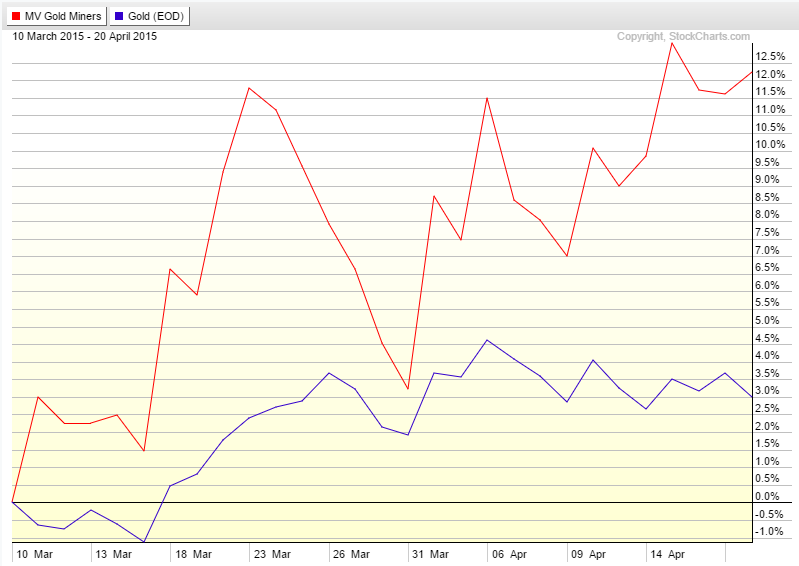

The recent outperformance of the gold miners (GDX) relative to gold itself has been quite striking:

My primary takeaways/interpretations of this recent outperformance are as follows:

- Investors are betting that gold is at the end of a cyclical bear market and on the verge of launching into a new uptrend

- In the past when there has been a large divergence between GDX and gold, more often than not GDX has been right. This was perfectly evident as the bear market began taking hold in late-2011 and 2012 when mining stocks stopped making new highs and began feeling very high even as gold itself was percolating above $1700/oz.

- Gold miners have finally right-sized their cost structure and are set up with considerable operating leverage to higher gold prices – investors are getting in ahead of the game.

While we do not know if they will end up being rewarded we can definitely say for certain that investors have taken a shine to the gold miners in recent weeks.