Record inventories and the prospect of further inventory builds in the US are putting WTI crude prices under heavy pressure this morning. Given the likelihood of additional inventory builds over the coming weeks there is a strong risk of a further decline to below $40/barrel.

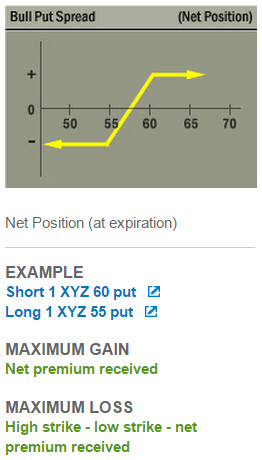

While I believe that a dip below $40/barrel will be short lived it is difficult to capitalize on it from an outright long position given the contango currently present in the crude futures curve. From my perspective the best trading opportunity will likely come from an options trade called a bull put spread which entails selling a put option at a strike price below the current level of the underlying security and then buying another put option at a strike lower than the strike of the put option which was sold. Here is an example of how the bull put spread looks:

Notice how in the above payoff diagram the price of the underlying does not have to mover higher to make money, it simply needs to not move lower. Additionally, a bull put spread options trade is especially attractive due to the high levels of implied volatility currently priced into crude oil options (using USO options) – currently the OVX (CBOE Crude Oil Volatility Index) is pricing in roughly a 17% move in crude oil over the next 30 days.

A dip below $40 followed by a rebound and a period of relative calm is our baseline scenario over the coming months given the various market dynamics currently in place; a decline below $40 will almost certainly trigger a strong supply response, meanwhile, any rally back above $50 is likely to be met by significant selling/hedging as producers seek capital and safety.

In summary, while long term investors may consider adding positions in quality crude producers into further declines those who are comfortable with tactical trading strategies should consider a bull put options spread on a move below $40/barrel over the coming weeks. Moreover, given the aforementioned scenario of a decline followed by a rebound and a period of stability more advanced traders could also consider a short strangle options trade as summer approaches.