Nothing scientific here, just letting my thoughts flow. Gold has been battered since its May peak at $1232/oz, falling more than 10% and hardly exhibiting any signs of life while doing so. Futures speculators have piled into short positions at a record pace while commercials have taken the opportunity to cover a sizable chunk of short positions.

Gold miners (the ultimate cyclical contrarian indicator) are finally facing reality and deleveraging after spending the last decade blowing through tens of billions of dollars of shareholder value on costly and inefficient projects. Meanwhile, the average retail investor is completely soured on precious metals. They have lost money and they want out of the space at almost any cost.

Anecdotally, I have a friend who sells rare precious metal and bullion coins to investors over the phone. A tough job to say the least but he does reasonably well at it. He hadn’t seen any drop off in sales until the last couple of months. Most of his clients are buying on impulse based upon how they feel on a given day and it seems that the bearish headlines and TV chatter surrounding precious metals have finally gotten to them. When he explained that it’s better in the long run to buy at cheaper prices they couldn’t be convinced and often respond with comments such as “I’ve lost too much already, i’m done with metals”.

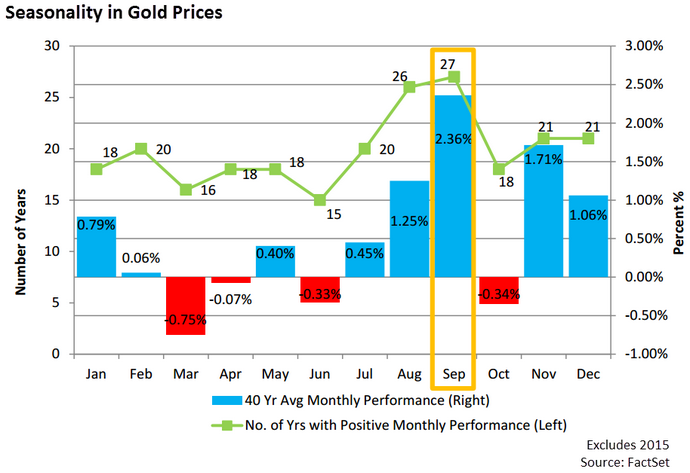

If these aren’t powerful contrarian indications that a tradable rally or major bottom is close at hand then I don’t know what would be. Deeply oversold conditions, extreme bearish sentiment, a record speculative short futures position, and the most bullish time of the year for gold historically offer very good odds that a ~5% rally could be imminent for the yellow metal.

Conditions haven’t been this ripe for a short squeeze rally since at least the summer of 2013 after gold crashed $300/oz in a matter of days….