Since gold topped out near $1307 in late-January the yellow metal has followed a standard script in its descent; violent $10-$20 down moves that occur in a matter of seconds or minutes followed by much lengthier sideways or slightly rising consolidations. The action of the last 2 weeks has been no different and this morning following the February non-farm payrolls report we are seeing yet another explosive $20+ down move:

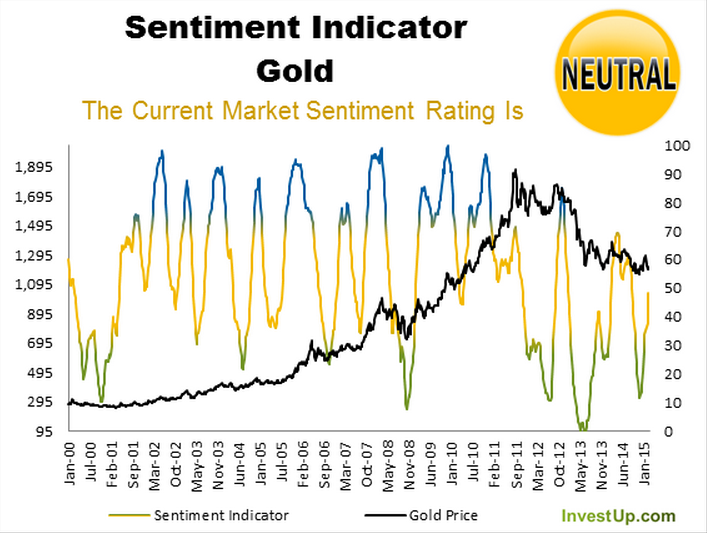

The most concerning aspect about this morning’s sell-off is that sentiment has been fairly neutral on gold for the past couple of weeks which means that we could be another $40-$50 from reaching any sort of bearish sentiment extreme:

CFTC Commitments of Traders data also is not indicative of a bearish extreme in gold despite the fact that speculators have paired back long positions in recent weeks:

There are two potential support zones below, $1170 and $1130:

Given the potential for a sentiment/speculative unwind to extreme oversold territory I believe another test of the $1130 level could be in the cards. It might even take a marginal new low below $1130 in order to flush out the last weak hands required to finally put a sustainable bottom for gold in place. Below $1130 we will begin talking about the Goldman Sachs $1,050 price target coming true which also happens to coincide with major support/resistance dating back to the 2008-2010 time period.