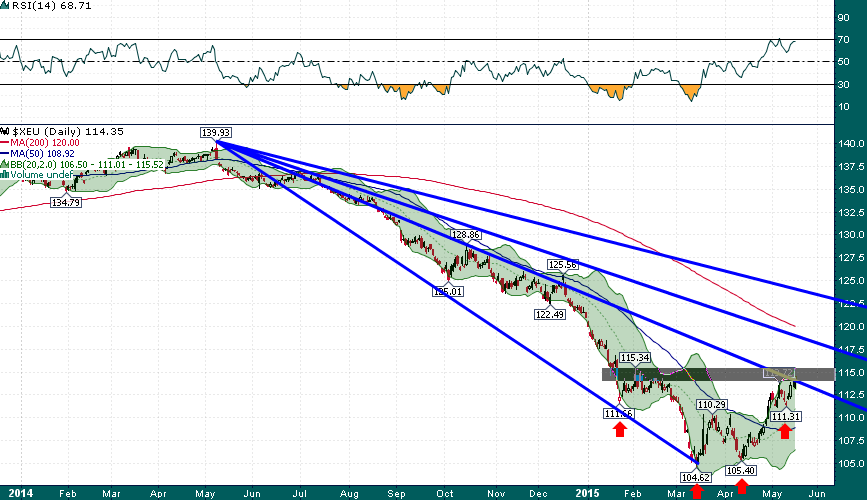

The EUR/USD currency pair is fast approaching a key technical crossroads :

The ~1.15 level represents support/resistance from January/February and also roughly equates to a 50% retracement of the entire December-March decline from 1.2556 to 1.0462. One can also easily discern a fairly clean bottoming pattern similar to a complex head & shoulders bottom with the most recent low of 1.1131 representing the right shoulder of this pattern.

A decisive breakout above 1.15 would minimally target the falling 200-day moving average the breakdown level from the end of last year near 1.20. Whereas, a failure to strengthen above 1.15 would likely mean a pullback to the 1.10-1.11 area is forthcoming.

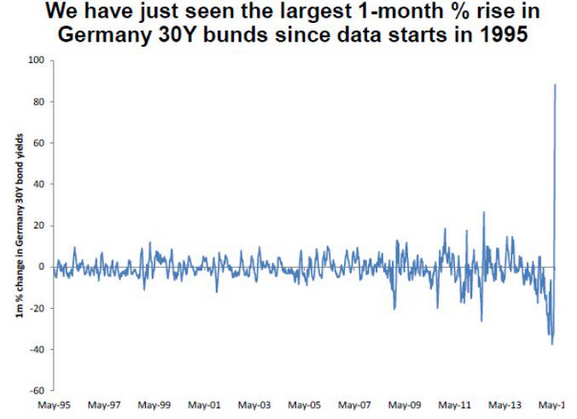

Why the rebound in the euro? A currency that everyone was sure was headed to parity or below vs. the US dollar. Look no further than charts of German bund yields and Fed rate-hike expectations:

We have just witnessed the largest 1-month increase in 30-year bund yields in at least 20 years…

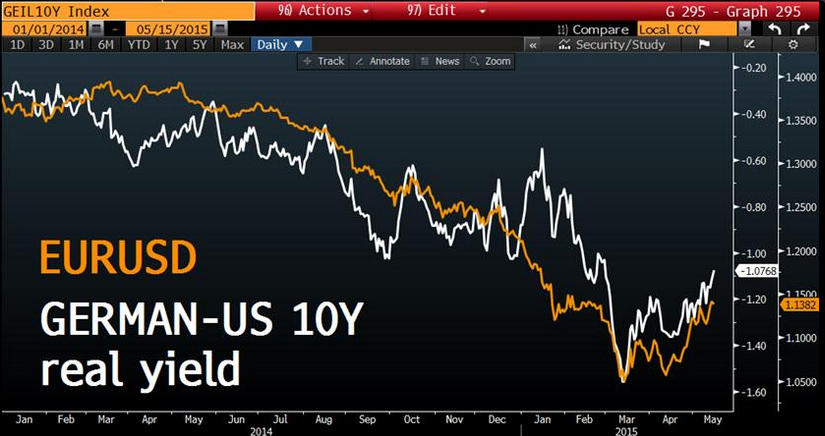

Bund yields and EUR/USD have an extremely close correlation:

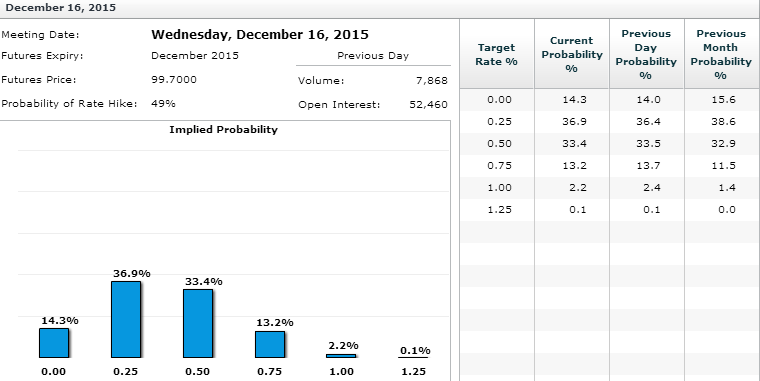

Much of the US dollar strength at the end of 2014 and earlier this year was predicated upon the idea that the Fed was close to launching into a rate-hike cycle. After this morning’s industrial production and consumer confidence data the odds of a Fed rate hike during 2015 have fallen below 50%:

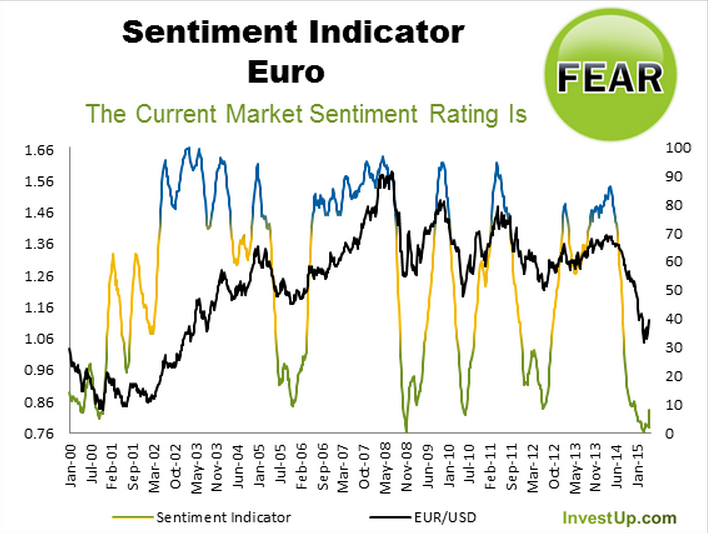

1.15 is a big level for EUR/USD, however, given the potential for a further sentiment unwind after reaching extreme bearish levels earlier this year I would not be surprised to see further upside towards 1.20 before the next sizable pullback occurs: