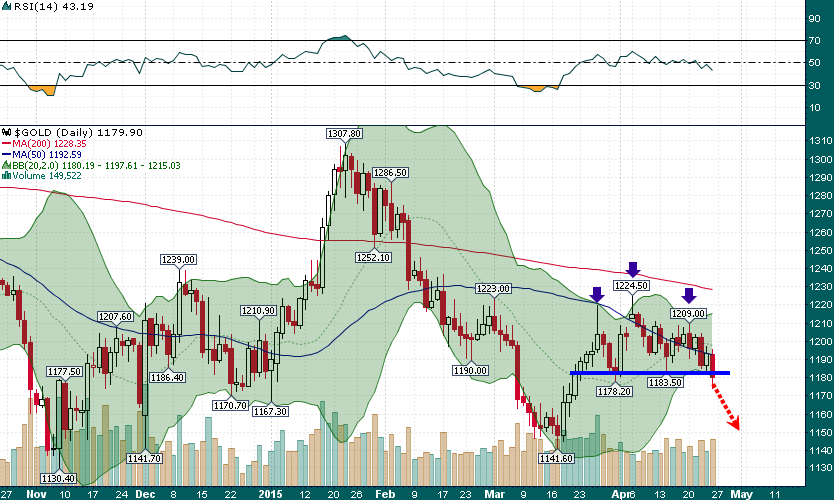

Gold marginally broke below support on Friday, breaking down from a small H&S top pattern:

The breakdown from this pattern targets a test of the March lows ($1140-$1150). However, the “break” was not as clear or as powerful as we would usually like to see when chart patterns resolve.

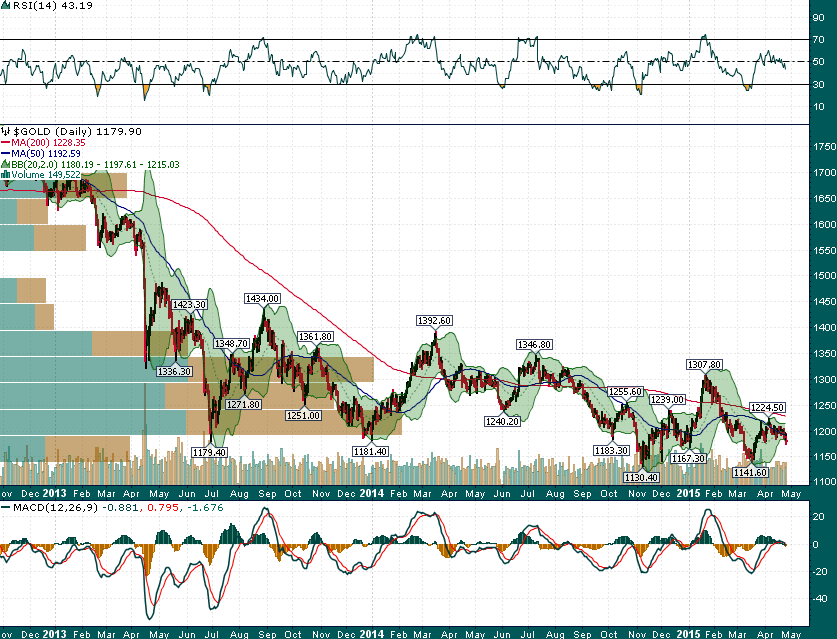

$1180 has been a crucial level for gold ever since the yellow metal found support at this level in June 2013 and proceeded to rally $250+ over the next couple of months:

From my perch, last week’s drop and breakdown from the 4-week H&S pattern does nothing to resolve any of the longer term patterns. The following conditions still exist:

- A low below $1130 still has not been made and we still have a higher low in place ($1141.60)

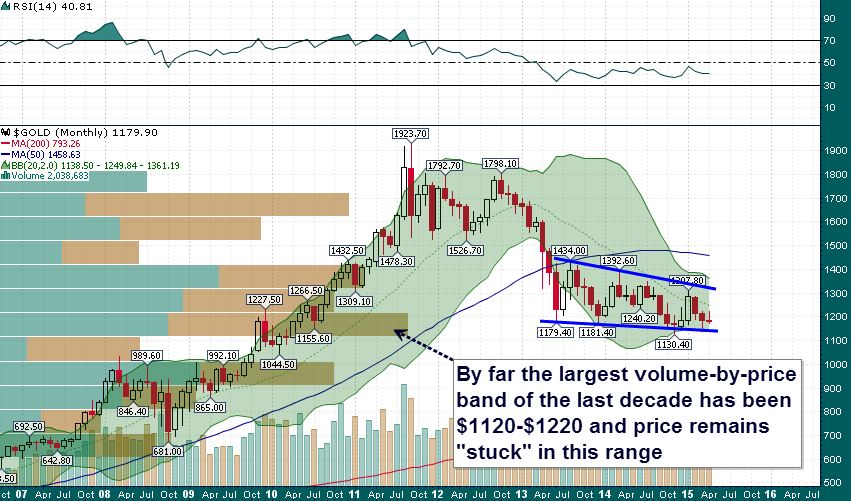

- Since the initial “deadcat bounce” rally (June-August 2013) a series of lower highs remains intact which is indicative of a bearish consolidation pattern on the monthly time frame

Gold remains mired in a descending triangle within a thick volume-by-price band dating back to major support/resistance from 2009/2010.

To have resolution of these long term chart patterns we will either need to see a lower low below $1130 or a rally above the double-top resistance at $1307 – everything else is just noise within an already existing range.