Last week, on 321gold‘s 20th anniversary I had the opportunity to spend an hour speaking with Bob Moriarty about some of his favorite junior resource stocks and why this is the greatest time in history to be a resource investor. Bob has been consistent in stating that the world needs a return to sound money, and natural resources will be at the forefront of this return to sound money once the Ponzi economy comes crashing down.

In July 2021’s Energy & Gold conversation with 321gold founder Bob Moriarty we discussed Eloro Resources, New Found Gold, Eskay Mining, and Bitterroot Resources among many other topics including the covid vaccines and why counterparty risk is going to become a much bigger problem for cryptocurrency investors….

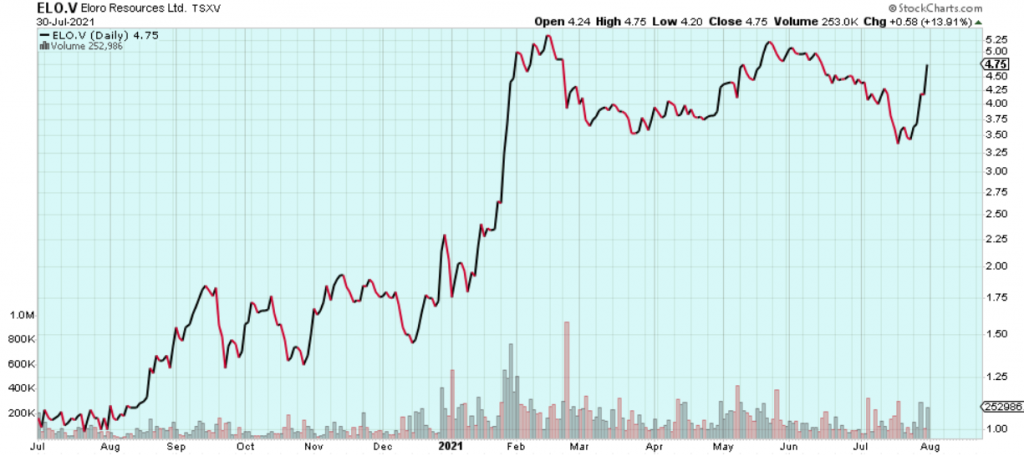

Goldfinger: Good to speak with you today Bob, let’s start with Eloro Resources (TSX-V:ELO, OTC:ELRRF). That’s definitely some notable news, and a stock that we have talked about many times – we were very early in illuminating this company and its potential. So in this hole 18 at Iska Iska, ELO intersected 300 meters of 129 g/t silver-equivalent mineralization, or if you want to make it gold equivalent term, it’s almost two grams per tonne gold. So that is an excellent width and grade, extremely good intercept.

The main question is that it’s a polymetallic deposit so there are eight different metals comprising this 129 g/t silver-equivalent grade over 300 meters. There is silver, lead, zinc, tin, copper, gold, cadmium, and even some bismuth.

Bob Moriarty: Yeah, it’s a polymetallic deposit. They’ve got silver, they’ve got lead, they’ve got zinc, they’ve got tin, they’ve got indium, they’ve got a bismuth sample and a tiny bit of gold. The key is that all of those minerals can be floated and you can make a silver con, a zinc con, a lead con, and a tin con. But here’s what I do, I’m the only guy that has done this, but I think it’s an accurate way of doing it. Nobody understands what a long intercept means. I used the analogy a couple of weeks ago, they had one fair size interval and one long interval, the long interval has a lot more impact on the total value. What I do is I imagine a cube, 300 meters by 300 meters by 300 meters. Now, obviously that’s the maximum size that you could possibly have. However, it gives you the ability to measure that against a hundred meter cube. Are you with me?

Goldfinger: Yes.

Bob Moriarty: So I worked up the numbers. I even applied 300 meters by 2.7 (specific gravity) by 2 grams (Au instead of Ag) instead of 129 g/t of silver, you divide by 31.1 to get ounces, and you come up with a hole that is 4.7 million ounces of gold.

Goldfinger: A 4.7 million ounce hole? 4.7 million ounces of gold in one intercept?

Bob Moriarty: In one intercept.

Goldfinger: Ok, but you’re giving them credit for many meters of mineralization or tonnage that’s not intersected in that little cylinder (the diamond drill core). You’re assuming that the mineralization extends out into an entire cube, that’s a big assumption right?

Bob Moriarty: Yeah, but here’s the key, and your point is absolutely valid. The only purpose of calculating the hole like this is to give you the ability to measure one hole against another hole.

Goldfinger: That makes sense.

Bob Moriarty: But if you had a cube, and it was 300 meters by 300 meters by 300 meters and 129g/t silver, you would have 7.5 billion dollars worth of metal. And the key here, is if it’s 300 meters in one dimension, but it’s only 50 meters in the other two dimensions, that’s still a fucking big hole.

Now, one of the interesting arguments and periodically, I guess you agree with Quinton, and once in a blue moon I’m right. And I’ve told Quinton and I’ve told Tom Larsen, right from the very beginning, that everybody is underestimating the size of that deposit. It’s an enormous deposit, if you go to the website and you look at the maps and you see the caldera. The whole damn thing, it is filled with mineral pipes and it’s mineralized deep. So it is going to be an absolutely world-class project. It will get mined, there’s no question about it. If it was one gram gold, equivalent, it would be economic. They had some intercepts of tin, that are 0.4%, and that’s roughly $120 value to the tonne just for the tin. So it’s going to be a giant silver project, but the tin could well be the most valuable mineral they mine at Iska Iska.

ELO.V (Daily)

Goldfinger: So just wrapping up on Eloro, the comments by the VP of Exploration, Dr. Bill Pearson are notable. He makes a point that there’s a gap zone between the central breccia pipe and El Porco. So there’s an area that’s been undrilled and he’s suggesting that the magnetic data suggests the potential for a significant amount of mineralization in this gap zone and they haven’t drilled it yet. What do you think about that?

Bob Moriarty: You’re absolutely right and he’s absolutely correct. That’s one of those projects like, New Found Gold (TSX-V:NFG, OTC:NFGFF) in Newfoundland. You need to bring in a bunch of machines and get to work. I talked to Tom and said, “Tom, you could support 15 or 20 drills.” And he totally agrees with me, but the problem is, they have 26,000 assays they’re still waiting for because of COVID. The labs and crew have been backed up, and he said, it’s a waste of time for us to go drill because it might be a year before we have the data. And that’s absolutely valid. But if you step back, look at all of the technical data, look at the maps and look at the size of the pipes they already know exist, this is a BFD deposit.

Goldfinger: Okay, fair enough. And the stock is up nicely today, about $4.20 a share right now, and it traded as high as $4.59 earlier. And yeah, that is a problem, the backlog on the assays, that’s a challenge that they’re dealing with. And I think a lot of companies working in areas outside of North America, they’re just doing the best they can. If we look at Australia and how they’re dealing with this COVID situation. Mining is considered an essential industry, but when so many things are locked down, labs are operating short staffed, and there are various logjams in supply chains and you’re going to get big delays.

Bob Moriarty: Well, because Australia has effectively been totally locked down for 15 months now, they’ve got a giant labor problem. The iron companies are getting the equivalent of four gram gold, and they can sell every ton of the iron ore they can ship. So they are paying absurd salaries to people. Which means companies like Novo and everybody else in the spectrum, has to belly up to the bar. Believe it or not, one of Novo’s biggest problems is, they can’t hire enough truck drivers to go eight kilometers from the mine to the mill.

But everybody in Canada, in Nevada, everybody is backed up on the assays. Everybody’s trying to hire people and they can’t hire people. You’ve got companies like Irving in Japan, effectively the Japanese wouldn’t let anybody in for six months, so there’s been zero news. So a great company, with a great deposit, it’s just hovering at new lows. And what’s really important for investors to understand, this is not bad management, it isn’t the fault of bad management, there isn’t a damn thing they can do about it.

Goldfinger: So let’s talk about sector sentiment and some of the price action that we’ve seen. We’ve been through a few rodeos in this sector, for sure, and this definitely isn’t our first one. I think back to other times where sentiment was really, really poor in the junior mining sector. End of 2015, summer of 2018, you couldn’t give a gold stock away. Obviously last March was another example, but that was very, that was a very short, violent experience and then we had a tremendous bull market run. How does this market feel to you? Relative to some of the other major lows we’ve seen in the last 5-6 years?

Bob Moriarty: One of the things I’ve tried to point out in my books and to the very best of my knowledge, I don’t know anybody else who has made this point. At bull market tops, everybody is in the market and at bear market bottoms, you can’t give shares away. That is a sentiment indicator that gives a very valid signal of just where you are in the cycle. Now looking at the HUI and the DM side, you don’t see any clear signals, like we had in 2008 and like we had in 2015. However, I think that we’re going to have a bounce, I think you called that absolutely correctly. But I think that what everybody needs to pay attention to, I am absolutely convinced the overall market is going to tank between now and October. I mean, we got this giant soap bubble, bubble floating around looking for a pin to pop it. And lots and lots and lots of people see it and it will take the resource sector down with it. The resource sector will be first to recover, but when the margin clerks come calling, everything gets sold.

Goldfinger: So what you just described reminds me a lot of 2008. If you’re saying that, okay, well we’re going to get a little bounce here into August, the seasonal bounce, but then we’re going to crash in September, October, and everything’s going to crash. Well, that reminds me of 2008.

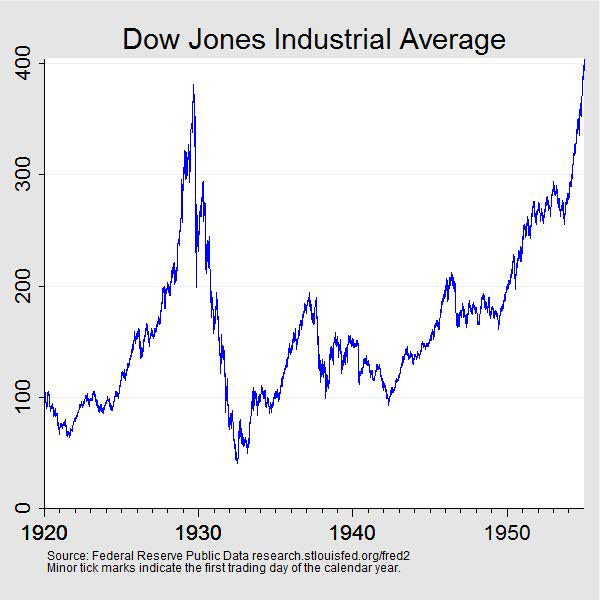

Bob Moriarty: I think it should remind you of 1929.

Goldfinger: Okay. 1929. Well, that was the great crash.

Bob Moriarty: Yeah. The Dow Jones peaked, I believe, on September 5th at 295 and then it declined at the end of October, and then it crashed at the end of October. Between September of 1929 and July of 1932, the Dow Jones and the general stock market declined 89% to 41. That’s going to happen again. But if you go back to the great depression, the number one stock during the entire depression was Homestake Mining.

Goldfinger: Well, gold was hard money, a store of value, during a very, very tough economic time. And that was a very high grade gold mine.

Bob Moriarty: I absolutely want everybody to understand, who’s reading this, that the financial system is in more of a precarious position than I have ever seen or read about. And some things like Tether, Tether’s a $62 billion fraud.

Goldfinger: Yeah. Let’s talk a little bit about Tether and this ponzi scheme that’s hiding in plain sight.

Bob Moriarty: And it’s going to blow up.

Goldfinger: Let’s talk a little bit about Tether and cryptocurrency. So, can you think of another situation where a financial company or some sort of financial product supposedly had $62 billion in assets and it didn’t have to regularly submit to third party accounting and audits?

Bob Moriarty: Sure. Of course.

Goldfinger: Which one is that?

Bob Moriarty: Bernie Madoff.

Goldfinger: (Laughs) Yes, Bernie Madoff. But that’s not a good one.

Bob Moriarty: How about those idiots down in Houston. What was that?

Goldfinger: I think that was Enron, right?

Bob Moriarty: Enron, the energy company… people and the quotes they come up with. Warren Buffet is very well known for his quote about “Only when the tide goes out do you find out who’s been swimming naked.” And that’s such a wonderful line. But here’s what, there are some things that are so obvious, you just wonder why people don’t get it. There was a great celebration about Tether, and it’s a $62 billion fraud. I mean, there’s no fucking way those people are running anything except a scam. It is a giant shell game run by criminals, who’ve been caught in the past and they’re getting away with it. But it is important for investors to understand that the SEC was warned by a whistleblower that the numbers Madoff was quoting couldn’t possibly happen in the real world. And a fund manager told the SEC and the world that Enron was a fraud a year before they finally blew up.

Goldfinger: Yeah, this is the really amazing thing. Usually when people have been found guilty of fraud, or caught in different sorts of financial shenanigans, it’s hard for them to pull off another, especially in modern day. Right?

Bob Moriarty: It’s normal.

Goldfinger: Okay, so about Tether, if you look at the background of some of the main people involved, including the CFO, they have a pretty checkered past. Now, normally, in the financial industry, when people have a checkered past, especially in the realm of financial fraud, they’re not given many opportunities to pull it off again, especially not at a large scale. There’s always fools born everyday, but to pull off something in the billions, especially $62 billion, is pretty unheard of. This is incredible, that this is basically the biggest Ponzi scheme ever hiding in plain sight. It’s a Ponzi hiding in plain sight. Have you ever seen anything like this?

Bob Moriarty: Yeah, Bernie Madoff

Goldfinger: Well, yeah, but with Bernie Madoff, we didn’t know, or most people didn’t know that he was running a Ponzi until it was much too late.

Bob Moriarty: A guy went to the SEC, he took out a sheet of paper, he wrote down some numbers, and he said mathematically it is not possible to do what he claims he’s doing. The SEC said, “Oh, that’s interesting.” To call these Tether guys, to suggest they have a checkered past is like suggesting a hooker has a checkered past. It doesn’t quite qualify.

Goldfinger: So how does this end? This is a $62 billion financial fraud that is a really integral part of the cryptocurrency system. What happens here?

Bob Moriarty: Somebody pulls the plug, and the water comes out of the toilet. You know exactly what I feel about cryptocurrencies, I have never made any bones about it. There is no there there. Why anyone would speculate, and I acknowledge a lot of people have made a lot of money, but it’s a fraud, and, if it’s a fraud, why would you consider it an investment? It’s going to blow up. One day we’re going to pick up the Wall Street Journal, take a look at it, and see that Tether has imploded.

Goldfinger: It kind of reminds me of baseball cards. As a kid, I bought a lot of baseball, football, and basketball cards. I thought they were really cool. I thought they were going to be valuable one day, and I spent thousands of dollars of my parents’ money on these sports cards, and it’s been 30 years and many of them aren’t worth much still, but some of them suddenly became sought after. Suddenly people wanted some of these cards again, like some of the rarer ones of the better athletes, and so it’s kind of like baseball cards or football cards.

If somebody’s willing to pay a price for the Bo Jackson card from 1988, then that’s how much it’s worth. I kind of think the same thing about bitcoin or dogecoin. If there’s a fool who’s willing to pay for it, then so be it. But it’s very easy for, suddenly, these things to become out of favor, and for people to realize they’re not as rare as they once thought they were, and for the prices to crash. That’s what happened with most of the baseball cards from the early ’90s. The companies printed a ton of them, and suddenly they were all worthless.

Bob Moriarty: Let me give you an analogy, and you’re going to enjoy this analogy. Who was the most famous presidential stamp collector in US history?

Goldfinger: Stamp collector? Roosevelt?

Bob Moriarty: Roosevelt, okay. During the Depression, people needed things to do, and during the ’30s, the ’40s, and the ’50s, well into the ’60s, there were a lot of stamp collectors, and there were companies like Prudential Insurance that would go out and buy tens of thousands of dollars of sheets of new stamps because, one, they knew they were going to use stamps just to get the plate blocks. The interesting thing about it was the post office went to stamps with sticky backs, okay, so when you put a stamp on an envelope, that was it. You couldn’t do anything with the stamp anymore. And the post office didn’t realize it, but they killed what was a very big industry. There used to be $5 Alexander Hamilton plate blocks. They were worth hundreds or thousands of dollars, because they were relatively rare. I think now you can buy it for $150, because there’s no stamp collectors anymore. Lots of plate blocks, no collectors. I used to buy sheets of US stamps at a 25% discount from a dealer because no one wanted them any more and had no use for them.

The idea of cryptocurrency, it’s a perfect example of the greater fool theory. You’re thinking about, and focused on, the value of an investment, and the fact of the matter is, no investment has any value. It’s what somebody perceives, and that changes constantly, so what you’ve got to watch for is human behavior. Now, since Christ was a corporal, people have wanted to speculate. They love the idea of instant riches. They never get it, of course, but it’s really fun, and people get into it big time. They did it with Beanie Babies, they did it with baseball cards, they did it with postage stamps. Now they are doing it with imaginary numbers generated by tens of thousands of computers all churning away doing nothing practical.

Human behavior calls for people to act like a herd, and when the herd changes direction, all of a sudden they’re gone. Now, the beauty of the cryptocurrencies is, because Tether is so obviously a fraud, they’re just going to yank that plug and cryptocurrencies are going to disappear overnight.

Goldfinger: Yeah, it could honestly be the sort of thing where somebody yanks the plug, as you say, and suddenly there are no bids in the market. You could go to sleep one night and your crypto could be priced at $2 a coin, and wake up the next day and it’s priced at five cents, or maybe even less. It could literally be the sort of thing where the market goes “no bid”.

Bob Moriarty: Yeah, but how would you like to be short? If you were to short it at $2 and it went to five cents, how would you like to be in that position?

Goldfinger: That would be great.

Bob Moriarty: No, it wouldn’t.

Goldfinger: Why? Why is being short something that drops in value a bad idea?

Bob Moriarty: Because of counterparty risk. Okay, you have, right now, about a $1.2 trillion market in cryptocurrencies with no substance behind it. When they go from $2 to five cents, it’ll go no-bid, and all of the guys who were short at $2 are going to find out what counterparty risk is. Let me give you an analogy. Have you ever been to Vegas?

Goldfinger: Yes, more than a few times.

Bob Moriarty: Okay. You walk in, you’ve got a million dollars, you put it down on the crap table. You tell them, “I want to roll until I either make my point or I lose, and I want to bet a million dollars on that roll. Will they take the bet?”

Goldfinger: Yes.

Bob Moriarty: Okay. What are the only things that can happen?

Goldfinger: You lose your million dollars or you double your money.

Bob Moriarty: You win.

Goldfinger: Yeah.

Bob Moriarty: Yeah, okay. You happen to be from Saudi Arabia, and you walk in there with a certified check for a billion dollars, and you go to the biggest casino in Vegas, and after they’ve talked back and forth a little bit, they decide they’re going to take the bet. What are the only two things that can happen?

Goldfinger: You lose or you win and they still take your money.

Bob Moriarty: They give you your money if you win. They can handle billion dollar bets. That’s not the end of the world. But somebody from China, say, walks in, and he’s got a trillion dollar certified check, and he wants to make the same bet. Will the casino take the bet?

Goldfinger: A trillion dollars?

Bob Moriarty: Yeah.

Goldfinger: (launghs) I don’t think so.

Bob Moriarty: Sure, of course they’d take that bet. But what’s the only one thing that will happen?

You’d lose. How many casinos can pay off a trillion dollar bet?

Goldfinger: Zero.

Bob Moriarty: Okay, so you would just introduce counterparty risk, and counterparty risk is not a function of the bet, it’s a function of the size.

Goldfinger: Okay. Got it.

Bob Moriarty: In the cryptocurrency market, you’ve got $1.2 trillion worth of assets, but you’ve got $1.2 trillion worth of liabilities, and nobody can pay off the liabilities. Therefore, if you’re short at $2 and it goes to zero, you’re holding a used lottery ticket with zero value.

Goldfinger: That makes sense, so let’s talk about COVID a little bit. You posted a good article on Ivermectin, and it’s becoming increasingly clear that Ivermectin is a really important part of the COVID protocol, and the deadliness of this virus is clearly a lot less than we thought it was a year ago or a year and a half ago when we first heard about it. Mankind has figured out much better ways to treat this illness, yet the focus is purely on vaccination. What is going on here?

Bob Moriarty: It’s the biggest medical fraud in history. COVID is a damn flu. You do not want to catch COVID, it’s a bad flu. You can pretty much prevent COVID by taking vitamin D and zinc. People who catch COVID are old, or they’re fat, or they’re vitamin D deficient. It is a disease for people over 80. The government doesn’t want you to know that, so what the government did is they paid hospitals extra money for COVID patients. Everybody that walked in the door and died, if you said that they were positive for COVID, they gave you $13,000. Now, the beauty is they were counting people like 22-week old premature babies who died, and bullet wounds in people who were shot to death. Those must have been COVID. They were counting automobile accident victims. Those must have been COVID.

Now, here’s the problem: the CDC has finally come out and admitted, by the way, the PCR test is total bullshit. It generates a 80 to 90% false positive, however it gets you really big numbers of people who test positive. But if you had a flu a year ago, you test positive. If you had any influenza in the last year or two, you test positive. It is not a test for COVID. It is a test for any COVID or any cold. It is bullshit, they knew it was bullshit all along. It was a mass transfer of power to governments around the world.

Now, the funny thing is, I actually had a video removed from YouTube and an interview because I talked about HCQ and Ivermectin. In Tanzania, everybody takes HCQ, it’s a 35 cent pill that you take once a week to prevent malaria, and they’ve had 16 deaths in the last 19 months. And, by the way, you could take Ivermectin, which is another $5 or $6 drug, one of the safest drugs in the world’s history, and it’ll cure COVID. They don’t want people knowing.

They are killing people. Let’s go one better. Have you ever heard of anybody taking a vaccine for HIV?

Goldfinger: No.

Bob Moriarty: Why?

Goldfinger: There isn’t one.

Bob Moriarty: Right. Ever heard of anybody taking a vaccine for the cold?

Goldfinger: No.

Bob Moriarty: No. Because there isn’t one. They do come out with the flu vaccine every year, but it’s a vaccine based on last year’s flu. It protects you against last year’s flu this year for really simple reasons. Vaccines mutate constantly. I wrote an article a year ago, and I said they’re never going to have a successful so-called vaccine because the virus mutates on a constant basis. Therefore you would have to have a shot every three months or every six months, therefore it can’t happen. We have done exactly the wrong thing. Children are not at risk from the flu. Two out of 100,000 would catch the disease in the first place, yet they’re insisting that we use this experimental gene therapy on 12 and 15 year old children who were never at risk. People are waking up around the world. There’s been this giant seizure of power by governments, and people are very angry.

When this boils over it’s going to be pretty messy, because people have a right to be angry. What we have done to children by putting them in masks and keeping them from socializing with their peers for a year, a year and a half, it’s absolutely criminal. I hope people get hung for that. That’s a monstrous thing to do, and we’ve known all along that children are not at risk.

Goldfinger: Yeah. It’s really amazing some of what has taken place in the last year and a half. So now we’re dealing with delta, and surely there’s going to be another variant that will come about in the next couple of months. How long can we continue this futile exercise before everybody just says, “Okay, the virus is not going away,” and it’s, in fact, going to shape shift and morph over time, and we’re going to have to learn how to deal with it. We’re going to have to learn how to live with it. We have treatments that work very well, and the mortality rate is extremely low, and, as you said, it mainly threatens the elderly and the extremely obese, people with really high blood pressure, diabetes, and that’s it. It’s really that simple.

Bob Moriarty: Well, it’s been a monumental fraud on the part of Fauci and Bill Gates. It’s all about money. There is something evil in trying to force people into taking a vaccine. Do you have the current numbers on how many people the vaccine has killed?

Goldfinger: No.

Bob Moriarty: It’s about 19,000 in Europe and it’s about 12,000 in the United States. Now, there was a vaccine back in, I think, 1976, against the Hong Kong Flu, and when it killed 25 people, they said, “This is way too dangerous for us to give to people.” What they’re doing now with the vaccine is nothing short of cold-blooded murder.

Goldfinger: But Pfizer stock is breaking out to new highs right now. It’s up 2.6% today as they’re forecasting to generate over $30 billion in revenue from the vaccine this year.

Bob Moriarty: That’s evil. When you go to sleep at night and the bastards running Pfizer are like the cocksuckers that were running the tobacco companies. “Oh no, tobacco isn’t addictive. Tobacco doesn’t kill.” That’s bullshit. They knew it all along, and they were sued and they were pretty much put out of business in good form, but the vaccines can never work. They are exceptionally dangerous. It’s the most dangerous thing I have ever seen. I said this to you, remember when you asked, God, it must have been a year ago. You asked me for a one-liner of something that you think is important. You remember that?

Goldfinger: Yes, yes. (CEO.ca – Lessons From 2020, And The Promise of 2021)

Bob Moriarty: I said the vaccine was the most dangerous thing I had ever heard of.

Goldfinger: Yes. I remember, yeah. That was the end of 2020 article.

Bob Moriarty: Yeah.

Goldfinger: Are there any stocks that you really think are important to talk about today? Are there any companies that are on your radar that we should discuss?

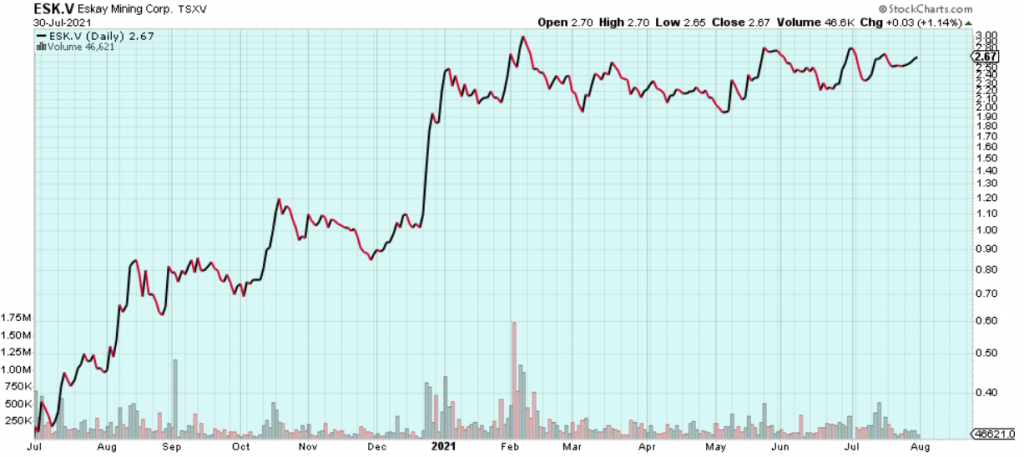

Bob Moriarty: Yes, I’d like to, and I would certainly be interested in your comments about this. You were in the market in 2001, 2, 3, 5, 8, 12, 15. There were a lot of shit companies. Many of them disappeared, and they took all the investors’ money. There was a lot of crap in Toronto and in Vancouver, and the situation is pretty close to the opposite now. There are so many great companies out there with so much opportunity. How can you look at Eloro and not see a multibillion dollar company? How can you look at Newfound Gold or Labrador Gold and not see a multibillion dollar company? How can you look at Eskay Mining (TSX-V:ESK, OTC: ESKYF) and not see a multibillion dollar mine? Incredible opportunities, and right now they happen to be cheap. Now, there will come a time that they’re expensive, but right now all of these companies are cheap, and they offer a hell of an opportunity. I think, personally, this is just my opinion. I think this is the greatest opportunity to invest in resource stocks in history.

ESK.V (Daily)

Goldfinger: Yes, I would have to agree that some of the secular themes that exist today, like copper, battery metals, modern monetary theory, these factors are very bullish for resources. These are very bullish for metals. We’re not making new copper out of thin air. We’re not creating tin out of thin air. We’re not creating gold bars out of thin air, and, in fact, if you look at the data on head grade of some of the biggest mines in the world, the head grade of copper mines has gone from nearly 2% 25 years ago to less than 1%. In fact, some of the biggest copper mines in the world are mining .5, .6% copper. That means that it takes more tonnage to create the same number of pounds of copper. It’s more costly, it’s harder to extract. We’re not finding new deposits regularly, and permitting, dealing with governments, as we’re seeing in South America recently, is becoming even more challenging.

The fundamental secular themes are stronger than anything I’ve ever seen. Modern monetary theory, the theory that the government can spend, can go into debt as much as they wish, because they can print their own currency, everything is priced in fiat. If fiat is on a race to zero, well, the fiat price of those metals is going to go a hell of a lot higher, right?

Meanwhile, natural resources are becoming increasingly scarce and we are witnessing industrial battery metals like copper facing a looming supply crunch. There simply aren’t many new mines of any significant scale coming online in the next decade.

Bob Moriarty: Well, take a look at the price of gold in Zimbabwe dollars.

Goldfinger: Yeah, exactly. Exactly. So this is a helluva time to be a resource investor, it’s a remarkable time. But, just like we started the conversation, Bob, yes, bigger picture bullish as ever, but even you’re worried about the short term, right? There’s this constant wall of worry that we have to climb as investors.

Bob Moriarty: That’s true, but let me point something out. You need to cleanse the system periodically. Because everybody in the world is on fiat currencies, we haven’t had the cleansing that took place in the 1930s. The government stepped in, and the government made everything far worse. But we had another depression in 1922, and the government didn’t do a damn thing. The government sat back and said, “Okay, you lost your job. You lost your factory. Too bad. You lost your home. We’re not going to do anything about it.” 18 months later, the economy rebounded. Government action doesn’t cure things. It causes bad things. We need to cleanse the system, we need to go back to real money. We need to go back to real world economics where people create things of value and they sell them at a profit, and when we do that, it’s going to be a much better world to live in.

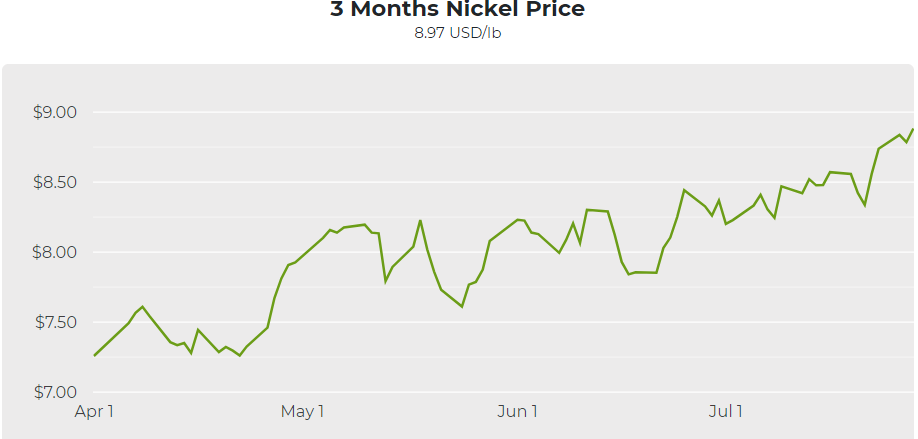

Goldfinger: I’d like to point out that copper had a correction after reaching nearly $5/lb, and it has started to move higher again. Nickel is also back up to around $9/lb. The battery metals revolution is still in its infancy and the US does not have much domestic nickel production, and other critical battery metals are also in short supply domestically. The nascent battery metals bull market got me looking for potential new discoveries of copper and nickel in the US. This led me to a tiny junior explorer called Bitterroot Resources (TSX-V:BTT, OTC:BITTF) that is exploring for conduit-hosted massive sulphides in the Upper Peninsula of Michigan. I have been accumulating a position in BTT and I wrote about the company in February.

Lundin Mining’s Eagle Mine is one of the few domestic sources of nickel. The Eagle Deposit is an extremely high grade copper/nickel/PGMs mine with a small environmental footprint. In the last quarter Eagle produced nickel at a NEGATIVE $1.62 per pound cash cost, this is due to the copper and PGM by-product credits. Bitterroot is exploring for an analog deposit to Eagle at its LM Project, which is 30 kilometers from Eagle. So far, Bitterroot has caught some sniffs of disseminated, sem-massive, and massive sulphides with a very high metal tenor (7-8% Ni, 7% Cu, and 2-3 g/t PGMs). The company is on the 4th hole of a 15-20 hole phase 3 drill program at LM, and it has a modest C$10 million market cap. This is a drill play with a lot of torque to a new discovery and I think the downside is pretty limited at this low valuation.

What are your thoughts on Bitterroot Bob, and how does the US find domestic sources of copper, nickel, cobalt and other battery metals?

Bob Moriarty: Interesting that you bring up Bitterroot. Quinton wanted me to talk to them and I did. That general area of the US used to be a big mining area but gradually mining companies moved to more friendly environments. There is a lot of metal still up there. Bitterroot has a great story and a great plan. They want to cookie cutter the Eagle deposit and should they accomplish that the shares are going a lot higher. Quinton and I differ on one important thing. He always focuses on the quality of the deposit and management. On the other hand, I get really excited when a good story is cheap. BTT is really cheap. I was buying in the open market at $.11 for a market cap of about $8 million. It can only go to zero or a lot higher on good results.

Goldfinger: I think that’s a great place to leave it for this month Bob. Before we depart I’d like to offer you congratulations on the 20th anniversary of 321gold, you have been an important voice for investors and the precious metals/junior mining world during the last twenty years. So thank you for all that you have contributed to the natural resources investing conversation, and thank you for your time and insights here today.

Disclosure: Author owns shares of Bitterroot Resources Ltd. and Eloro Resources Ltd. at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Bitterroot Resources Ltd. and Eloro Resources Ltd.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The companies mentioned in this article are high-risk venture stocks and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.