US based gold producer Newmont Mining (NEM) has been a serial underperformer in recent years with shares falling more than 70% from its late-2011 all-time high to the December 2014 low. However, things may be on the verge of turning around for Newmont investors.

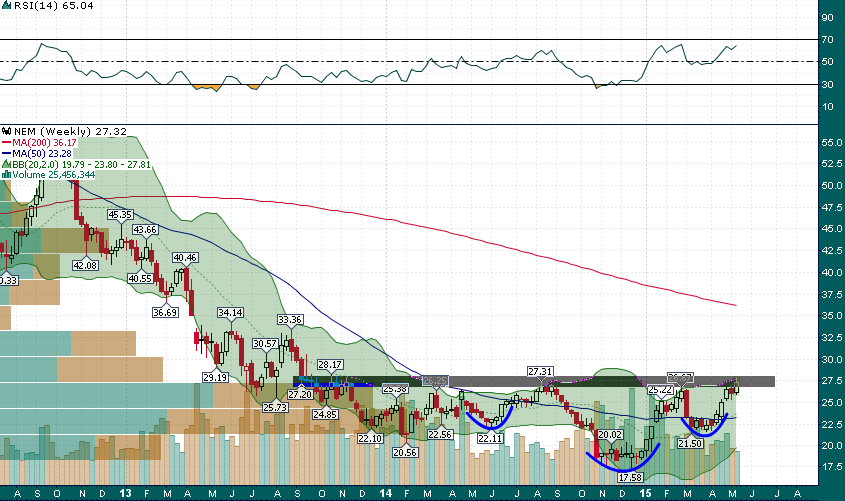

The stock has carved out a very clear and broad based head & shoulders bottom during the last year:

A breakout above the $27.50 resistance level should target the open gap from April 2013 up at $35.04. What’s even more interesting about the recent strength in NEM is that sell-side analysts remain fairly neutral on the name with the majority of price targets remaining between $26-$30/share. This sell-side ‘pessimism’ is actually a bullish phenomenon given that a chart breakout will likely result in a series of late upgrades that should serve to further catalyze the rally.

Read Also: Strong 1Q15 Allows Newmont Mining to Maintain Guidance