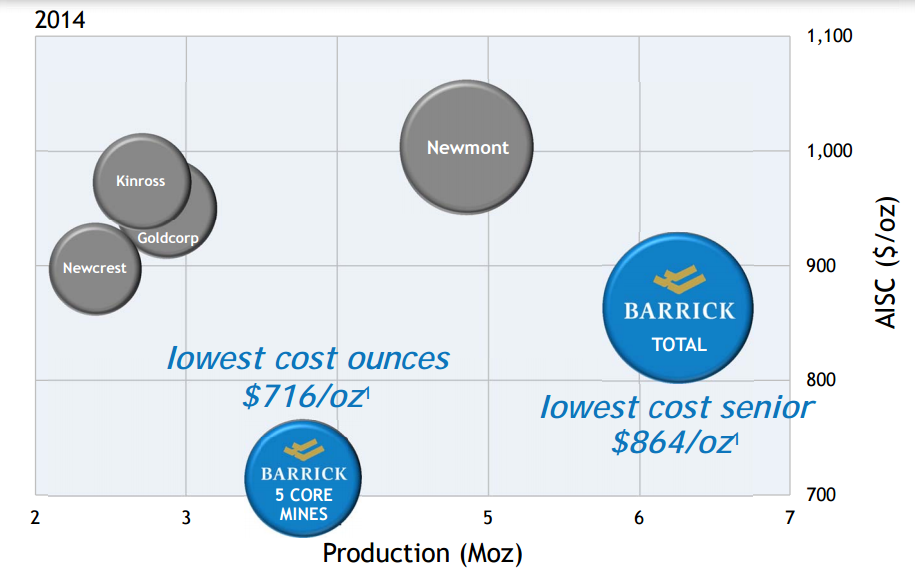

After suffering through what have arguably been the most challenging few years in the company’s history, Barrick (ABX) investors may finally be ready to profit from a sustainable turnaround in the company’s fortunes. ABX has right sized its cost structure and begun to focus on its largest and most profitable mines – the result can be summed up by the following two slides from the company’s most recent investor presentation:

ABX is now the lowest cost senior gold producer

Barrick also has the largest and highest grade gold reserves

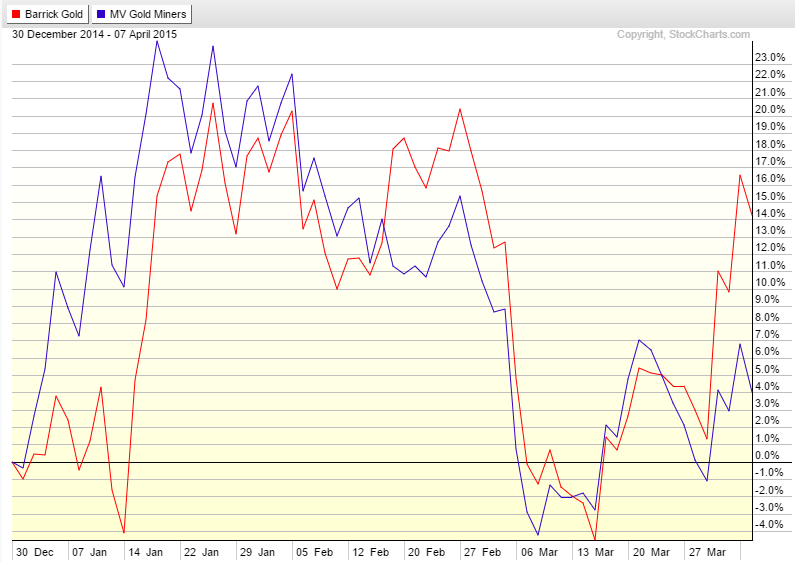

Investors have also been paying attention to Barrick’s recent transformation; ABX shares have outperformed the rest of the gold mining space by a factor of more than 3-1 during 2015:

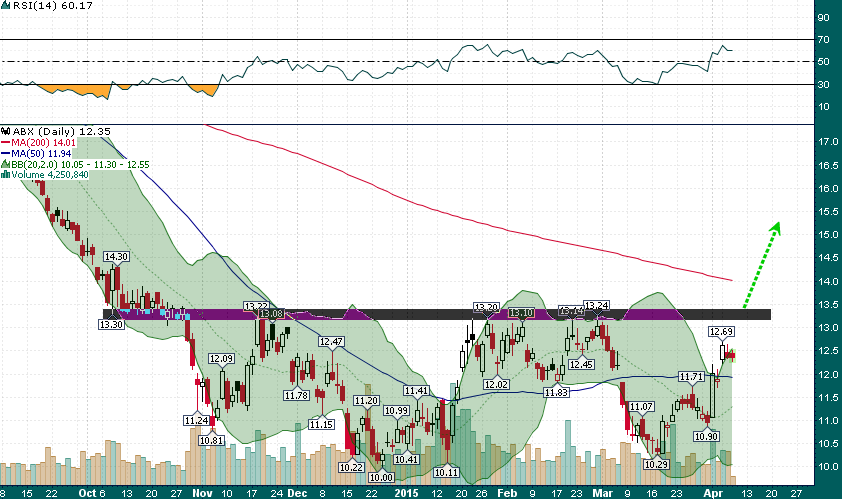

Technically speaking, after a powerful rally during the last week ABX is consolidating just below an area of major resistance between $13.00 and $13.25:

A break-out from the multi-month head & shoulders bottom pattern would target at least another 15% of upside (~$15.50).