Eurozone equity allocations have not been this high since 2006 which happened to coincide with a major peak in relative performance of EU equities vs. the world:

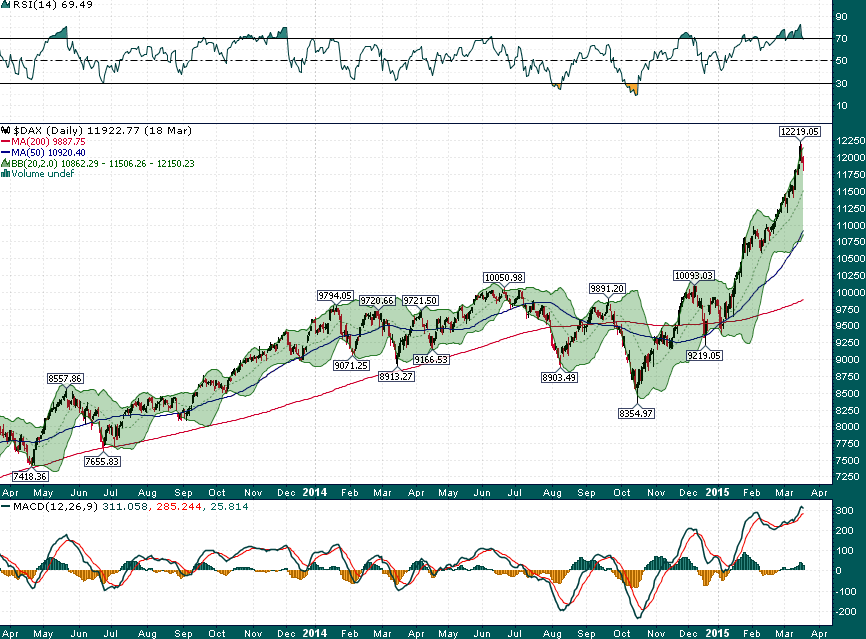

Meanwhile, the German DAX Composite Index hasn’t been this far above its 50-day simple moving average ever! Not even the 2000 dot-com bubble compares to the current level of parabolic overbought we are seeing in core eurozone equities:

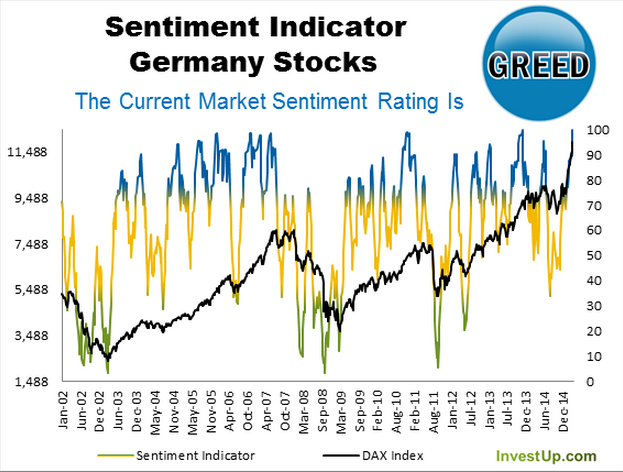

And as one might expect investor sentiment on the DAX is absolutely white hot, at levels only seen a handful of times in the last decade (usually at or near intermediate term tops):

For North American investors who would like to speculate on some downside in the DAX, a short position in the exchange-traded fund EWG in combination with a short position in EUR/USD in the same dollar amount as the EWG short position will effectively short the DAX and mute the currency effects.