Bob Moriarty, founder of 321gold, has a knack for cutting through the ocean of noise that’s out there and getting to the meat of what’s important to an investor. As commodities and emerging markets come under increasing pressure on a daily basis Bob sees a storm just over the horizon that will “change everyone’s lifestyle over the next six months”. The world is awash in debt and the recent US dollar strength is causing tremors in far away places like Turkey and China, but make no mistake, nobody will be left untouched by the crisis that is coming. Without further ado here is Energy & Gold’s rather lively and far reaching August 2018 conversation with Bob Moriarty…

Goldfinger: Last week you wrote a piece saying that you were early with your bottom call at the end of June, but now we’re at a real bottom. On Friday afternoon I published a piece highlighting the extreme positioning we’re seeing in gold futures via the CoT data. There are also a number of other factors that are all lining up right now which point to a tremendous buying opportunity in gold and gold mining shares.

Bob Moriarty: I think what’s going on in Turkey and in the banking system overall is floating over into gold. I think we’re in the exact same spot we were in August 2008 where people were dumping everything they could in order to get liquidity. And in that case i’m glad to be wrong because when we come out of this the gold price is going to explode higher. This thing in Turkey is a lot more serious than people realize, the entire world is on the edge of a precipice financially. The world is awash in debt and the piper has just come to the door saying that he needs to be paid.

Goldfinger: You are calling for a broader equities market crash in September or October, and it feels like some of the ingredients are lining up for that to happen. The S&P 500 is still near all-time highs and there is still a great deal of complacency out there, what’s it going to take to finally tip this thing over?

Bob Moriarty: This is how it always is just before a crash. We have a situation very similar to the very top in bitcon back in December where there were all kinds of tremors going on and it was obvious to see in hindsight that it was a bubble. We know that every country in the world is bankrupt and we just kicked a hornet’s nest in Turkey. To blame it all on Turkey is just rubbish, and it could have major impacts upon Spanish and French banks that have gotten involved in Turkey in the last decade.

Meanwhile, in China the peer-to-peer banking system is crashing and it’s turning out to be similar to bitcon because most of it is fraud. Now whether the absolute crash happens in September, October, or November I don’t know and I don’t really care. The same as whether the absolute bottom in gold happens in July, August, or September I don’t know and I don’t really care. When gold comes out of this, as it will, the forces that are in play are explosive.

Goldfinger: The macro question I see right now that’s crucial for getting gold right is trying to figure out whether we are in an inflationary or a disinflationary global economic environment. We are experiencing a lot of disinflationary headwinds right now, which include a strong US dollar, trade tensions, central bank monetary policy tightening, and emerging market panics in Argentina and Turkey etc. What is going to change these disinflationary headwinds into inflationary tailwinds?

Bob Moriarty: Strange enough it will be the collapse of the US dollar as the global reserve currency. Gold is an insurance policy against stupidity, and we’ve got more stupidity going on in the world today than I have ever seen in my life. Trump has unleashed something in Turkey that he doesn’t even understand, he just kicked a hornet’s nest and in September or October we’re going to learn about the consequences of twenty years of unlimited spending globally. When the dollar collapses people will lose faith in the global monetary system and there will be a rush into gold like we’ve never seen before.

Goldfinger: So you think we’re seeing a final short covering squeeze in the US Dollar Index right now that will reverse sharply to the downside over the next few months?

Bob Moriarty: The world is awash in debt and all of that debt is worth about as much as used toilet paper. The US Dollar Index could break over 100 in the next few weeks but then I expect countries who hold US Treasury debt to begin liquidating that toilet paper at a rapid pace. The emperor has no clothes and piper has come to get paid.

Goldfinger: Delving a bit more deeply into the Turkey situation, it seems that Trump has the upper hand here due to Turkey’s fragile economy. However, by raising aluminum and steel tariffs to very high levels and sanctioning Turkey in other ways he has set in motion an economic disaster for a country that at one point seemed to be on the brink of joining the EU. Trump has also been throwing his weight around with China, pushing our largest trading partner to the brink of economic trouble. How far can Trump use this trade war leverage before something really bad happens?

Bob Moriarty: That’s a really good question. The US continues to isolate itself from the rest of the world. On behalf of Sheldon Adelson who owns and operates President Trump (he bought him for $30 million) first of all we moved the US Embassy to Jerusalem contrary to international law. What’s happening in Gaza is criminal beyond all belief, I mean the US paid for all of those bullets. Sheldon Adelson has an irrational hatred for Iran, Iran’s not an enemy of the US but the mad men in charge of US politics want to attack both Russian and Iran. So we put sanctions on Iran, and we told China that they can’t buy oil from Iran and China said “Watch us!” What Trump is doing is destroying the United States by misusing its power.

Now i’m going to ask you an interesting question, what was it that Turkey did that Trump is so pissed about?

Goldfinger: They jailed an American pastor, and I think there may have been some promise to release the pastor that was not kept .

Bob Moriarty: There was a coup d’etat in Turkey in July 2016 and Turkey blamed this coup on a pastor named Gulen who lives in Pennsylvania so Turkey arrested a US pastor in Turkey to put pressure on the United States. Now there’s a real good chance that the American pastor is CIA and that’s why Trump is trying so hard to get him. But we are literally destroying Turkey’s economy in order to retrieve an American pastor. Who gives a shit about this guy?

Now when you’ve got one thousand dominoes stacked up you don’t knock over a single domino because you could collapse the whole thing. Now let me ask you another question, when bank’s advertise that they’ve got a billion dollars in assets what exactly are those assets?

Goldfinger: Loans to consumers (mortgages, credit cards, etc.) or small business loans.

Bob Moriarty: That’s right. But according to banking lore the safest thing you can invest in is loans from other banks. So banks are invested in one another’s bonds. What happens when one bank collapses?

Goldfinger: A bunch of them collapse like we saw in September 2008.

Bob Moriarty: That’s right, they all collapse. The banking system is made up of loans to individuals, loans to small businesses, loans to corporations, etc. And these loans are made using tremendous leverage which creates the potential domino effect. All you need is a small percentage of a bank’s ‘assets’ (loan portfolio) to go bad and the whole thing comes tumbling down. In 2008 we should have let the banking system collapse and we didn’t. Now if it happens again the Fed is out of ammunition. If the Federal Reserve goes out and starts handing out trillions of dollars you’re going to see inflation explode like something that’s never been seen before.

Goldfinger: Right now it sounds like we have all the ingredients for a deflationary bust and we might be seeing the first signs of that with the recent weakness in emerging markets and commodities.

Bob Moriarty: Absolutely! Once all those fake assets around the world go bust that’s exactly what’s going to happen. But you’ve got to realize that the central banks and governments are going to try to inflate their way out of any bust, but it won’t work this time. All those fake assets are going to evaporate and that is highly deflationary.

Goldfinger: To be a precious metals bull right now do I have to hope for more global central bank balance sheet expansion?

Bob Moriarty: Nope, that makes it too complicated. Here’s how you should think of it more simply. You’ve got a T-bill in your left hand and an ounce of gold in your right hand at the end of the day which one is going to have value?

Goldfinger: The ounce of gold.

Bob Moriarty: That’s it.

Goldfinger: Turning to the White House. If this isn’t end of empire stuff I don’t know what is. Is this the most absurd soap opera playing out in Washington or what?

Bob Moriarty: Of course it is, this is the end of the empire. Did Hillary Clinton steal the nomination from Bernie Sanders?

Goldfinger: Yes.

Bob Moriarty: We know that Hillary Clinton stole the democratic nomination from Bernie Sanders, we also know she did about $80 million in money laundering when money that was supposed to go to the DNC actually went to her. And we also have a good idea that Hillary Clinton and her allies tried to steal the election from Trump with the help of the DOJ, CIA, FBI, NIA, and NSA. This is the first time in history that all of these government agencies tried to rig the election. To hear Peter Strzok testify that he hated Donald Trump and he was the guy in charge of investing Hillary Clinton. Did he do a good job of investigating Hillary Clinton?

Goldfinger: Obviously not.

Bob Moriarty: That was the biggest whitewash ever. How could he not find her guilty of wrongdoing? We even later found out that the Chinese had intercepted 30,000 emails from Hillary because she was using an insecure server.

When you talk about Donald Trump being a buffoon, a narcissist, and an idiot, which are all true you have to realize that the alternative was Hillary. We know damn well that Hillary Clinton was a crook and liar. So the voters were given two very poor options and they chose the narcissistic buffoon over the liar and cheat.

Goldfinger: There was a great article that I read over the weekend and it was titled “All Things Fall Apart” and the point the author made was that U.S. voters have moved to the extremes, extremes that may have only been seen twice before (before the civil war in 1860 and in the 1930s before WW2). So we are moving closer to a breaking point at which point something catastrophic will occur (civil war, revolution, major military confrontation with an adversarial nation, etc.).

Bob Moriarty: It’s much more likely to be a revolution than a civil war. When you see someone like John Brennan (former CIA Director) accuse the President of treason for inviting Putin to Washington, how is that treason? Isn’t the President supposed to be diplomatic with other global powers? There is a coup d’etat underway by the deep state and it’s plain as day.

Have we ever had an idiot as President?

Goldfinger: Yes, George W. Bush.

Bob Moriarty: Exactly. We’ve had senile Presidents (Reagan) and we’ve had idiot Presidents. We can survive those, but what we can’t survive is treason. The deep state can’t be allowed to undermine a sitting President of the United States. The FBI shouldn’t be allowed to determine who the President is.

This financial crisis that is here now, that is showing up in Argentina, China, Turkey, and the EU is going to change everything. Everybody’s lifestyle is going to change dramatically in the next six months and everybody including those who were prepared are going to end up paying a price of some kind. You cannot have that much debt without everybody being injured, the only question is how injured are you going to be.

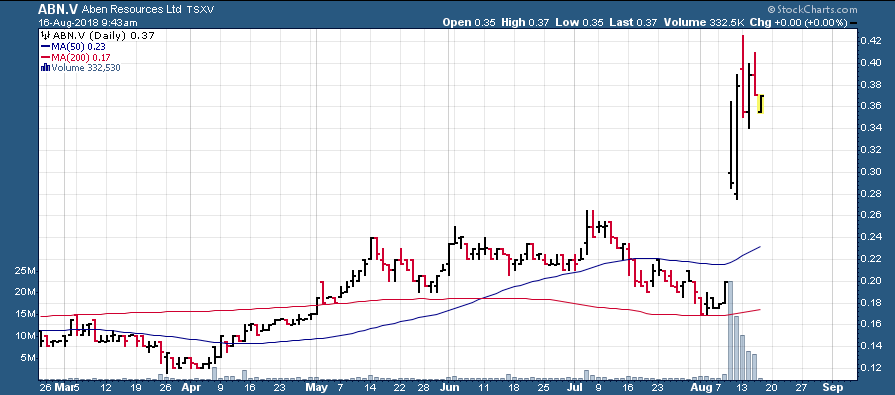

Goldfinger: Turning to the junior mining sector, last week we got news from Aben Resources (TSX-V:ABN, OTC: ABNAF) that was rather stunning as they delivered nearly 40 grams/tonne gold over 10 meters. Would you like to share your thoughts on Aben here?

Bob Moriarty: They hit a home run on their first hole in a new zone. So what they’re going to be doing is punching holes between that hole and an old high grade hole that is 230 meters away. My OPINION (I want to emphasize that it’s my OPINION) is it’s a giant find, it’s a real find, and it’s going to set everything in the Golden Triangle on fire. Now I happen to agree that Garibaldi (TSX-V:GGI) is a nothingburger and they were announcing pretty rock instead of actual results last year.

I expect to see more good assays from Aben in the next couple of weeks and on a fully diluted basis Aben still has less than a C$50 million market cap so the stock is still very cheap and has room to run if this is a real discovery.

ABN.V (Daily)

Goldfinger: How much is a discovery worth in this challenging market environment?

Bob Moriarty: Well I believe what Aben has is far more valuable than what Garibaldi has and Garibaldi has(d) a C$300 million market cap so it wouldn’t be inconceivable to see ABN shares up at C$2.50 in the event that a significant discovery is confirmed.

Goldfinger: Who are your favorite newsletter writers and who are the guys who have been getting it mostly right in 2018?

Bob Moriarty: Bob Hoye and Tom McClellan are always great. And you have done a remarkable job of calling things. You told me a week ago that we were heading for a capitulation in gold and mining shares, and that’s exactly what we’ve been seeing this week.

Goldfinger: Thank you Bob, it’s been a tricky market environment and I’m proud to be able to say that i’ve kept my head and my subscribers’ heads above water in 2018. I tend to agree with you that the next couple of months are going to be critical and that we are likely to see volatility ramp up substantially across all sectors and asset classes.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Some of the stocks mentioned are high-risk venture stocks and not suitable for most investors. Consult the companies’ SEDAR profile for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.