Since peaking in early June West Texas Intermediate (WTI) Crude Oil has been in . There are some interesting observations to be made about the current setup in crude oil and energy stocks:

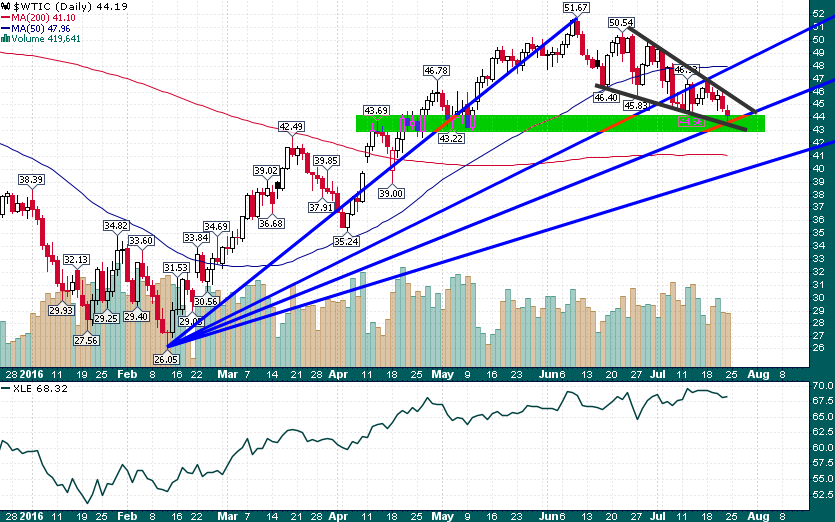

WTI Crude Oil (Daily)

Since peaking at $51.67/barrel on June 10th WTI crude oil has corrected more than 15%, meanwhile oil stocks as represented by the XLE (at bottom of the chart above) have actually risen over the same time frame! This is an impressive outperformance which seems to indicate that equity investors are much less concerned about the short term performance of crude while they become more comfortable that crude has found a new equilibrium range centered around the $50/barrel price level.

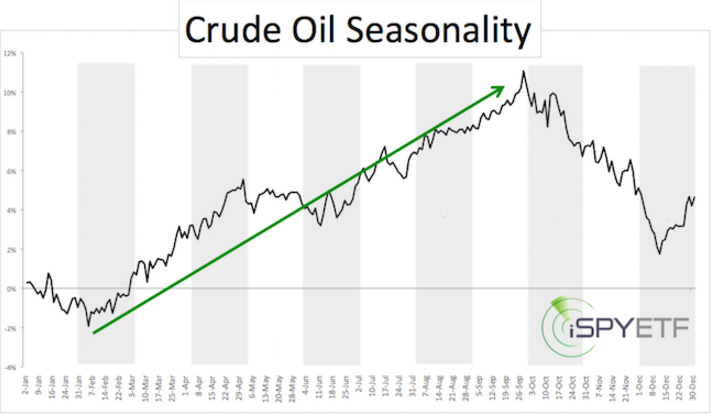

In addition, WTI crude oil has formed a falling wedge during the recent correction and Friday’s low tested important support/resistance and the 50% Fibonacci fan drawn from the February low to the June peak. Despite the recent decline the current setup in crude oil has a bullish flavor to it particularly considering the bullish equity divergence and seasonal tailwinds which should remain supportive through the end of September:

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher ofEnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.comfor important risk disclosures. It’s your money and your responsibility.