The last time Bob and I spoke global equity markets were coming unhinged and he very calmly stated that he thought there was a very good chance of a stock market rally starting very soon. As it turns out he was right, within a couple of days only because markets were closed on Christmas Day. Stock have essentially rallied non-stop for the last month and Bob now thinks the dead-cat bounce is about to come to an end. He also has some interesting thoughts on the global debt bubble that is about to pop and the government shutdown that just ended in the U.S. Without further ado here is Energy & Gold’s January 2019 conversation with 321gold founder Bob Moriarty…

Goldfinger: We’ve seen a nice move up in precious metals since the last time we spoke (Christmas Eve) and gold is currently knocking on the door of important resistance near $1300. Gold mining shares have also spent the last few weeks undergoing a healthy consolidation. What do you see for precious metals and mining stocks right now?

Bob Moriarty: I think that gold is the antithesis of the stock market right now. When stocks went down in December gold went up and two Fridays ago we saw gold get dinged about 1% while stocks rallied. I think a lot of smart people are sensing a crash is right around the corner and I think that gold and gold mining shares will soar when the stock bubble pops.

Goldfinger: We’ve received quarterly earnings reports for many of the world’s largest mining companies and generally speaking they have been quite poor; BHP disappointed, Freeport lowered guidance, Barrick didn’t impress with higher than expected costs, etc. We are starting to see a trend of increasing costs across the mining sector – even a massive miner like Barrick Gold reported US$3.00 per pound all-in sustaining costs (AISC) for copper production which means that Barrick is losing money mining copper on an all-in cost basis. While their cash costs are considerably lower (around US$2.00/lb) which means they won’t be reducing production anytime soon, the fact is that many global copper producers aren’t really incentivized to find new sources of copper production with copper prices sitting at US$2.65/lb.

Bob Moriarty: Here’s the deal, prices go from extreme highs to extreme lows. The prices of commodities will often go below the cost of production and people will shut projects down which will help commodity prices go back up again. The cost of labor has gone up while grades keep dropping, this explains why costs keep rising. Now when I see a price of copper of US$2.65/lb and I see all-in sustaining costs of US$3/lb I know we’re near a low.

Goldfinger: Considering the growing demand for electric vehicles and the rewiring of the global energy grid the future looks particularly bright for copper right now, however, you wouldn’t have guessed that by looking at the copper price chart:

The world is going to need a lot more copper over the next couple of decades. If Barrick can’t even mine the stuff profitably where are we going to find new sources of economic copper? Or I guess another way to ask that question is why aren’t copper prices a lot higher?

Bob Moriarty: It’s pretty clear to me that resource prices will have to move a lot higher and that would include base metals like copper and zinc. If copper prices remain below US$3/lb we simply won’t have enough supply to meet demand and prices will skyrocket higher in a very short period of time.

Goldfinger: Do you have any comments on the big gold producer mergers we have seen recently (Barrick and Randgold, Goldcorp and Newmont)? Do these mega-mergers have any impact upon the juniors and are we likely to see even more M&A within the gold sector in 2019?

Bob Moriarty: In general this trend is good for the juniors because the majors do not have exploration departments anymore, most of their new projects have to come from juniors. If metals prices go the way I think they will this year we will see more and more M&A throughout the year. You have to remember that majors like to acquire exploration & developments projects when prices are high and/or rising – nobody is going to make a big copper project acquisition at $2.65/lb but you can be certain that at $3.65/lb we will have more takeovers.

Goldfinger: One of my themes for 2019 is outperformance by the mid-tier gold producers and developers. One of the key catalysts to drive this outperformance should be M&A, with majors acquiring the most attractive mid-tiers while we will see mid-tiers combining with one another to create larger companies that will be treated better by the market, due to increased synergies and better cost structures.

Do you agree that we will see a lot of consolidation among mid-tiers in 2019?

Bob Moriarty: There has to be more consolidation in the sector, they have no choice. When you mine you are constantly consuming your young so you either have to explore and make new discoveries to replace the ounces you’re producing (read consuming) or you have to use M&A to replace reserves. Right now we aren’t seeing much exploration and certainly not much exploration success so the mid-tiers and majors have no choice but to merge with one another.

The big mergers that we’ve seen are also designed to make the companies more efficient and to lower costs per ounce. They should be more efficient and they should have lower costs, it’s not excusable for a major gold mining company to have all-in costs of over US$1,200 per ounce.

Goldfinger: The CEOs of Barrick and Newmont have stated publicly that they are no longer in the business of growth at all costs, they are going to manage their companies with an eye to the bottom line and clearly these recent mega-mergers help to achieve that objective.

Bob Moriarty: One of things that I don’t hear mentioned very often is that since 2007 the financial mismanagement by the global central banks has caused so many whipsaws in commodity prices that it has made it very hard to run a large commodity producer. How can you run an oil company when oil is $140 one day and then $35 the next day?

We need to get back to financial sanity and I believe we are seeing the gold mining sector get back to financial sanity with a focus on the bottom line.

Goldfinger: At the end of 2018 we had a brief stock market panic, let’s call it the Christmas Eve 2018 panic, you had been calling for a market crash and while I wouldn’t call it a crash it was definitely a serious panic. Is that it? Or was that just a tremor before the real crash happens?

Bob Moriarty: The last time we spoke I predicted a turnaround in stocks and then I wrote a post stating as much on Christmas Eve. Stocks have basically moved straight up for the last month and I still believe we have a monster crash coming. It could start next week or 1-2 months from now, but it is coming. December was the end of the beginning, we’ve just seen the previews of the real movie. The financial system is so warped that when the crash comes it’s going to the greatest financial tsunami in history. The action since Christmas Eve up until now is just a dead-cat bounce which helps to build up some more complacency before the real downturn begins.

Goldfinger: It’s more evident than ever to me that we are in a central bank controlled financial system and this was clearly evident when the Fed quickly backpedaled after New Year’s indicating they would be “patient” with regard to any further rate hikes. The market took this to mean that there wouldn’t be another hike for at least six months and that any hike would be well telegraphed far in advance.

Meanwhile, we’re seeing a lot of evidence that global economic growth has been deteriorating and there are few indications that this trend will change anytime soon. Precious metals and gold in particular could be in a sweet spot as global central banks begin easing (after a couple years of tightening via rate hikes and balance sheet shrinkage) against the backdrop of weakening economic growth and an unusually daunting set of global macro uncertainties. Price action in precious metals has also been quite constructive since August of last year while sentiment has remained relatively muted and institutional exposure to gold and silver continues to be virtually non-existent.

With the US dollar looking like it’s about to turn lower after a strong performance in 2018, gold in US dollar terms is poised to perform exceptionally well in 2019. It feels like conditions are ripe for a stellar year for precious metals in 2019.

Bob Moriarty: I think you’re onto something there and there’s some data that’s shown that gold has been making record highs in almost every other currency other than the US dollar. What I see happening is the stock market beginning to crash in the next couple of months which will cause the Fed to panic and reimplement QE-infinity which will weigh heavily on the dollar and in turn turbo-charge precious metals and other hard assets.

There are tremendous forces building up across the world right now that will eventually result in a massive explosion. Let me give you an example, I just wrote a piece about the yellow vests in France. Did you know that there are now protests going on in more than 30 countries around the world? Yellow vest protests.

Goldfinger: No, I didn’t know that. The Gilets-Jaunes (yellow vests) are a symptom of a bigger problem. The elite and ruling classes have ripped off the system and left the common working class people paying for their excesses and the excesses of central banks that they have managed to profit from.

What do you think about the FBI dawn raid and arrest of Roger Stone?

Bob Moriarty: We’re in never never land, we’ve got the FBI and the DOJ trying to say who the President of the United States should be. This is treason being carried about by government law enforcement agencies. This is the most bizarre thing in American history, i’ve never seen anything like it. And then you have incidences like the one with the Kentucky high school kids at the Lincoln Memorial where the leftists and left-stream media are trying to completely distort reality and it can only end in tragedy. There is going to be a revolution/civil war in the United States and it is going to spread worldwide. There are yellow vest protests in China and Poland and around the world. They’re even protesting in Canada! Who the heck protests in Canada?!!

Goldfinger: Trump caved in on the government shutdown last week after 35 days of shutting down the federal government. What was accomplished through this government shutdown and can Trump really build a wall via emergency order?

Bob Moriarty: Nothing at all. Trump tried to show Pelosi how much power he had and he did. He has next to none. The whole wall issue is a circus side show. We have had open borders for a hundred years and we somehow survived. Fifty years ago I would go dove hunting in Mexico and you could wave at the customs guys as you passed through.

Goldfinger: I read a statistic the other day that the US has US$122 Trillion of unfunded liabilities which equates to 564% of Fiscal 2018 GDP. To fund these unfunded liabilities would require 10% of GDP for more than 56 years. The debt pile that has built up around the world, particularly in the US, is so large that it will never be repaid. I don’t think these massive government liabilities were ever meant to be repaid.

Bob Moriarty: You’re right, it will never be repaid and it was never intended to be repaid. When you were a kid did you ever blow up a balloon at a party?

Goldfinger: Yes, of course.

Bob Moriarty: I want you to imagine the biggest balloon you’ve ever seen and you start blowing into it, you keep blowing into it, and it keeps expanding, what is going to eventually happen?

Goldfinger: Eventually it’s going to pop!

Bob Moriarty: No shit! If you understand balloons then you understand debt bubbles. You can keep blowing into that balloon but you can be sure that if you keep blowing into it then it’s going to pop. The same way that if we keep inflating the debt bubble you can be sure that it’s going to pop one day and the consequences will be like nothing you or I have ever seen before. One day grandma is going to go try to cash her social security check and the bank is going to tell her the check bounced. Want to see a panic? That will be a real panic.

Goldfinger: One more topic before we wrap up, we’ve talked about a few companies recently including Westhaven Ventures (TSX-V:WHN), Irving Resources (CSE:IRV), and Novo Resources (TSX-V:NVO). Do you have any comments or updates on these stories?

Bob Moriarty: Novo is everything i’ve been saying for the last six years and they are making wonderful progress. Novo CEO Quinton Hennigh is also Chairman of the Board of a company called Miramont (CSE:MONT) that literally just started drilling some attractive targets in Peru and that one is going to be a home run. Quinton is also involved with Irving Resources and they are about to start drilling on Hokkaido Island in Japan.

Westhaven delivered some nice intercepts recently and notwithstanding the short term market gyrations I believe that Shovelnose is a great project that will eventually be a mine.

Goldfinger: So Irving is about to start drilling within the next couple of weeks?

Bob Moriarty: Yes, and they will announce it to the market when they do begin.

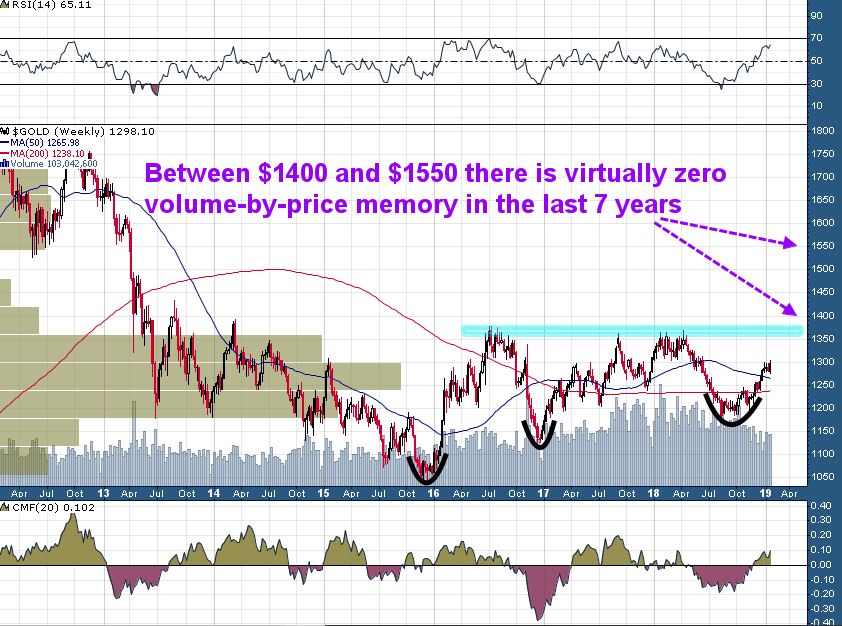

Goldfinger: I posted a couple of charts of gold and silver recently illustrating a positive outlook for both metals. What is sentiment telling you here? Is there room for silver to get up to $17 and gold up above $1350 before we have the next correction?

Gold (Weekly)

Silver (Weekly)

Bob Moriarty: I’m ok at predicting price direction but hopeless at predicting price. We have had a bottom in silver, gold and platinum. Palladium has gotten pretty toppy. If and when the Fed reinstates QE, you are going to want to hold precious metals.

Well that sums it up succinctly; we’ve made a bottom in precious metals and the growing global debt tsunami increasingly makes precious metals a compelling asset for investors to hold. Bob doesn’t proclaim to be a market timer, nevertheless his calls at key market turning points are among the best i’ve ever seen. I believe him when he says the dead-cat bounce in large cap US equities is coming to an end very soon. As always, we’d like to thank Bob for his time and insights. Until next time…

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Some of the stocks mentioned are high-risk venture stocks and not suitable for most investors. Consult the companies’ SEDAR profile for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.