We’ve written on this topic before and I am compelled to make this point again, even more emphatically. While persistent deflationary conditions that last for years are certainly not bullish for gold, the threat of deflation IS actually bullish for gold. And we have plenty of evidence of this from recent history: Gold launched into its decade long cyclical bull in 2001 as the US economy sunk into a shallow recession following the dot-com bust, meanwhile gold experienced its best three year run in history following the 2008-2009 Global Financial Crisis (GFC) which saw global economies spiraling into a deep but short lived deflationary vortex.

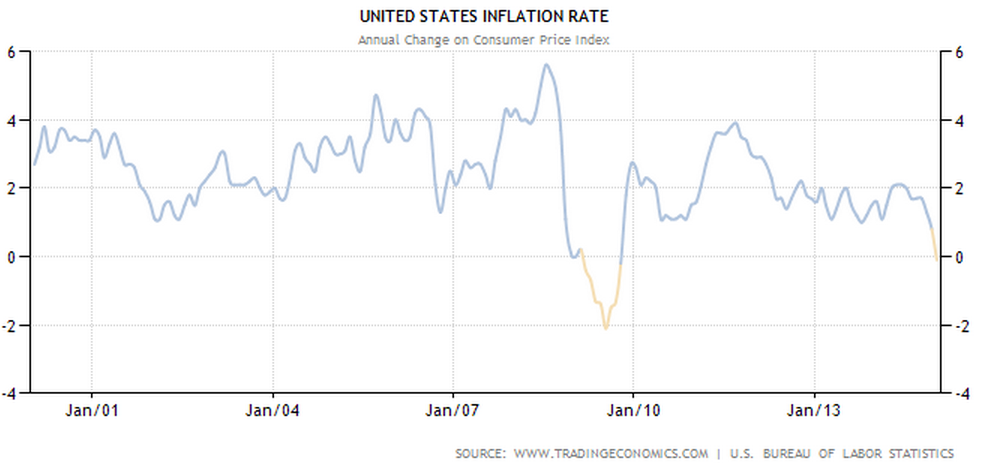

We are in the midst of the 3rd global deflationary scare in just the last two decades and while gold attempts to find its footing in the mid-$1100s the reasons for owning gold may have never been stronger. Investors are dumping gold due to a multi-faceted set of fears: A global deflationary pull, extreme US dollar strength, and the threat of a Federal Reserve tightening cycle. However, judging by the following US/Euro Area inflation charts the fear of a Fed tightening cycle is almost certainly unfounded:

The Fed’s mandate is essentially to create and maintain a steady level of roughly 2% inflation. They are not achieving that mandate and beginning a rate-hiking cycle is definitely not the way to achieve it. Moreover, Euro Area inflation poses even more of a problem:

The 2008-2009 Global Financial Crisis and resulting policy responses from global central banks laid the groundwork for gold’s spectacular rise to $1923/oz in August 2011. Regardless of all the media hooplah and bearish public sentiment on gold right now, the long-term uptrend remains intact and it would be quite fitting if a major low in gold were to be put in place this year as US equities run out of steam in the 6th year of their bull run which began as the GFC was in its final innings:

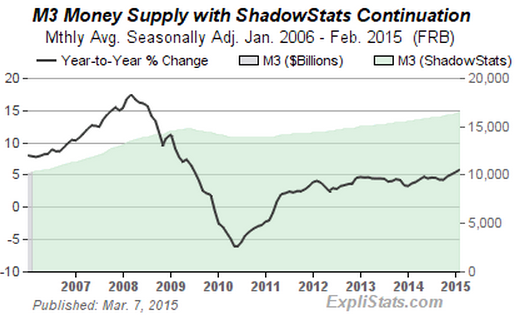

Structural deflation remains a challenge globally and given the threats to developed markets such as Europe, The US, and Japan it looks like more monetary policy responses are the only tool to fight the fire in the short term. Meanwhile, global monetary aggregates continue to expand and reach new record high levels:

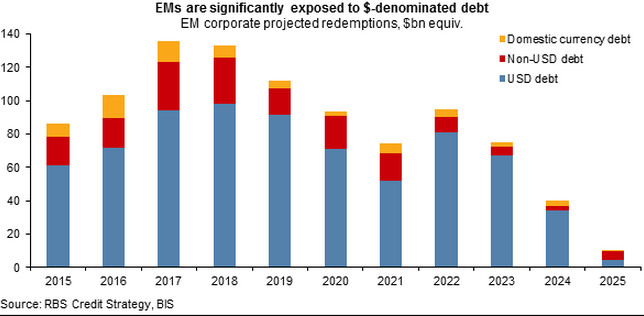

And the consequences of the US dollar reserve currency status may soon make itself felt as an emerging markets US dollar funding crisis may be right around the corner:

In an increasingly unstable global macroeconomic environment gold offers investors consistency and stability. All that is needed is for a sufficiently powerful catalyst to bring about a sea change among investors and trigger a massive shift out of equities/Treasuries back into precious metals. I’m betting that this sea change will occur this year.