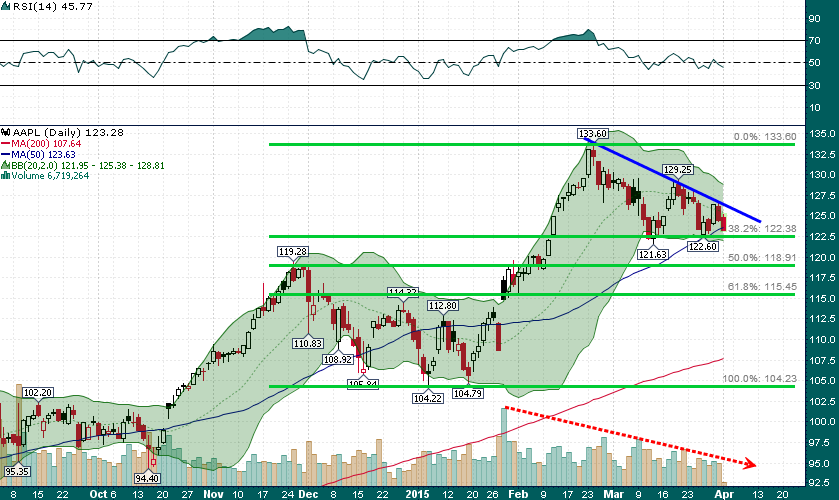

The chart of Apple (AAPL) has formed a small descending triangle during the past few weeks as it begins to slip below its rising 50-day simple moving average on decreasing volume:

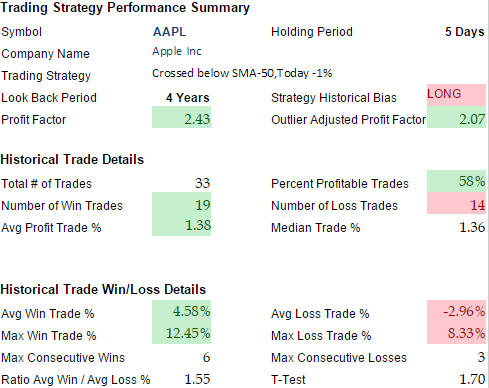

The key downside level here looks to be ~$122.50. A clean break below this level will set up a move down to the $119s (previous resistance). Another interesting fun fact is that a strategy of shorting AAPL at the close when it is down 1% on the session and crossing below its 50-day SMA, then covering at the following day’s open has proven to be impressively profitable during the last 4 years:

However, history also indicates that tomorrow’s open (assuming it’s a gap lower) should be bought for a 5-10 day swing trade:

It will be important to see how AAPL responds to the $122.50 level if it is tested, and more importantly nimble traders might be able to ‘skin the AAPL cat’ both ways over the coming days.