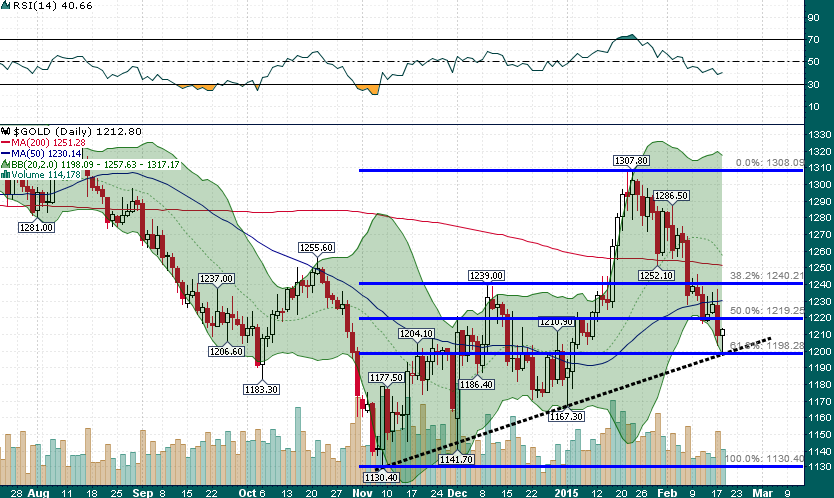

Gold briefly breached the key psychological $1200 level before finding support at a likely spot:

The 61.8% retracement of the entire November-January rally happens to also coincide with the uptrend drawn through the December and January lows and the lower 2-standard deviation Bollinger Band on the daily chart. Today’s hammer candlestick off a key confluence level offers hope that the $110/oz drop which gold has experienced during the last month has come to an end. A Friday close above $1225 would go a long way toward confirming that today’s upside reversal marked a turning point, whereas, a breach of the uptrend (dotted line) would indicate that lower levels must be tested before any sustainable low is put in place.

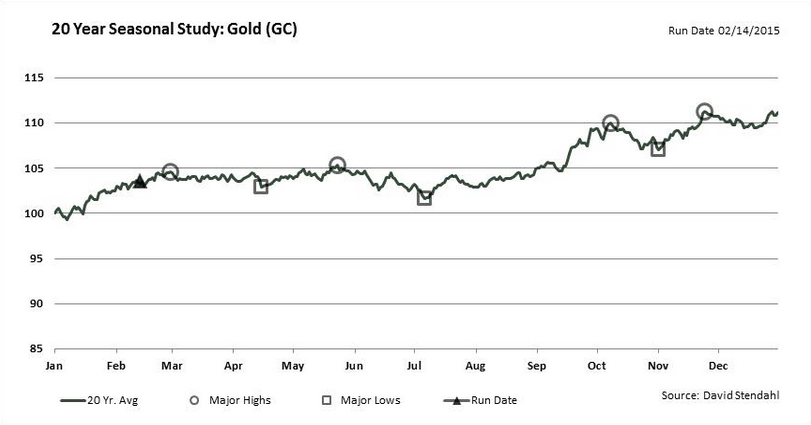

From a seasonality perspective gold is now entering a challenging period for the next couple of months:

Mid-February through mid-April has produced slightly negative returns over the past 20 years.

All of this adds up to an intriguing end to this week with bulls eagerly looking for follow through to today’s reversal with a weekly close above $1225 and bears looking for price to permanently submerge below the key $1200 psychological level.