The Red Lake Region of Western Ontario is famous for gold. In fact, it’s one of the most prolific gold producing regions of North America having produced over 25 million ounces of gold throughout its history. Another thing which sets Red Lake apart from other gold mining districts is the incredibly high grades that the area is known for; the two principal mines in Red Lake (Campbell and Red Lake) both have historic ore grades of more than ½ ounce per tonne. At a time in history where 1 gram/tonne gold is considered to be a good ore grade, Red Lake’s average grades are ~20 times that!

In the last year Great Bear Resources (TSX-V:GBR) has taken the junior mining sector by storm, releasing eye popping drill results virtually on a monthly basis. Great Bear’s Dixie Project is located in Red Lake and Great Bear’s success has caused a giant rethink of this entire district that already has a rich history of high-grade gold mining.

GBR.V (June 2018 – September 2019)

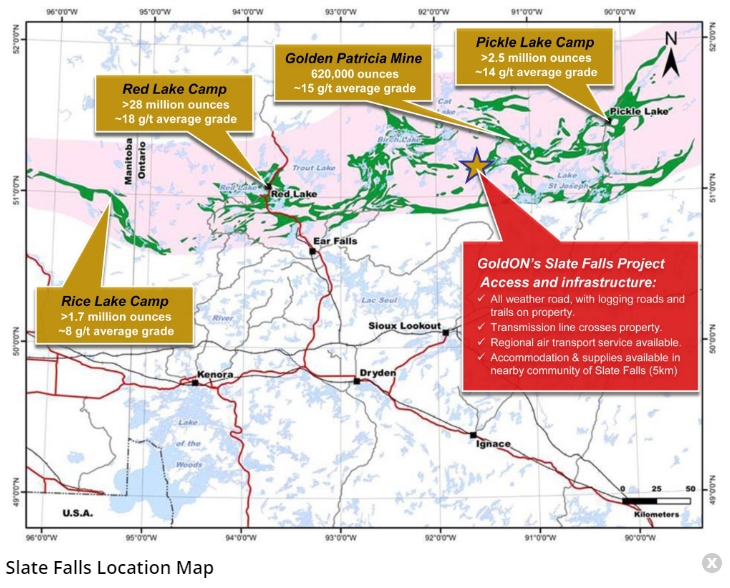

Today I want to highlight a project generator called GoldON Resources (TSX-V:GLD). GoldON is focused on the Canadian province of Ontario and the company has five projects in Red Lake including West Madsen (an option/JV with Great Bear), and its flagship Slate Falls project located between Red Lake and Pickle Lake. GoldON’s projects are unique and highly prospective in their own right. But let’s first get into what really caught my attention about GoldON.

Project generators are focused on acquiring options on highly prospective early stage properties and rapidly either making a discovery on these properties or determining they aren’t worthy of additional exploration expenditures and letting them go. Project generators create shareholder value through identifying the best project opportunities and diversifying shareholder risk by having multiple projects, so that no single project can sink the company.

Not only does GoldON have two highly prospective projects in one of the hottest regions for gold exploration on the globe, but it has all the key ingredients in place for a 10-bagger. Let’s revisit my checklist for under the radar junior mining stocks and allow me to show you why I think GoldON is such an attractive speculation right now:

-

Tight share structure with no “free” shares. GoldON has 20.3 million shares fully diluted with no large warrant overhang. This is about as tight as a share structure gets.

-

Strong insider ownership – GoldON has ~20% insider ownership that bumps up to around 50% if we include close associates of management such as Goldcorp founder Rob McEwen (~5%).

-

Experienced management team led by CEO Michael Romanik and strategic advisor Perry English (35 years of prospecting in northwestern Ontario). Mr. English is often referred to as a one-man project generator, he is an accomplished prospector who specializes in Ontario’s Red Lake area. CEO Romanik has demonstrated a keen ability to build lasting relationships and he has assembled a highly effective team of executives and consultants to work at GoldON.

-

Highly prospective projects in one of the hottest gold mining camps in the world (Red Lake and the Meen Dempster Greenstone Belt).

-

Strong pipeline of news flow over the coming months including drilling at the company’s flagship Slate Falls Project and phase 2 exploration at the recently optioned West Maden Property (including an extensive 3-D Spatiotemporal Gas Hydrocarbon (“SGH”) soil survey).

-

Tiny market valuation (C$7.3 million market cap and less than C$10 million fully diluted market cap at recent C$.48 share price) which offers 10-bagger potential should the company generate a new discovery.

GoldON has two primary projects, Slate Falls and West Madsen, both of which are discovery stage projects and Slate Falls hasn’t been drilled since 1984. The fact that Slate Falls has been relatively dormant for the last 35 years is remarkable considering that previous drilling intercepted bonanza grades.

GoldON has a very clear plan of action over the next 6-9 months which includes a phase one drilling program at Slate Falls which is commencing imminently. GoldON’s objective with drilling at Slate Falls is to substantially improve the merit and geological knowledge to mineralizing controls at the Trail Zone, and the Sanderson Main, East and North zones while confirming that the historical exploration was largely misguided.

GoldON CEO Michael Romanik offered the following comments on upcoming drilling at Slate Falls:

“The Slate Falls property is an exciting piece of ground and we expect the forthcoming drill program to be the first of many. We are looking forward to seeing some drill core and starting to understand the continuity of some of these high-grade gold and silver bearing structures, both near surface and at depth for the first time.”

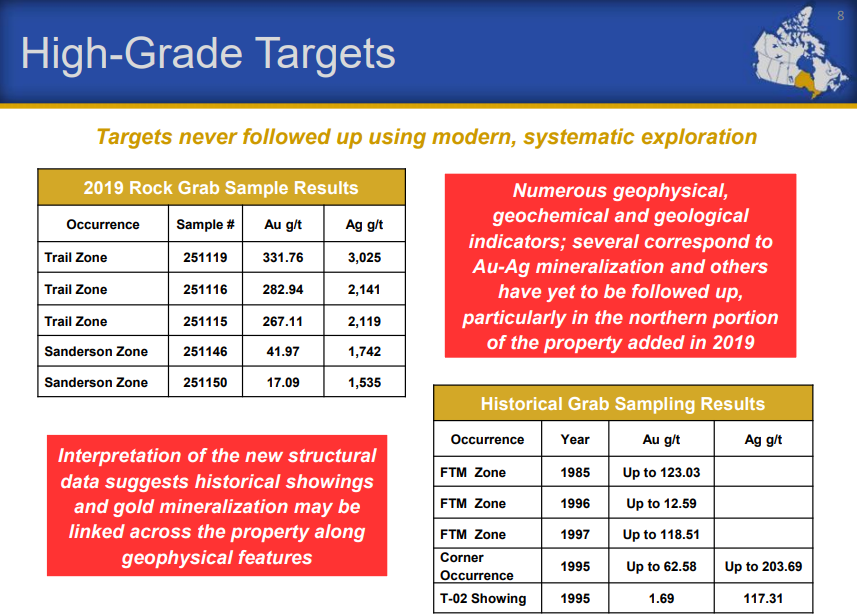

Slate Falls is a 5,687-hectare property that is located in the Meen-Dempster Greenstone Belt between the Red Lake and Pickle Lake Greenstone Belts of northwestern Ontario. The “Trail Zone” has had grades as high as 861 g/t gold in drill core (1966) and 3,025 g/t silver in surface rock samples (2019).

2019 grab sample results at the Trail Zone were impressive to say the least:

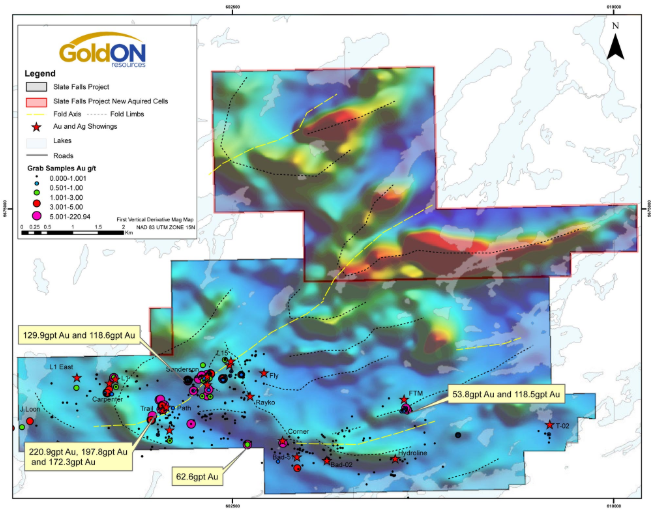

Several mineralized showings have been identified at Slate Falls including the Carpenter, Fly, FTM, J. Loon, L1, L15, Path, Sanderson and Trail Zones. All of these zones are part of the Slate Falls Deformation Zone and extend for over 10 kilometers (km) in strike and 1.5 km in width within the Property’s boundaries. All zones host high grade gold-silver mineralization and are related to regional fold axes and structures that provide traps for mineralizing fluids (see property map below).

The Slate Falls diamond drilling program will consist of at least 10 drill holes (~1,000 meters) which could be expanded as the program progresses. This will give GoldON steady news flow well into next year. In addition, the company is committed to a prospecting program at its West Madsen Project (which adjoins the highest grade gold development project in Canada) that will help determine drill targets for a phase one drill program anticipated in the first half of 2020.

In what has been a surprisingly challenging year for the junior gold mining sector (despite the fact gold is up ~$200 per ounce in 2019 many junior mining shares are down year-to-date), GoldON shares are up more than 200% year-to-date:

GLD.V (Daily)

This strong performance is a testament to GoldON’s tight share structure and management execution. I have purchased GLD shares on the open market and I view the recent ~50% correction from the June highs as an attractive opportunity to get into an emerging story just as GoldON is ramping up exploration activities and news flow.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. GoldON Resources Ltd. is a high-risk venture stock and not suitable for most investors. Consult GoldON Resources Ltd.’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for marketing & promotional services by GoldON Resources Ltd. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.