Less than one month ago I spoke with 321gold founder Bob Moriarty and he was adamant that the stock market was in big trouble. As it turned out, his timing in that assessment proved to be spot on. In this month’s conversation we discuss the sudden banking crisis in the US, and the prospect that this crisis goes global. We also spend some time discussing precious metals sentiment and why we could still be early in the rally in precious metals.

Without further ado, Energy & Gold’s March 2023 conversation with Bob Moriarty….

Goldfinger:

Bob, it’s good to speak with you again. I think everybody is aware, at least what the headlines and major coverage was over the weekend about Silicon Valley Bank and Signature Bank.

It’s interesting. These two banks had a lot in common. They were active in venture capital and cryptocurrency.

It doesn’t seem to be an accident that they both failed and were brought into receivership by the regulators. What’s your take on everything, Bob?

Bob Moriarty:

Well, here’s what’s interesting. I think about banks collapsing, it wasn’t two banks collapsing, it was three.

On Wednesday of last week Silvergate collapsed, Silvergate was a crypto bank that collapsed. Then on Thursday, Peter Thiel said that his funds should remove their money from SVB. That’s what caused the immediate collapse of SVB. They pulled $42 billion out in two days.

It’s very important for people to understand that banks lend long and they borrow short. So, it doesn’t take much of anything for there to be a run out of bank no matter how well run it is.

Goldfinger:

I want to give you a little bit of an acknowledgement, because the last time we spoke you were pretty bearish on stocks. That was about as good of a call as I’ve seen by anyone so far in 2023.

One of your key points is that we need a new financial system based upon natural resources. So, how does this bank failure and shock to the confidence of the financial system tie in to what you see in this new financial system based upon natural resources?

Bob Moriarty:

Okay, there’s $300 trillion in debt in the world between individuals, corporations and governments. Can that money be paid back?

Goldfinger:

No. It’s not meant to be paid back.

Bob Moriarty:

Actually you’re dead right there. The fractional reserve banking system is based on the interest paid on debt, they don’t want you to pay the money back because they want to collect interest.

But from a mathematical point of view, there is always more debt than there is money to pay that debt. So, at some point in time you have to balance the books. You’re going to have a mass crash.

Quite bluntly, everybody that can count understands $300 trillion is an enormous number, but the quadrillion or two quadrillion in derivatives is the real danger.

I would say, I see crypto as a form of a derivative. It’s a derivative on money as it were. The system has to crash.

If you step back a little bit, and I’ve talked about this with you before, the issue between Russia and Ukraine is really an issue of the United States and NATO supporting the debt-based system and Russia and China supporting a new financial system.

Now, they’re not absolutely certain of what it should be. No one is, certainly including me. However, it’s obvious to anybody that works at the debt based banking system, it’s past its sell-by date.

Goldfinger:

There’s a lot to unpack there. Let me see if I can set this up in a simple way. If we think about how a bank run happens, obviously back in the 1920s and 1930s there were bank runs every week. There were multiple bank runs a week because it was so easy to lose confidence in things, banks were much smaller, and there was no FDIC.

But today, just looking at the SVB financial statements, it’s clear that they were drunk on the punch bowl of liquidity and didn’t plan properly for deposit outflows and rapid Fed rate hikes.

From 2019 to 2022, they enjoyed the boom times. They knew how to be aggressive and build deposits during the boom times, but didn’t seem to have a good plan for when the tide went out.

But during the Fed hiking from zero to 5%, they weren’t such good risk managers. They made some kind of crazy investments, piling into 10 year bonds at very low yields, thinking that it was risk free.

Then all of a sudden the yield curve shifts drastically, and you have a situation where they’re at a big loss.

Simply put, the Fed raising the price of money has created all kinds of challenges for different financial players that didn’t really know how to manage in an environment with real interest rates, with actually more than a zero interest rate.

There has to be more out there than just this Silicon Valley Bank and Signature Bank. There are more losses out there being covered up.

Now, what does the Fed do here? Because I know you don’t like to forecast the Fed and I get that, but it’s important because if the Fed makes the wrong move here, we’re going to a 2008 style crack up.

If the Fed makes a different move, it may not be the right move but a different move, we could be going for a super inflation environment where gold could go to, I don’t know, $3,000 or $4,000.

I mean, name the number. It’s going to be a high number. It’s going to be higher than it is today. What do you think about that and the Fed’s quandary here?

Bob Moriarty:

Well, the Fed, I think you’ve identified clearly as being the incipient cause of this whole thing. They created the monster by lowering interest rates artificially to far less than they should’ve been. In a sane financial system, interest rates always have to be higher than inflation because that’s how you pay for taking the risk of loaning the money. They’ve lowered the interest rate to the point where it literally free money.

Now, some banks like SVB, when you look at the actual numbers, they did nothing to hedge the risk. I mean, it was incredibly poorly run. However, the Fed has 30,000 employees. Didn’t somebody, one guy out of those 30,000, point out, “Hey, by the way, when we increase the interest rates, the value of bonds is going to drop?”

Of course the bond market’s far bigger than the stock market. Last year in the UK the highest rated bonds were down 53% at one point. In Germany, the highest rated bonds were down 23%. Now what that means is every bank in the world is bankrupt. It means every pension fund in the world is bankrupt. Japan is totally bankrupt.

I think that this is going to be what takes down the whole system. You were comparing it to 2008. I think you’re wrong there. I think you should compare it to 1929 but far worse.

This is something that is now global and that’s where the danger is. Frankly, the Russians and the Chinese see it and that’s why they’ve been loading up on gold.

I think the decision that the Fed, the treasury made over the weekend to bail everybody out, I think that pretty much guarantees hyperinflation.

Goldfinger:

It’s interesting because you mentioned that about the Fed, they have something like a thousand PhDs there. Their annual payroll is in the billions, yet they couldn’t see this coming I guess.

But part of the reason why they couldn’t see it coming might have to do with the fact that the CEO of the bank was a board member at the San Francisco Federal Reserve.

So, there’s conflicts of interest throughout the financial system. It’s not just the financial system, the legal system too. There’s lawyers who went to school with the judge and they play golf together on the weekends.

There’s conflicts of interest all throughout the world. It’s just the way the world is. Right? But in the financial system, the prices paid can be very, very high for these conflicts.

Clearly, this SVB CEO sitting as a board member on the San Francisco Fed had some pull. Maybe they overlooked certain things because they were friends with him or they were getting some sort of benefit.

Also, there are many Fed voting members that have been cited and penalized for trading their personal accounts in the last several years, which is really unspeakable. They’re setting monetary policy. How can you be trading your personal account? You should have no trading capability at all. You should just be in a mutual fund and that’s it. Somebody else should be managing it for you. You should have no say over it.

But this is the world we live in and there are a lot of conflicts of interest out there. So, where to now?

Because I agree with you from our February conversation, that one side of me says, “Damn, I agree with Bob. It’s really scary out there.”

China’s cozying up to Iran. They’re setting up a way that it will be very hard for the Israelis to bomb where they’re building the nukes in Iran. God forbid when that happens. That’s going to be another whole mess out there.

With Russia and Ukraine, I don’t see a peace deal. I don’t see a compromise happening there this year. I just don’t see it because both sides can’t back down on certain key points. So, it’s just very ugly.

Then you have the de-dollarization and bifurcation of the global financial system. There’s a lot of scary stuff out there. There’s stuff that we don’t even know about right now, that we’re not even talking about. The true black swans are what’s not in the headlines.

There’s one side of me that’s quite concerned about the world and the banking system. However, the other side of me sees all of this as the wall of worry that bull markets have to climb and somehow we’ll find a way through it.

Bob Moriarty:

Let me give you a couple of numbers that are pretty scary, from the very top in the Dow in September of 1929, it took until 1954 to surpass that number.

The other is, 17 US intelligence agencies have said twice that Iran has no nuclear weapons program. Now Israel has been claiming for 25 years that Iran is months away from a nuclear weapon.

There is no nuclear weapons program in Iran. Israel made it up. It was fiction 25 years ago. It’s fiction now. Iran is not the enemy of Israel.

It is true that Israel is the enemy of Iran, but you should pay attention to what the Chinese just did. They got Saudi Arabia and Iran to agree to a peace agreement. That’s going to have immense ramifications. That just made China the big dog in the Middle East. The US Empire is falling apart like pulling a thread from a cheap sweater.

Goldfinger:

So China, this Xi guy is very clever. He is doing whatever he can to usurp the US role in the world, including now trying to broker some sort of a peace deal between Russia and Ukraine. Now, I don’t really think that’s going to happen, but he’s trying.

This is pretty interesting because the US has gone from a mad man narcissist to a senile incompetent and this is the best that we have to run our country. It’s quite a sad state of affairs.

I mean, Biden can’t even walk down the hall without somebody holding him up. That is the leader of the free world. Now, it doesn’t ring true as the leader of the free world.

So, clearly the world is in transition here and China is really working hard to be at the forefront of that. What are the implications of China’s emergence for financial markets and how should we invest?

Bob Moriarty:

That’s two questions, one of which I can answer. The other is, I have no clue. For 18 of the last 20 centuries, China and India have been the leading economic powers of earth.

The debt-based system of the West has really only come into being in a big way when Columbus… I can’t think of a good term, when he invaded the Caribbean, but clearly the United States is collapsing. The debt-based system is collapsing. Everything in our society is corrupt.

I’m not against a change. I think a change is mandatory. I think that Russia and China and Iran and Saudi Arabia and South Africa are saying, “We need a change.” Frankly, I think the change will be a good change. Hell, even Mexico wants to be part of the new BRICS.

Goldfinger:

So all of these countries getting together, I mean, how realistic is it that these different countries can agree on things and to agree on a common currency or whatever it’s going to be mean? Is this looking like a European Union economic zone or is this more like a Eurozone, common currency situation? How does gold play a role in that?

Bob Moriarty:

That’s a really good question because for a year the Russians have been talking about some kind of resource-based system. Frankly, I believe they’re going to go to gold because it’s so simple. It’s something you can do.

Now, if you started trying to have currency based on the price of oil and corn and wheat and silver and leather and zinc, that’s problematic. But going to a gold-based system is very simple.

If you go back 150 years, Brazil was on a gold standard, Mexico was on a gold standard, the United States on a gold standard, Germany, France, Italy, the UK. Everybody had gold and it worked. The period from about 1825 to 1900 was the period of the greatest economic boom in world history.

Now I think the fiat money fraud, cliptocurrency fraud needs to blow up. We need to recognize, hey, wait a minute, that doesn’t make any sense whatsoever.

When people go into debt, they have gone into slavery. The whole World Economic Forum thing is about the 1/10th of 1% taking control of all the assets and then renting it out to the rest of us. We’re slaves to them. They even talk about “useless eaters.” That’s us.

Now, I believe that the WEF agenda is failing, but climate change, Antifa, BLM, the Ukraine war, the end of fossil fuels, it’s all part of the same story.

If you backtrack, you just gotta say it’s a conflict between a debt-based system and a resource-based system. We’ll go to gold because it’s the only choice.

Goldfinger:

I know you like sentiment. I’m just pulling up the Daily Sentiment Index numbers right now. Sometimes it’s interesting, not the absolute numbers, but the change in the numbers day to day.

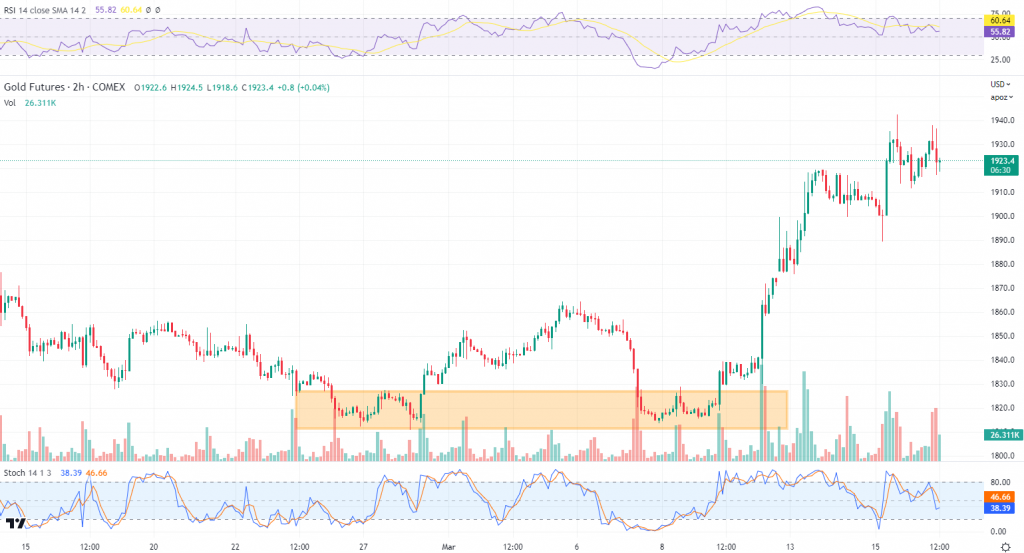

Gold jumped up big yesterday from the fifties to 70. So, there was a real big thrust, higher in bullish sentiment on gold and a big drop lower in sentiment on the S&P 500, it’s down to 15.

This sort of move, to me it seems like this is a sort of move where both sides are set to go to extremes, which to me would mean that the S&P goes into single digits and gold goes to 85 or 90 or something like that, a really extreme overbought reading. What’s your take on sentiment right now, and what are you thinking?

Bob Moriarty:

One of the comments, I’m not sure that I’ve made it with you, but I’ve made it on a number of other interviews, is that we’re going to have more change in the next six months than we’ve had in the last 50 years.

I absolutely believe that’s true. We may have more change this week than we’ve had in the last 50 years. But 98% of the time, sentiment measures accurately what’s going on because it’s how people feel.

I certainly see the potential for much higher gold. I certainly see the potential to go at least as high as the S&P is (3,900), it’s so overpriced it’s just simply insane.

The market has got to revert back to the mean and the mean is far lower for NYSE stocks, but you can have external events that affect price. That’s only true perhaps one or 2% of the time.

But SVB and the bank in New York are going under, those are very big. It’s the start of the avalanche, and I think it’s going to continue. However, as bad as the banking system is in the United States, it’s far worse than Europe. They’ve still got a lot of zero interest rates and that’s insane.

Goldfinger:

The banking system in Europe seems problematic, there’s a lot of smaller banks, national banks in smaller European countries that are absolutely zombie banks. They can’t make new loans just simply because they have so many existing bad loans.

They’re not being marked properly. They’re being propped up. That’s why inflation is generally low in Europe. Aside from the natural gas price surge of 2022, inflation is really quite low and economic growth is quite low.

Finally, turning to junior mining, the sector that both of us spend a lot of time on, is there anything that’s striking your fancy out there? Is there anything that you really want to make note of?

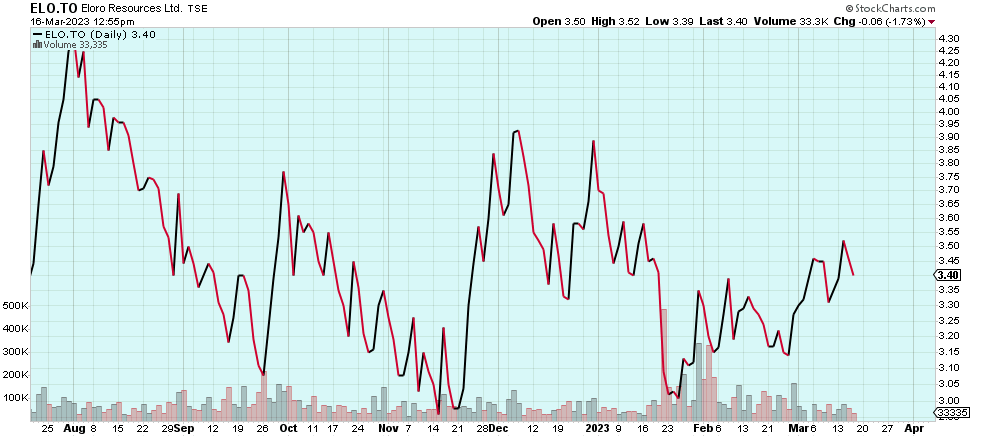

I know that we are waiting for news from Eloro Resources (TSX:ELO), the Maiden Resource Estimate (MRE) for Iska Iska. They got uplisted, so they’re on the big board in Canada. That’s definitely something of interest.

I think they’re getting ready to drill that deep tin porphyry. They finally got the roads to the drill pads in that southern area called Mina Casiterita. That gives them much better access to tin porphyry. There are a lot of catalysts lined up for Eloro.

ELO.V (Daily)

Bob Moriarty:

Absolutely. Eloro is supposed to come out with a 43-101 literally in the next two weeks. I think that’s going to be very important.

But another one that’s certainly interesting, it’s New Found Gold (TSX:NFG). They’re using seismic to determine the structure of the veins in Newfoundland.

That’s interesting because that’s exactly what the people eventually did at Fosterville, which is precisely the same kind of deposit. Fosterville is the highest grade gold mine in the world today. I think New Found Gold is going to be higher grade and it’s closer to the surface.

So, across the board, there are dozens and dozens of dozens of well-financed, well-managed, excellent junior resource companies that are especially cheap now.

We’re going to see soon, but I think by the end of the week we’re going to recognize the Fed has found the root of hyperinflation.

That’s going to be incredibly powerful for resource companies because you’re going to have to invest in something real, tangible, that you can put your hands on. I think that the days of paper assets are history.

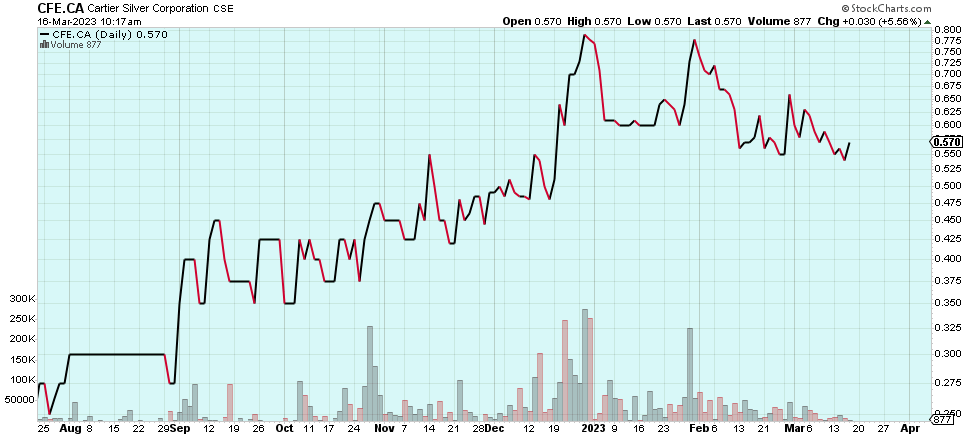

Most people are not aware of it but Eloro has a sister company now named Cartier Silver (CSE:CFE) that picked up a similar project to Iska Iska owned by Eloro. Tom Larsen runs both companies and he is an excellent CEO who knows how to keep a tight share structure. There is a project located near Iska Iska that Tom has been trying to pick up for a couple of years now. But family in Bolivia is very important and the project he just picked up for Cartier Silver was owned by a different family than the family that controls Iska Iska. So it was not feasible to put both projects in the same company because no matter what you do, you will be thought of as stepping on someone’s toes.

Cartier Silver will be drilling shortly. I think from a price point of view that CFE is in exactly the same place as ELO was three years ago at $.175. They went up thirty fold in the next year. CFE has the same potential and they own 2.1 million shares of Eloro.

CFE.CA (Daily)

Goldfinger:

The days of paper assets are history. I think that that is the big battle right now and a debt-based system versus something else, natural resources, gold, what have you.

I just want to wrap up the conversation saying that it was interesting yesterday to observe… I didn’t get any text messages from any of my friends, about gold or silver, although I had a few about Bitcoin.

“Hey, should I buy some Bitcoin? Why is Bitcoin up?.” Bunch of text messages, “What’s going on with this Silicon Valley Bank? Should I get my money out of the bank?” But nobody asked me about gold or silver, whether they should buy gold or silver.

Then I go on Twitter and I’ve got hundreds of gold people that I follow. They were very muted, mostly just focusing on the financials and seeming like they were in shock. They weren’t bullish on gold really.

I remember February of 2021, everybody on my stream was posting pictures of silver coins and silver bars. That was when silver was $30 an ounce. Now it’s trading around $21. We’re having a major banking crisis and it seems like nobody cares about precious metals.

So from just an anecdotal observation standpoint, this is very interesting because it feels like this move could actually be real and have some legs in gold and silver because nobody seems very excited about it. Nobody thinks it’s going to last.

You could see that in the juniors yesterday. New Found obviously put out a great drill intercept, an incredible one, up 17%. But aside from a few outliers, most of the junior gold and silver companies were flat on the day.

Gold is up more than $100/oz in the last week, and the gold stocks are just treading water with no trading volume. So, it doesn’t feel like we’re late in the move, that’s for sure.

Gold (2 Hour)

Bob Moriarty:

Oh, absolutely. But if you go back to the Middle Ages, when they were making a map and they went outside the area they were familiar with they would put a dragon and say, “Beware, dragons lie here.”

We are in an area that the world has never been in before in history. Is the big crash going to come now, which I think is a very real possibility, or is it going to come down the road?

The longer it takes the worse it’s going to be, but I mean, it’s an interesting observation on your part.

I saw the same thing. I thought, that’s crazy. They’re giving these stocks away. Gold’s up 50 bucks and everybody’s yawning.

Goldfinger:

People are afraid. They’re afraid, and I think most have very low exposure to gold, if any. We’re nowhere near any kind of stampede in precious metals, and certainly not in the juniors.

It’s a scary environment. Everybody is pretty uncertain and nobody really owns any precious metals. So, we could definitely go a lot higher, and even devout gold bulls are skeptical of this move and just waiting for the next $100/oz elevator down day.

Bob, thanks a lot for your time and insights, and for nailing this market panic with impeccable timing. Until next time.

_____________________________________________________________

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Dolly Varden Silver Corp. is a high-risk venture stock and not suitable for most investors. Consult Dolly Varden Silver Corp’s SEDAR profiles for important risk disclosures.

EnergyandGold has been compensated to cover Dolly Varden Silver Corp. and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.