A lot happened this week in the precious metals & mining space. A quick summary of the big events:

- Gold finished the week $65/oz higher and rallied as high as $1263.90/oz on Thursday, reaching its highest level in US dollar terms in a year.

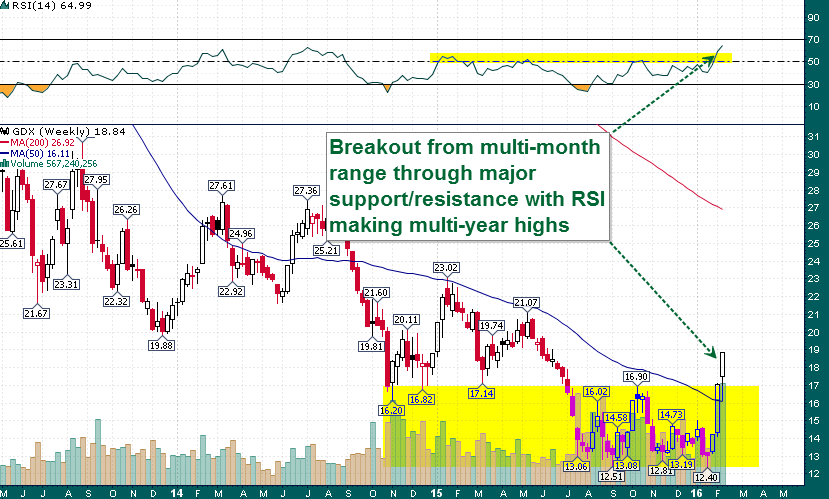

- Gold mining shares as represented by the GDX rallied 10.5% on all-time record weekly volume

GDX (Weekly)

Breakout from 7-month bottom on massive volume targeting ~$21

- A significant acquisition in the gold mining space took place earlier in the week with Tahoe Resources purchasing Lake Shore Gold in an all-stock deal at what is now a roughly 30% premium to where LSG shares were trading before news of the acquisition leaked.

- Largest weekly inflow into gold exchange-traded products (as % of AUM) in nearly six years.

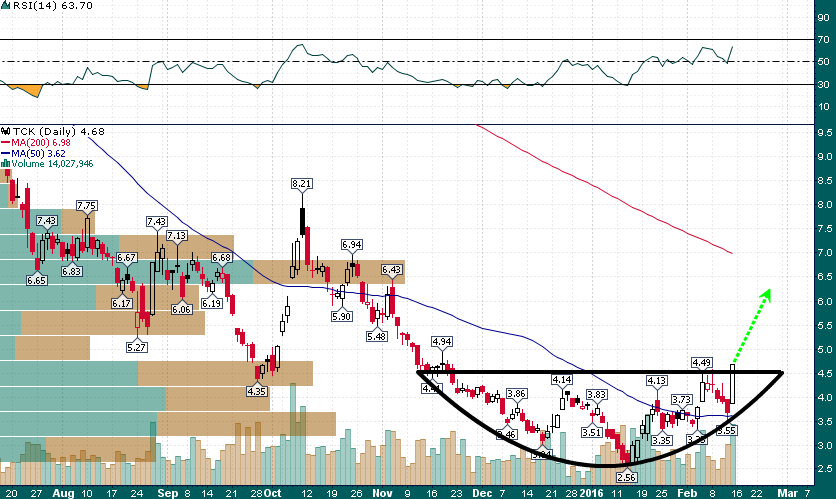

- Individual mid/large cap mining stocks continue to break out from well developed basing patterns – Friday’s huge rally in TCK was an impressive example of this phenomenon:

TCK (Daily)

Breaking from 3-month+ rounding bottom pattern (a H&S bottom is also present) targets $6+

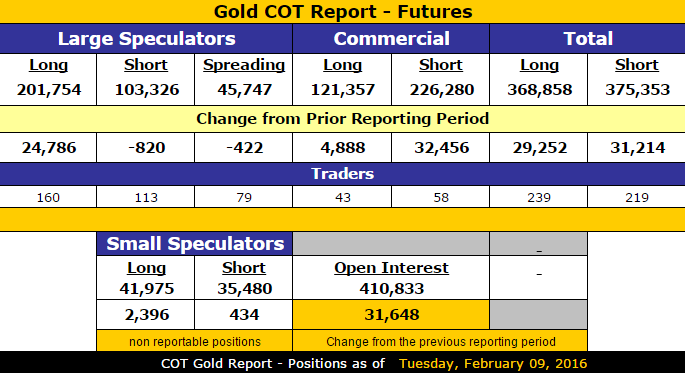

- Futures speculators have piled back into gold to the tune of more than $3 billion in net notional long exposure in just the last week (not including Thursday’s huge rally).

- GLD options activity was off the charts this week.

- And Jose Canseco is really bullish on gold…

In summary this week’s action in the precious metals space adds a tremendous amount of weight to the case for a long-term bottom being in place. However, bullish sentiment has probably gotten a little bit out of hand. We will continue to monitor Jose Canseco’s Twitter feed for further developments…