After running into resistance in early February the gold miners have been correcting for the last month. The correction has been deeper than a ‘garden variety’ sort of pullback with the GDX declining 17.5% from its peak on February 8th to the low this morning, however, there are indications that a bottom may be close at hand:

GDX (Daily)

Source: Stockcharts.com

GDX has responded well when it has entered ‘oversold’ territory (RSI-14 reaching 30 or below) recently with downside momentum fading and price often reversing higher. In addition, when ROC (12 period rate of change) has reached -15% it has often been a sign that downside momentum has reached its zenith and some stabilization and/or upside reversal is near.

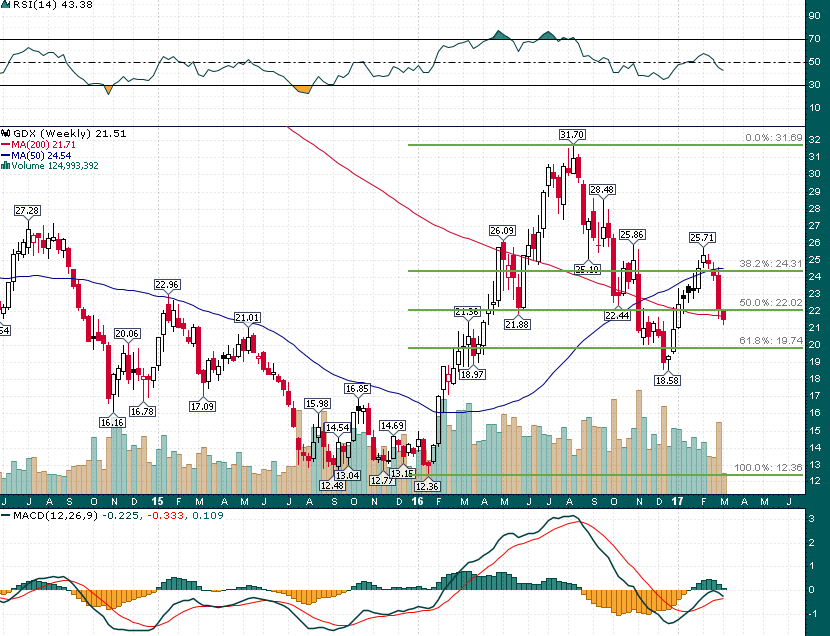

Zooming out to the weekly chart we can quickly see the importance of this week; in addition to being an important test of long term support/resistance, GDX is also currently slightly below the 50% Fibonacci retracement of the entire January 2016-August 2016 rally and the falling 200-week moving average:

GDX (Weekly)

Source:Stockcharts.com

An upside reversal and weekly close back above ~$22 would be a very constructive sign.

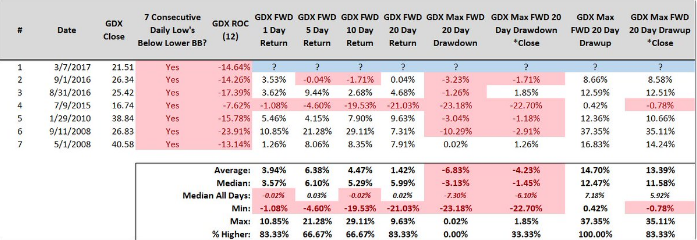

Even more interesting is a backtest of what happens historically when GDX trades below its lower 2-standard deviation Bollinger Band for 7 consecutive trading sessions:

Source: @SJD10304

Despite the relatively small sample size (this is only the 7th time this has happened in the nearly 11 year history of the GDX) the short term returns for this setup have been excellent with 1 day returns averaging nearly 4% and an average 5 day return of 6.38%. The only time this setup didn’t work as a buy was July 2015 (ROC-12 was not below 10% on this occasion as it was on all other setups including the current one), literally in the depths of the worst bear market in the history of the gold mining sector.

There are also a few other non-chart based reasons why the gold mining sector might be at, or near, a tradable low:

- In a webcast after the market close Tuesday legendary fund manager Jeffrey Gundlach reiterated his bullish outlook for gold stating that “the next major move in gold will be higher.”

- Sentiment on the sector has cooled considerably since reaching somewhat frothy levels in early February. Using a variety of sentiment tools that I look at sentiment has gone from over bullish to firmly bearish in the span of one month. Even at the world’s largest mining show this week (PDAC in Toronto) the mood was fairly cautious and subdued.

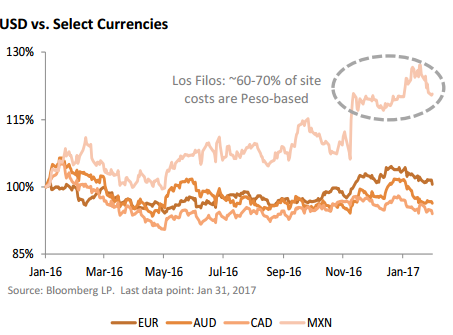

- Wednesday Leagold Mining (symbol LMC on the TSX-Venture) is expected to begin trading after a lengthy halt following one of the largest capital raises in recent gold mining sector history. Large financings don’t usually occur during bear markets and how Leagold trades following roughly ~C$500 million in financings could be an could be an important indication of investor interest in the gold mining sector after one of the toughest 30-day periods for the sector in the last couple of years. Leagold was created with the intention of becoming a mid-tier Latin American gold producer with virtually the same management team that built Endeavour Mining (symbol EDV on the TSX) into one of the most successful mid-tier producers of the last decade. Leagold made a splash in January by acquiring the Los Filos Mine in Mexico from Goldcorp and vaulting from a mere shell company to an emerging mid-tier producer. Leagold is confident it will be able to effectively reduce costs (Life of mine all-in sustaining costs at Los Filos are currently projected at ~US$800) and extend the mine life at Los Filos through a rich PEA stage development project adjacent to the mine called Bermejal Underground. The fact that 60-70% of Los Filos site costs are peso based adds to the attractiveness of the acquisition:

Source: Leagold Mining

The gold mining sector is at a crucial moment nearly 14 months after a major long term cycle low was put in place in January 2016. Bull market cycles, by definition, rarely see declines of more than 20% and the gold miners are very close to reaching this threshold since the February 8th high. How this sector trades over the next couple of weeks could give us a major clue as to whether the cyclical bull market is alive and well or if it needs more time to heal and reset.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.