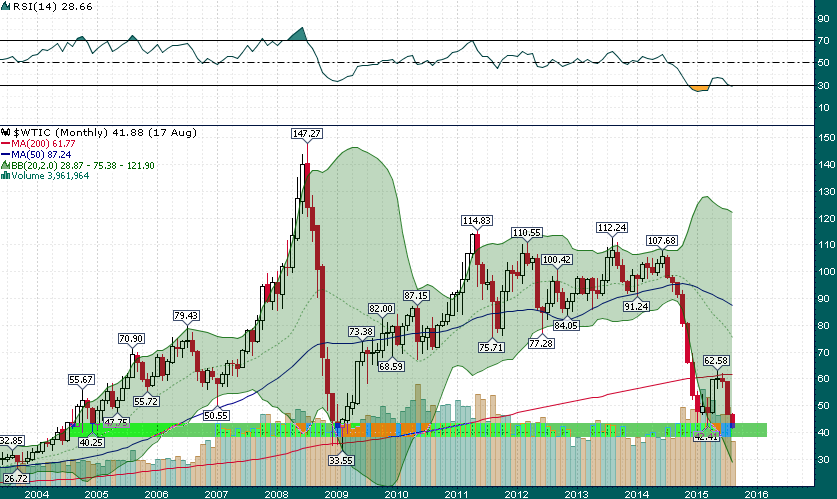

It’s clear that $40/barrel is a major sticking point price level for multiple reasons and if we look at a long term chart of WTI crude oil prices we also find that the nominal $40/barrel price level represents major support over the last decade:

While the trend in crude oil couldn’t be much uglier (down 9 consecutive weeks), it’s pretty clear that it will take a major global downturn in demand for prices to fall below $40/barrel for an extended period of time. We aren’t there yet, in fact demand is still growing.