So far in 2023 stocks have climbed a steep wall of worry. A wall of worry that looks even steeper as we begin a holiday shortened President’s Day week in the US. In the final months of 2022 Bob Moriarty of 321gold was consistent in calling a bottom in precious metals and pounding the table on a major buying opportunity in junior resource stocks.

As it turned out, precious metals and resource shares had a tremendous rally in December/January. However, the month of February has brought with it a significant correction and resource investors are beginning to feel that familiar feeling of despondency. Given the market setup and the increasingly stark macro backdrop I figured it was a good time to update December’s conversation with Bob Moriarty. Is it still a generational buying opportunity in resources? Is the one year anniversary of the invasion of Ukraine going to see a major escalation? Can the stock market remain intact in the face of heightened macro risk?

Without further ado, Energy & Gold’s February 2023 conversation with Bob Moriarty….

Goldfinger:

There’s a lot going on in the world. My sense right now, just being a market observer and obviously a human being, is that there’s a lot of worry out there. Whether it’s Chinese balloons, reports that China and the US are no longer communicating, missiles from North Korea, and obviously the war in Ukraine. And so put it all together there’s a vast wall of worry out there. Most investors that I speak with are not bullish, to put it mildly. However, so far the stock market is holding up relatively well. In fact, the S&P 500 is up more than 6% so far in 2023. What do you say to that?

Bob Moriarty:

A guy jumped off the Empire State Building and as he passed the second floor, somebody leaned out a window and said, “How are you doing?” And he said, “So far so good.”

Goldfinger:

(Laughs loudly) So the stock market’s on the second floor?

Bob Moriarty:

Yeah, exactly. I see some things happening that terrify me that I have never seen in my life, and I think we’re one tenth of a second to nuclear midnight. I’m going to read something to you from the Hal Turner Radio Show.

VP Harris: “the United States formally determined that Russia has committed crimes against humanity.”

That’s scary. Now you can argue whether it’s a good war or a bad war. The head of NATO now admits that the war started in 2014 with the illegal coup d’état in Ukraine. But when the United States starts taking the position that the United States formally determined that Russia has committed crimes against humanity, they are crossing an extremely dangerous red line. And I’m also reading that the United States has military forces in Romania prepared to invade Ukraine. Should they do that, it will be World War III.

Goldfinger:

The reality is that Russia has committed crimes against humanity, lest we not forget Bucha, Mariupol, etc. I will say that in the last year since the invasion, there have been multiple scary moments where it felt like an escalation was happening. I have a Russian friend who I talk to sometimes about Putin and the war, and you know what he says when I bring up the topic of whether Putin Will use nukes? He says: “Any man that gets manicures is not going to press the red button.”

And Putin gets manicures. He lives a pampered life. He’s extremely rich and he knows if he does that, it’ll be the end. It’ll be the end of him, it’ll be the end of a lot of people. So my friend says that thinking about that is “not even worth the time.” I mean, that’s his opinion. He’s Russian. What do you say to that?

Bob Moriarty:

I think Putin is the only sane person in the entire dialogue. He would say in December of 2021 that he wanted rock solid ironclad guarantees that the Minsk-2 agreement was going to be enforced. And we now know that the United States lied 30 years ago about moving NATO one inch to the east. And we know that Ukraine was lying about Minsk-2, and we know that the UK was lying about Minsk-2, and we know that France was lying about Minsk-2, and we know that Germany was lying about Minsk-2. We now know that the United States committed one of the greatest acts of terrorism in history against Germany when they blewup the Nord Stream pipeline. And I’m seeing things that I think are insane. Now, if you step back and you say, how important is it to the United States to have Ukraine in NATO? My answer would not be very important. I don’t give a shit. It doesn’t make any difference to me at all. Ukraine is nothing but a laundramat for the Democratic party. I don’t see NATO as a force for good. If you believe it’s a force for good, take a trip to Libya and you can go to the downtown Walmart and you buy slaves there. Thank you NATO for doing such a wonderful job of bringing slavery to what used to be the richest country in Africa.

NATO is not a force for good and it’s not a defensive force. It clearly is an offensive force and Russia responded by defending itself. I’m not sure what other alternative Russia had. And Putin said, “What exactly were we supposed to do?” The Rand Corporation in 2019 came out with a plan to get Russia to invade Ukraine. So Russia invades Ukraine and just recently the Rand Corporation has come out and they’ve recognized what I recognized last March, and they said a prolonged war is not in the best interest of the United States. Now here’s the problem, and this is where it’s dangerous. The United States has no strategic plan. They only have tactical operations. They think putting a hole in a bridge is a good idea or sinking the Moskva is a good idea or sending 30 tanks is a good idea. And none of those end the war.

They don’t end it in any way. It only prolongs it. And the Secretary of Defense and Milley have said the purpose is to bleed Russia dry. And they’re not going to succeed at that. Russia’s a very powerful country and frankly, and in this situation, I do have some expertise, their weapons are absolutely terrifying. They are far better than the weapons the United States has. So the United States has nothing to win and everything to lose. And even Seymour Hersh came out and said the attack on Nord Stream could be the end of NATO. Now the very best thing to happen would be for there to be some kind of peace conference and for Russia to get an absolutely rock solid guarantee that the United States is not going to keep moving nukes to their border. Now, that’s too simple.

Goldfinger:

With the one year anniversary of the invasion it seems like things are coming to some sort of a climax, especially because it looks like Bakhmut may fall soon and then obviously the US has sent Bradley Fighting Vehicles and Abrams Tanks, Germany sent some Leopards, etc. So it does feel like it is an escalation.

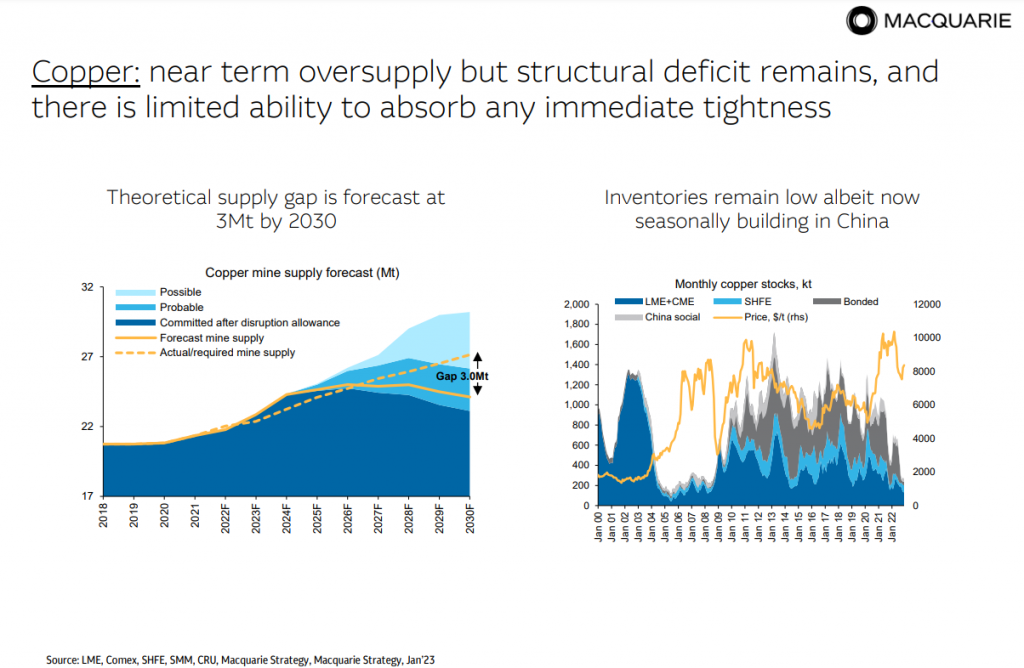

Let’s turn to metals. Because one thing that’s interesting, as awful as war is, if you acknowledge that you or I have no control over what happens in Ukraine, all we can do is observe and comment and then maybe help people to make some good investment choices. War requires a lot of metal. The aging infrastructure of the US and many parts of the world. I was in South America recently. There needs to be a big infrastructure upgrade globally. And everybody wants the fastest wifi, everybody wants cheap energy, everybody wants to be able to go where they please quickly and cheaply.

And all this requires metals. A lot of metals. And then we are at the precipice of this explosion in EV demand and production – some of the forecasts for compound annual growth for copper, silver, nickel, and lithium are pretty mind boggling. The world’s starving for all of these metals. And then there’s more obscure metals like tungsten, or vanadium. The list goes on. The world needs a lot of metals.

How do you see this playing out? Is the world going to be able to produce the metals that we supposedly are going to need in the next decade? And what are your best ways to profit from this paradigm shift, as billionaire investor Robert Friedland calls it, the revenge of the miners?

Bob Moriarty:

Strange enough, Friedland is on something, but not for the reason that he says. And your points are very valid. We need a lot more metals in the future. Now, there’s some conclusions that I’ve come to. Climate change, COVID, clipto currencies and electric vehicles are all fraudulent, period. There is not enough lithium, nickel, and copper in the world to transition internal combustion engine vehicles to electric vehicles. And the fatal flaw to electric vehicles is where does the electricity come from to power them? And of course the electricity comes from fossil fuels. But the chaos in Ohio with the train wreck proves how dangerous the United States is now in terms of infrastructure. Instead of spending money on wars, we need to be spending money on infrastructure. We need to be spending hundreds of billions of dollars a year rebuilding our infrastructure and we’re not. I’m just so dead set against all these stupid wars and quite bluntly for Europe to conclude Russia is the enemy and want to destroy them is simply stupid. They were getting all their natural resources, they were getting cheap energy from Russia.

What did Russia do to become the enemy? So we are absolutely at a turning point. We either blow up the world in the next two weeks, which is a very real possibility, or we get back to sanity and we say, hey, wait a minute. What exactly are we fighting about? Russia has very clear objectives and very clear intentions and the United States doesn’t. And the scary thing is the United States is incapable of admitting it made a mistake. And it’s like Afghanistan, that war went on for 20 years. I was always wondering who actually thinks this is a good war? It’s a stupid war. And we squandered $2.3 trillion on Afghanistan. If we put $2.3 trillion into our economy, we’d have brand new airports in every city in the United States over 500,000 people. We need to start doing things that move the United States forward, not backwards.

Goldfinger:

Yeah. I’m not going to delve into that whole justifying the war. I think war is wrong, period. And I don’t think that Russia has the right to invade a foreign country, a sovereign nation and murder tens of thousands of people. So no matter how you want to argue it or spin it, I don’t agree with it. I also don’t agree that the US should escalate. And I think that escalation is dangerous and I have no idea what we’re shooting out of the sky over Canada. I don’t even know if they know. It’s a very strange time. And so if we can just agree that it’s a dangerous and strange time in the world. And trains getting derailed in Ohio, Blackhawk helicopters crashing in Alabama, seems like a lot of weird things happening in the world. So you made a funny comment about a guy who jumped off the Empire State Building and on the second floor he said he was fine. You’ve had a negative view on the market previously. What makes this time different from previous times? Why is there more risk now?

Bob Moriarty:

Well, that’s kind of a broad question. I’m not sure that I can answer it fully. My belief, and it’s just an opinion, I didn’t come down the mountain with Moses carrying a tablet, my belief is that the stock market’s terribly overvalued. We’re going to have something worse than 1929. I believe it has started. And certainly it appears that the Fed’s going to keep raising interest rates until something blows up. They’re caught in a quandary. They’ve painted themselves into a corner. If they raise rates, it blows the economy up, and if they lower rates we have sky high inflation. And it’s like arguing that dying of heart attack is a better way of dying than dying of brain cancer. And the answer to that is neither one makes any sense whatsoever. Dying is dying. I will address your issue about how you feel about tens of thousands of people killed with illegal invasions and point out, you mean like we did in Iraq and Afghanistan and Syria? Do you feel the same way there?

Goldfinger:

Yeah, I didn’t agree with any of those. I wasn’t supporting invading Iraq. In fact, I thought it was a terrible idea.

Bob Moriarty:

Well, we could end the war in Ukraine in a week. There’s no issue whatsoever as to what the Russians would settle for. And my problem is, and I’ll go back to this, the United States doesn’t know how they made a mistake. Now, let me give you a good example. You were talking about the UFOs over Canada and over the United States that the F22 shot down. One of those was a $20 balloon. It was a hobby balloon that a club sent up as a weather balloon. And I will say I’m really impressed with the military’s ability to pick up a $20 balloon on radar. I mean, there’s something incredible about that. But the mathematics of spending a half million dollar sidewinder to shoot down the $20 balloon, that’s a little bit silly. The whole balloon issue was so blown out of proportion, I’m absolutely staggered.

And you raised another issue, and I’d like to go back to that. Remember when you said that on Friday the Chinese shut off communications?

Goldfinger:

Yes.

Bob Moriarty:

That’s what you do just before you start a war. Now the United States’ overreaction to the Chinese balloon … And I don’t give a shit if it was a weather balloon or the biggest spy balloon in the world’s history. We do the same thing with satellites. My God, I mean a weather balloon is no threat. Even a weather balloon spy balloon is no threat. There’s nothing you can do with a balloon that you can’t do with a satellite. So we overreacted so much and we’re doing everything in our power to piss off the Russians and piss off the Chinese. And we’re acting like there’s not going to be any ramifications from that. And I’ll tell you another thing. The Russians have clobbered NATO. There are US forces in Ukraine. There are French forces in Ukraine. There’re British forces in Ukraine. There are Canadian forces in Ukraine. There are Australian forces in Ukraine. There are Polish forces in Ukraine.

And Russia’s demolishing them. The numbers that I’ve heard that I think are valid, and this came from Jim Rickards, was 20,000 dead Russians and 500,000 casualties for Ukraine, that’s both injured. This war was stupid. It was stupid from the beginning. There was absolutely nothing to be gained by it. And Russia is not the enemy of the United States, and is not the enemy of Europe. Europe needs Russian and what we’ve found the last year is Russia doesn’t need Europe. I saw something that’s quite interesting because we could get into if you wanted to. I saw a report by some, I think reputable, economics association in Europe that said based on the cost of energy, there were going to be somewhere between 30,000 and 300,000 people freeze to death in Europe this winter because of the cost of energy due to the sanctions.

Now, it’s been an extremely mild winter so if anything, it could be like 20,000 people freezing to death. But the sanctions drove the cost of energy sky high and there is a price to be paid and 20,000 people paid it and they didn’t need to die. Had it been a bad winter, 300,000 people could have died so the United States can bring Ukraine into NATO. And to put bluntly, that’s totally nuts. You don’t have to like Putin. I don’t have to like Putin. I don’t have to like Zelensky. There are people in the world that you don’t have to like. But one of the things you should do is you’ve got a really nasty neighbor who’s nuclear armed, leave him alone.

Goldfinger:

I think it’s been proven time and again throughout history that the appeasement approach doesn’t work when it comes to dictators like Hitler and Putin. Chamberlain’s “Peace for our time” is a particularly striking example of appeasement.

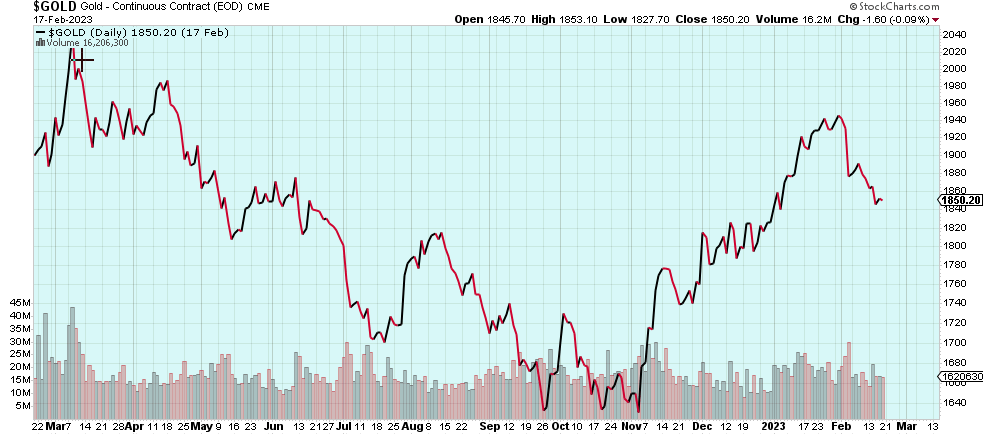

Turning to junior mining, it seems to me like we had a really solid start to 2023. However, since the beginning of February we’ve seen many stocks give back their January gains. Some are even making fresh 52-week lows as financing concerns bite hard. We spoke at the end of last year around the holidays and you quite rightly pointed out that it was a tremendous buying opportunity and you were quite optimistic on the sector in 2023. So we went up, we went down, gold went from $1620 the first week of November to $1975 the last week of January, and then proceeded to trade down to $1827 Thursday night. Gold ended the week at about $1850 on the front month futures. Silver’s had a little bit of a worse year ending the week around $21.70. Actually it’s one of silver’s worst starts to a year in history. So where do you think we are in terms of the junior mining sector, and then gold and silver?

Gold (Daily)

Bob Moriarty:

I’m glad we’ve had so many conversations in the past, certainly silver led the rally starting September 1st and then gold jumped into the fray at the end of September. Gold and silver had absolutely wonderful rallies. The shares didn’t do as well as I had hoped, but a lot of those stocks that I was talking about that were under five cents did go up 100%, 200%, 300%. But you had to be really quick on the trigger to exit with a profit. Now my belief is, and again, I didn’t come down the mountain with Moses, my belief is this is a perfectly normal correction. I think the general stock market is kind of dragging resource stocks down, but I think the junior resource stocks now just offer exceptional opportunities. And the beauty is it’s not the five cent stocks now that offer the most opportunity, it’s the really solid stocks that are so good and offer so much opportunity and literally are so safe from a long-term potential.

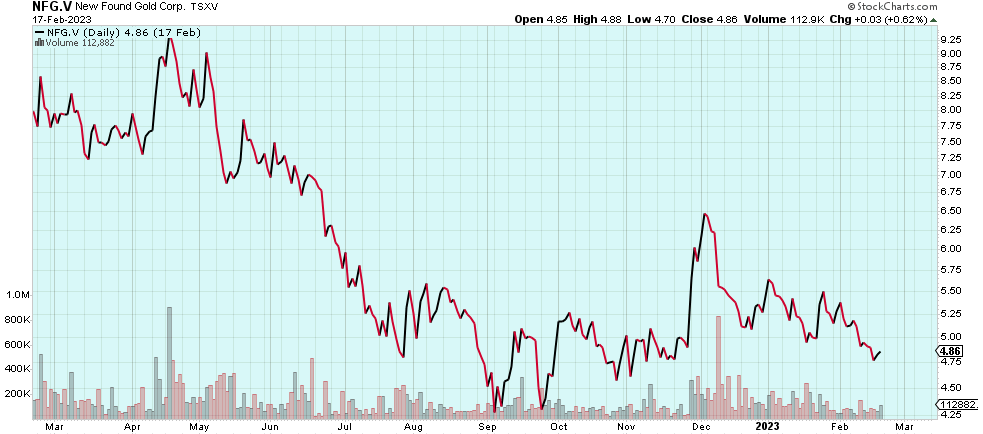

I’m going to be writing a piece this weekend about a stock, and the last time I wrote about it, it was $1.45 and that was a little over a year ago. Today, it’s trading around $.70 and the company is focused on the Golden Triangle. I’m not going to tell you what the stock is, but their projects are in the Golden Triangle and they’ve had nothing but good news. Meanwhile, the stock has been cut in half. Labrador Gold (TSX-V:LAB) has also been cut in half, New Found Gold (TSX-V:NFG) got cut in half, Eldorado got cut in half, Novo got absolutely slaughtered. Why? These are all really excellent companies that are moving forward. Most of them are well cashed up and I think there is a really bright future for them. So I think we’re in a correction, but I’m not particularly concerned.

NFG.V (Daily)

Goldfinger:

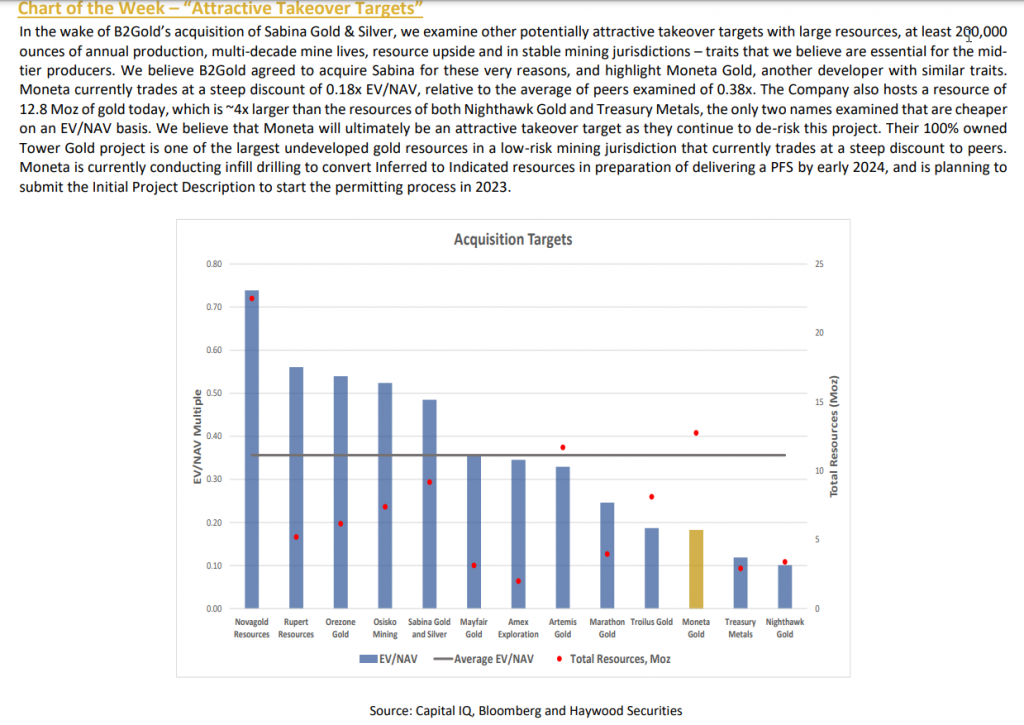

That’s interesting about the golden triangle because Newmont has bid for Newcrest and if that deal goes through then Newmont will be the biggest player in the Golden Triangle – I wonder if we’ll see more M&A activity in the gold sector, and perhaps in the Golden Triangle more specifically. I mean some big announcements last week. Sabina is going to get be taken out by B2 Gold. Obviously Sabina has a very high-grade gold deposit in far northern Canada. But it seems like the M&A cycle is accelerating in the gold mining sector. The Golden Triangle’s a good place to look. One of the companies I like in the Golden Triangle is Dolly Varden (TSX-V:DV, OTC:DOLLF). That’s a silver primary company, but obviously they have a lot of gold and silver. In certain areas of their projects they have very high grade silver. And I wonder if that will be an M&A target in the next year as silver picks up and there are so few high-grade silver primary projects in viable in jurisdictions.

It seems likely based upon the EV transition, more and more solar panels are being manufactured worldwide. We need a lot of silver and $21.50/oz seems like a pretty low price considering if you think back to 2010/2011, silver was $30 or $35 an ounce. So silver’s gone backwards if you started in 2010 or 2011, yet the world needs so much more silver than it was consuming then. There aren’t many truly high-grade gold/silver projects of sufficient scale globally, so I wonder if high-grade deposits like Dolly Varden or an Amex will be targets for larger companies in the coming year.

Bob Moriarty:

You’ve raised a really good point and I’m going to educate you a little. What kind of deposit was the Comstock lode?

Goldfinger:

Silver

Bob Moriarty:

Okay. So if they found the Comstock Lode today, the exact mineralization, what kind of deposit would it be?

Goldfinger:

Oh, I would guess it’s a silver deposit.

Bob Moriarty:

Nope. No. What was the ratio back then?

Goldfinger:

Oh, the ratio of silver to gold was 20 to 1.

Bob Moriarty:

Well, it was 18 to 1 I think, but you’re pretty close. Here’s the key. Depending on what the ratio of silver to gold is determines whether it’s a silver deposit or gold deposit. I just did a podcast on Dolly Varden a few days ago. I love Dolly Varden. I’m very close to management. I think they’ve done a wonderful job. And I have always called Dolly Varden THE silver company. So last year they did a deal with Fury and they added a piece of ground onto the Dolly Varden piece of ground. But the piece of ground that they added was actually a gold rich portion. So Dolly Varden used to be a pure silver company, and now it’s a gold and silver company. They’ve changed because the ratio is like 84 to one as opposed to 18 to one. So the interesting thing is, depending on how the economics change, depends on what kind of deposit it is. But the golden triangle, I mean there’s probably five or 10 companies up there that are absolutely exceptional and they’re going cheap. Now, I’ll give you a little bit of history. When did you actually start studying junior resource companies? When did you get involved?

Goldfinger:

The first time I ever bought a junior mining company was 2003.

Bob Moriarty:

That’s pretty good. But if you go back to Bre-X, at the time, the major mining companies had big exploration departments. And because everything got slaughtered after 1997, the majors got rid of their exploration departments. So now they’re counting on the juniors and the mid-tiers to do their exploration for them. There just has to be tons of M&A coming up in the future. The majors are consuming their young and they absolutely have to add ounces. Because every year they’re producing ounces and they’re decreasing what they’ve got in resources. So I see a lot of M&A in the future, and I’ve seen a lot of companies that I think have the potential of Great Bear. Great Bear went from 50 cents to 28 bucks a share. And there’s a lot of companies out there. Actually, the company that I’m writing about this weekend has better grades than Great Bear did. And God, it’s like a 60 million company with $15 million in the bank. So there’s enormous potential for the future. And the one thing that I’ll say is in September, October and November, I was telling people to buy the cheap lottery tickets and now I’m saying, okay, the market has shifted. You should go for the absolutely top tier great juniors with resources, with money, with management.

Goldfinger:

I posted a report from Haywood on Twitter that shows gold M&A targets. Now obviously the B2 bid for Sabina prompted Haywood to make this chart. And I’m going to name some names and you tell me which ones you really like based upon enterprise value to net asset value. Haywood says Nighthawk Gold (TSX:NHK), Moneta Gold (TSX:ME), Marathon Gold (TSX:MOZ), Amex Exploration, and a few others. So they think those are cheap relative to all the others on an enterprise value to ounces in the ground basis.

Bob Moriarty:

Amex is an exceptional company. A great drill program, great management, great resources. I don’t know Nighthawk or Monetta, but you’ve got Western Alaska Mining who’s had some exceptional drill results. You’ve got Snowline, which really looks to be 10 to 20 to maybe 30 million ounces. It’s not in a good area of Yukon. However, I think there’s going to be so many ounces they’ll get taken out … But the top tier companies, yeah, there’s going to be a lot of M&A.

Goldfinger:

And then the final topic, copper. I think we can all agree that the world needs a lot more copper and there’s a lot of possible copper mines out there. For example, Pebble or NovaGold, there’s a lot of big copper projects in Alaska, Yukon, even in BC. But they’re all possible projects that have big permitting hurdles. Are there any copper plays that come to mind where you think they’re cheap and maybe they could actually get permitted?

Bob Moriarty:

You raised a really good issue there because the issue is not from a tactical point of view, the issue is from a permitting point of view. And I’ll point something out. I wrote up Nova Resources when it was a dollar a share and when I wrote it up, it doubled and then I wrote it up again six weeks later and it doubled again. Nova Resources was the number one gaining stock on the Canadian Stock Exchange in 2001. It got as high as 20 bucks a share and then dropped and got as low as 45 cents a share. It’s in a tough area and permitting and the total cost of putting it into production could be a lot. I wrote up Pebble when it was 50 cents a share, and I can’t give you what the stock price did, but the stock price went up 10 or 20 fold. There’s a lot of political interference there and the woke generation who want electric vehicles, they just don’t want copper or lithium or nickel, they are literally killing the market, which is really foolish.

You either buy into the green energy or you don’t buy into the green energy, but if you buy into it, you also have to buy into a lot of mining. I did come across a company literally last week it started trading again that it’s the best copper story that I’ve ever heard. Here’s a short synopsis. The company is called Gladiator Metals (TSX-V:GLAD), and many years ago the president of the company met the head of a drilling company, who’s runs a First Nations drilling company based in the Yukon, and they own a bunch of land right next to Whitehorse and they’ve got extraordinary grade, like 1.5% to 2% copper. They’ve got somewhere between 10 and 20 million tonness already outlined. And the company … Let me see if I can figure out what it’s selling for. It was such a ridiculous price. They got to do a placement, which is not a bad thing because it could give people an opportunity to get into the stock. Let’s see. GLAD. It’s got a $6 million market.

Goldfinger:

Wow, that’s cheap.

Bob Moriarty:

Yeah. I worked out the numbers and I think they had three and a half billion … No, they had five and a half billion dollars worth of copper. Not in a 43-101, but historic resources and solid information. But the beauty is one, the vendor of the land is First Nations. They are very important people in the Yukon, period. These are the best guys in the Yukon and they’re actually funding most of the drilling that these guys are going to do. They’re going to take a big part of the upcoming placement. And they have been using this ground for training for 20 years. So they know exactly what’s on it. So they’re going to be doing the drilling. They’re vending the project in, and the beauty is they’re vending the project to Gladiator for 15 million shares. Now how much is it going to cost Gladiator to print off 15 million shares?

Goldfinger:

Probably not that long. It’s junior mining.

Bob Moriarty:

Well, I mean it’s a simple question. If I gave you a ream of paper and said, “I want a thousand shares on each piece of paper,” how much would it cost you to print off 15 million shares?

Goldfinger:

Not much.

Bob Moriarty:

Nothing. It’s paper. They didn’t say we want $15 million in cash before we’ll show you the ground. They said, we want 15 million shares because the vendor of the property knows what’s on there. And they’re saying, “We want a big piece of this, and we’re experts at drilling it. We don’t want to be experts at exploration.” It’s the most amazing story that I’ve ever heard. And I’ll be a bit candid. I mean, where’s five and a half billion dollars? What’s it worth? And it’s a bunch more than $6 million, I’ll tell you that.

Goldfinger:

That’s an interesting one and I’ll need to take a look at that more closely. But there’s a lot of projects like that. I mean, a lot might be an exaggeration, but there are a number of projects around the world that maybe have resources of four billion pounds of copper, five billion pounds of copper, maybe even more than that. And they’re just sitting there because there is some perception that they can’t get permission. I think of Libero Copper (TSX-V:LBC, OTC:LBCMF) in Columbia, the Mocoa project, that’s an example. I mean, the existing resource is something like five or six billion pounds of copper. They’ve got a lot of Molybdenum too. But in reality, this deposit is probably well north of 10 billion pounds. However, there’s a perception that Colombia or this region will not allow it to be permitted. So it’s sitting here at whatever, $17 million, $18 million market cap. And so for us to supply this energy transition with copper, some of these possible copper projects are going to need to go forward. So the money will be made by investors who are able to figure out which one of these deposits, or which ones plural, will actually get the seal of approval and get the proper government and local support. And I think there’s a lot of value to be had there. Of course, a number of these projects are probably going nowhere for any number of reasons.

Bob Moriarty:

I’ll give you an analogy again, and you’ve hinted at it, you’ve asked a question that asks another question that’s very important. In my opinion, the conflict between Russia and Ukraine, it’s not a conflict between Russia and Ukraine. It’s not a conflict between Russia and NATO and the US. It’s a conflict between the debt based system of the west and the resource based system that India, Brazil, China, the United States, South Africa, intend to create. I think the resource based system will be based around gold. And quite bluntly, all of those projects are going to get permitted because the world has been living on Uncle Willie’s platinum American Express card for the last 40 years and the bill just came due. We got $300 trillion in debt and there is nobody sane in the world who believes it’s going to be paid. It is not going to be paid. We need a new financial system based around resources.

Now, when all these companies realize that it’s either produce or starve, they’re going to say, “We can’t keep writing checks for stuff that we don’t intend to honor. Why don’t we actually produce something?” And I think that producing things is a wonderful idea. There is so much that we could do for the seven or eight billion people in the world if we weren’t spending money on war. And I fought in Vietnam. I wasn’t fighting for America, I wasn’t fighting for my country. I was fighting for Conviar and I was fighting for DuPont and I was fighting for Grumman. And that’s bullshit. Okay? We need to fight for our country, our neighbors, our families, our cities, and they’re deteriorating. The United States is falling apart because we’re shipping 155 millimeter shells to Ukraine. Why are we doing that? Who’s better off? And I don’t give a damn if Raytheon has 15 generals on their board of directors, it’s criminal. We have to stop that and we have to go back to some kind of reality. And to the extent that China, India, Brazil, South Africa, and Russia are saying, “Hey, we want a reality based financial system,” I think that’s a great idea.

Goldfinger:

I think that’s a perfect place to wrap it up. You said it well. We need a new global financial system based upon resources. I think that sums it up very well, and I think that also actually understates the investment opportunity in commodities. So thanks a lot for your time, Bob. I think we covered a lot of ground and yeah, have a great weekend. I look forward to the articles that you mentioned that’ll be coming out this week.

_________________________________________________________________

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Dolly Varden Silver Corp. is a high-risk venture stock and not suitable for most investors. Consult Dolly Varden Silver Corp’s SEDAR profiles for important risk disclosures.

EnergyandGold has been compensated to cover Dolly Varden Silver Corp. and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.