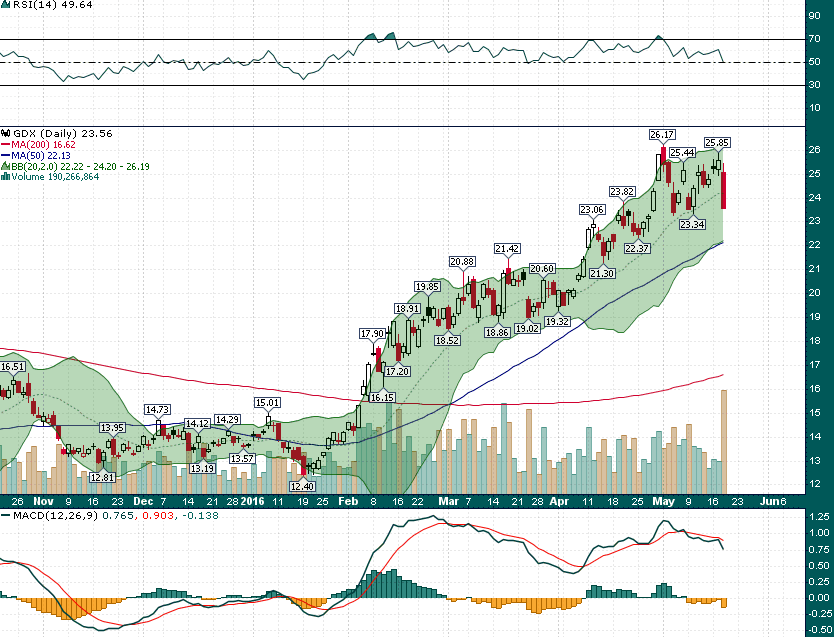

We have not made it a secret that we have interpreted the recent volatile, high volume trading range in the gold miners (GDX) to be a bearish prelude to a summer correction. After more than doubling from the all-time low made in January the gold miners (GDX) have spent the last few weeks trading in a volatile range while churning a tremendous amount of volume – this is an unmistakably bearish dynamic especially when considering that GDX has made lower highs during this time as investor sentiment on the sector has become more bullish.

Today’s nearly 8% drubbing on heavy volume (more than 2x average daily volume) is quite likely the beginning of the summer correction in the precious metals mining sector that we have been expecting for the last couple of weeks:

GDX (Daily)

At minimum a test of the rising 50-day simple moving average would be normal during a corrective market phase. However, given the ferocity of today’s decline a deeper correction down to retest the breakout level and major support/resistance near $21 may be necessary to reset market expectations and shake loose weak hands.

As I commented over at CEO.CA, for those who are committed to trading the long side of the goldies I suggest waiting until the 3rd day of any market decline before trying to bottom fish: