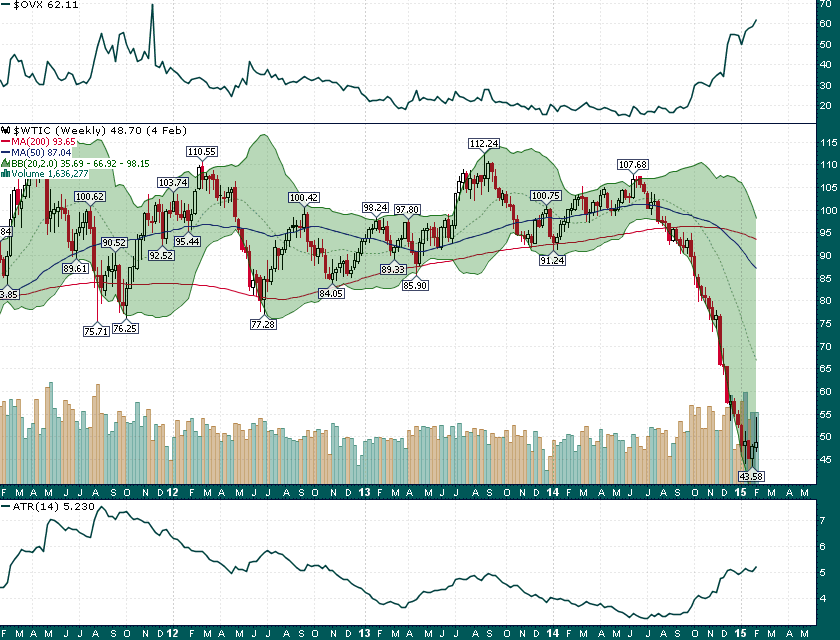

Oil implied volatility as measured by the OVX (CBOE Crude Oil Volatility Index – at top of chart below) is breaking out to the highest levels seen since the 2008 Global Financial Crisis:

Meanwhile, realized volaility (as measured by the average true range) is also spiking higher but not quite catching up with implied volatility.

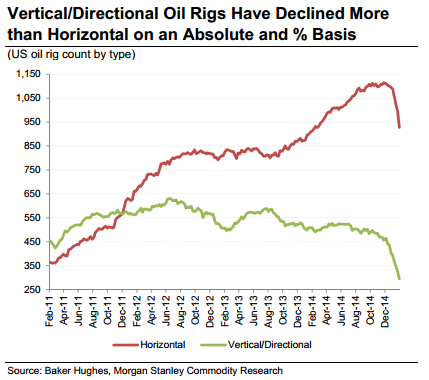

The big uptick in both realized & implied crude volatility in recent days seems to have a lot to do with conflicting interpretations of the large drop-off in rig counts:

Last Friday the market applauded a new report showing an even steeper recent drop-off in rig counts throughout the lower 48 states. However, a report from Morgan Stanley which came out on Monday highlighted the fact that much of the reduced rig count has come from lower quality/lower producing vertical rigs. Moreover, the horizontal rigs that have been a part of the recent decline have come from less prolific shale plays.

This is all actually quite logical, however, the market may have gotten a bit ahead of itself in thinking that the drop-off in US crude production would be sharper than it will turn out to be in reality. It seems to me that crude oil volatility, both realized and implied, is a sale right here and crude is likely to settle down into a range between $45-$65 for the foreseeable future.