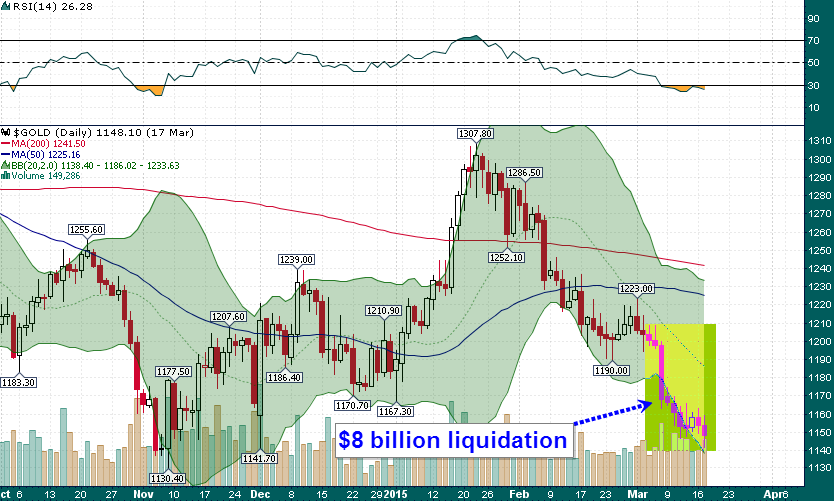

In the last two weeks gold futures speculators have liquidated a total of 66,897 gold futures contracts which equates to a notional amount of nearly $8 billion:

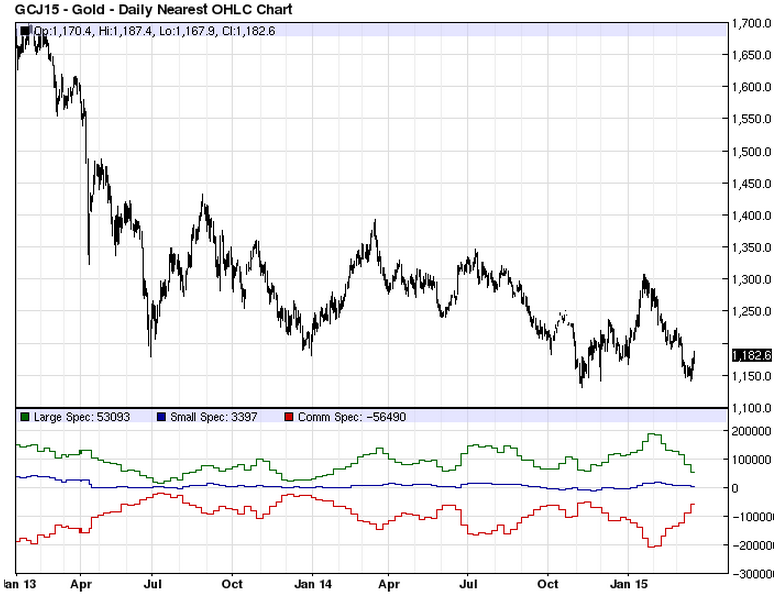

To put this recent gold liquidation into perspective it is the largest 2-week liquidation in gold futures since the April 2013 gold crash:

The size of the most recent speculative liquidation can partially be explained by the stubbornness which speculative longs exhibited during much of the decline since the January peak. However, it is still an inordinately large amount of selling given the relatively small decline ($8 billion produced a roughly $60/ounce drop as opposed to a $200+ decline in April 2013). This means that institutional buyers were more aggressive during some of the larger volume down days of the last two weeks as price found firm support on each dip below $1,150.

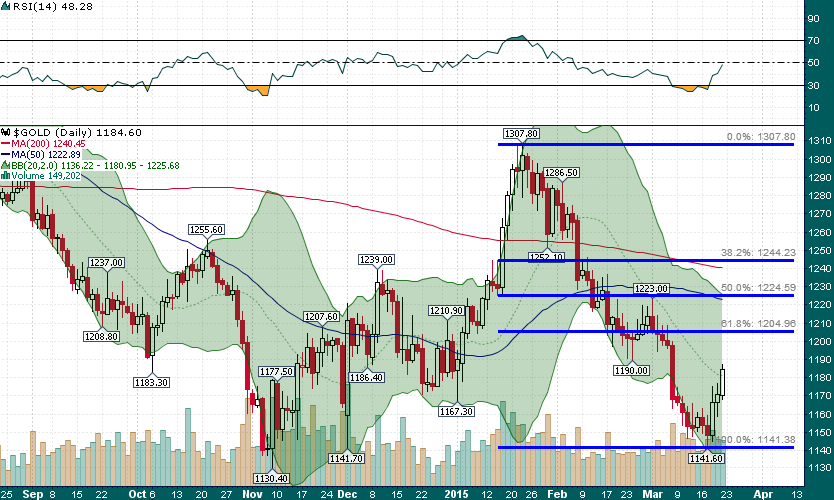

As of Tuesday (the date of the latest Commitments of Traders Report) speculative positioning in gold futures was actually below where it was at the two most recent major lows (June 2014 and November 2014). As is typical, after becoming oversold and seeing signs of capitulation selling early in the week gold finished the week strong with a $45 rally. The next upside target will be the $1200 round number and the 38.2% retracement level of the January-March decline: