Since the end of April financial markets have become increasingly volatile, seemingly no sector or asset class has been spared. Last week, I had the opportunity to speak with Bob Moriarty about where we are at today in the gold sector, and how he see things playing out across markets in the 2nd half of 2022. As usual, Bob and I don’t see eye to eye on everything, however, that is also what makes these conversations interesting and worthwhile.

We also discussed several individual junior mining companies and the sentiment cycles in financial markets, including junior mining. Without further ado, Energy & Gold’s June 2022 conversation with 321gold founder and noted financial author Bob Moriarty…

Goldfinger:

Bob, there’s no shortage of things to talk about again. That’s for sure. Gold and gold stocks have actually risen since the Fed raised the Fed Funds Rate 75 basis points on Wednesday. Someone once said that markets bottom when they stop going down on bad news. What do you make of where we are at with the gold mining sector today?

Bob Moriarty:

I think you have to look at gold and the gold stocks as a subset of what’s going on overall. Now, I’ve been saying for years, we were going to have a massive crash in bonds, and in the stock market, and I think we’re there. However, in the massive crash everything goes down, stocks, bonds, resources and the margin clerks are calling up. People are selling everything they’ve got. I think it’s a massive opportunity if people are willing to trade stocks. And I believed that we were going to have a rally through the end of June, into the end of July, and I think we’re there. I mean, certainly it shows that gold and gold stocks are not dead; they’ve just been hammered.

Goldfinger:

It’s really interesting to see the sentiment shifts in this sector, and I know you’re a student of sentiment. In March, gold was above $2,000 an ounce. All these sanctions started being put on Russia, and gold came into favor as this asset that has no flag and no counterparty risk. The tried and true store of wealth throughout human history. And Russia happens to have a hell of a lot of gold. And then in April and May, the sentiment shift was very notable to the downside. We went from bullish sentiment in March, and went to 121 mining conference in Las Vegas at the end of March. It was very bullish. Definitely spirits were high. And now I look at some conferences that have happened in the last few weeks and attendance is already way down.

So it’s really interesting to see that sentiment shift to the downside, and then we had a big rally last Friday. Now, that was just one trading session, so we don’t want to make too much of it. But what’s your take on sentiment in the gold sector and the mining sector, and where we might be?

Bob Moriarty:

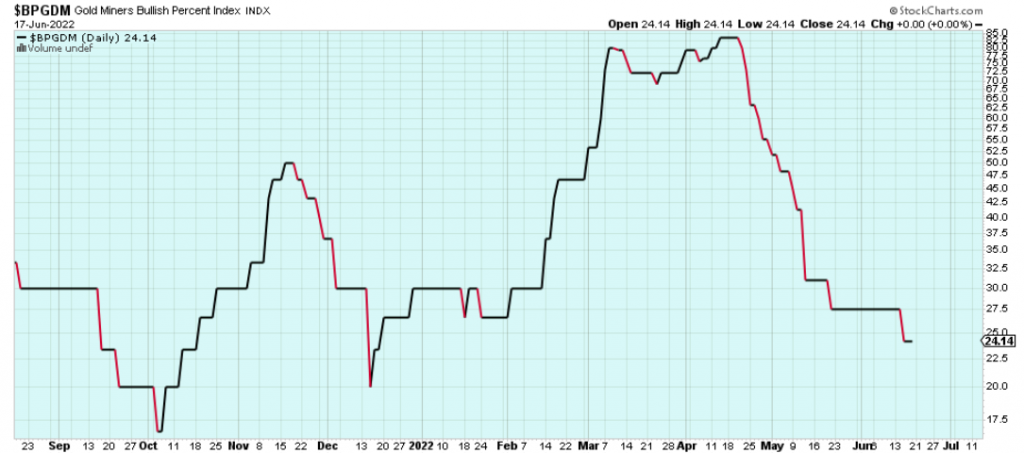

Well, the sentiment on gold right now, the Daily Sentiment Index is 71, and it’s a lot closer to a top than it is to a bottom. However, if you look at the bullish percentage sentiment, it would be indicating at least a tradable low. Well, we’re good for another six weeks or two months, and then I’d look at a monster crash coming in again.

Now, one of the things nobody’s talked about lately, which I find quite interesting, we talk about the stock market crash, and we’ve watched the bond market crash, and we’ve watched currencies crash. Nobody’s talking about derivatives. That’s the ticking time bomb that’s going to blow the financial system up worldwide. And it’s going to crash, I mean, derivatives. Or just think: I mean, there are hundreds of billions of dollars in derivatives, and it’s like an Indian casino. It’s not an economy. It’s an Indian casino where people throw dice and count cards. Certainly you and I have been talking about the cryptocurrencies for years, they’ve already lost $2.1 trillion. And I believe tether is 100% fraud. Grant Williams has done a great interview talking about tether. I think that it’s going to drag the entire cryptocurrency market into cryptocurrency heaven, literally overnight.

Gold Miners Bullish Percent Index (Daily)

Goldfinger:

Yeah, it’s a really good point about the cryptocurrency space. I can’t think of a better poster child for the market froth and the everything bubble of 2021 than the cryptocurrency space. And we’re seeing a lot of wealth being destroyed in that sector in the last year. I want to talk about stagflation, and we got some economic data on Friday. There’s two pieces of data that really stand out. The first one was the consumer confidence number that came in at a 42-year low. So the University of Michigan does a consumer confidence survey every month, and the reading came in at the lowest level since 1980. We also got CPI data, so we got inflation data that actually was higher than consensus estimates, and indicative of about 8.6% annual inflation right now. We can argue all we want about what inflation is actually running at now, but regardless, we can all agree it’s high, much too high.

Consumer sentiment is really, really weak, and inflation is really high. The last time we’ve had a situation like this was probably in the early eighties or the late seventies. And it smells like stagflation. Now, I wasn’t really around back in those days. Can you tell us a little bit about the seventies and the early eighties, and what actually worked as an inflation hedge back then?

Gold (Weekly – 1975 to 1983)

Bob Moriarty:

Well, that’s a really good question. Okay, let’s talk about what doesn’t work. Do you know the term Pyrrhic victory?

It’s a victory in which far more damage is done to you than to your opponent.

Goldfinger:

Right.

Bob Moriarty:

Now, who do the sanctions hurt?

Goldfinger:

Are you talking about the sanctions on Russia?

Bob Moriarty:

Yeah.

Goldfinger:

I think it hurts everyone.

Bob Moriarty:

The sanctions hurt the West and do nothing to Russia.

Goldfinger:

I don’t agree with that. Russia’s economy is a mess and they’re not allowed to import a lot of goods that they use from the west, like microchips and such. And they can’t export a lot of things that they were previously exporting to the west. It is definitely hurting their economy, it just might not be hurting Putin and his inner circle as much as it’s hurting the rest of the Russian people.

Bob Moriarty:

Well, you couldn’t measure it by any measure. They’re making money hand over fist. And what they’ve done, this is talking about China and Russia, is they’ve realized that you don’t hold assets outside of your country, and you don’t hold assets in international currencies, because the governments of those countries will steal it from you. But think about the sanctions. I mean, for crying out loud, are you going to tell me that Russia’s been hurt by the sanctions?

Goldfinger:

Yeah, I think so. I mean, you and I don’t really know what’s happening for real inside of Russia right now, but there’s no doubt in my mind that their economy has been damaged by the sanctions. Now, just because they’re able to still sell oil and generate a lot of revenue from that doesn’t mean that there’s no other segments of the economy that are hurting. And also, Russia is an oligarchy, right, led by Putin? Well, all those oil revenues are stolen by the elite. So the rest of the country suffers while a few men gather all the wealth. So you can’t tell me they have a strong economy, Bob.

Bob Moriarty:

Well, you can look at the hard numbers and we know it’s true. When sanctions were announced, the ruble shot up to 160 to the dollar, and the interest rate shot up 20%. And the ruble is now at 55 to the dollar. It’s the strongest currency in the world.

Goldfinger:

Yeah, because they’re not allowed to buy anything that’s outside their border. So all the money’s flowing in and not out.

Bob Moriarty:

We just talked about consumer confidence in the United States. Do you have any idea what Putin’s approval rating is?

Goldfinger:

We’re really shifting away from my question here. I mean, Putin’s approval rating based on Russian media isn’t really relevant, because if you don’t approve of him, you go to prison or get shot. I don’t really think that the approval ratings reported by the Russian government are a very objective analysis.

Bob Moriarty:

Well, it’s the proof. I mean, I thought for a minute you were talking about Ukraine, because Ukraine is definitely the most corrupt country in the EU and should be filthy rich, and all of the wealth has been stolen by the oligarchs. I don’t agree with Russia stealing. The oligarchs are stealing because they’ve all been kicked out. Let me give you some numbers and…

Goldfinger:

Can we go back to the question I asked, the question about stagflation in the 1970s?

Bob Moriarty:

Well, let’s talk about inflation because that’s the most important issue. According to Americans, that’s what they’re most concerned about. Russia and Ukraine produce 33% of wheat and barley, 17% of corn, and nearly 80% of the world’s supply in sunflower oil. One of the things that everybody is ignoring to their peril is that Europe cannot survive without resources from Russia. Now, back in 1979 and 1980, we had Paul Volker. And when interest rates shot up to 20%, it killed inflation, and now we’ve got interest rates below 2% and we’ve got inflation at 8.6% that they’re admitting. You’re not going to solve 8.6% inflation with 2% interest rates. We are doing exactly the opposite of what we should do. Biden has literally attacked the energy industry, and the reason the cost of gas and the cost of fertilizer is going up is because of Federal Government restrictions. We need to undo the sanctions and we need to stop attacking fossil fuels.

Goldfinger:

So, does gold benefit in a stagflationary environment?

Bob Moriarty:

In 1979, from November until January 21, 1980, gold went from $350 to $875. Silver went from $15 to just over $50. So it’s correct to say gold and silver reacted well during that short period of time. But the fact of the matter remains: I think the economic crash across the board is more of a danger right now than anything else. And when I’m telling people they need to cash out, I think between August and October, we’re going to have a massive crash.

Goldfinger:

So I wrote a blog post two Fridays ago saying that I’m getting a feeling like June of 2008. I think you read that. And so if you’re thinking that we’re going to have a crash between August and October, this is shaping up to be like an almost perfect repeat of 2008, because in 2008, the market really started to roll over in August. And then obviously in September was Lehman brothers.

Bob Moriarty:

Your article was right on track. I think it’s accurate. It certainly fits in with what I’ve been predicting for a year. And I hate saying, I mean, the Biden administration is filled with the most incompetent yo-yos in American history, and that’s not a political statement. They’re all idiots. We don’t even know who is really running the White House. It sure isn’t Joe Biden.

Goldfinger:

Yeah, yeah. This is actually very scary because when a ship gets into rough waters and gets into a storm, you want your captain of the ship to be an experienced veteran that really knows what they’re doing, so you don’t die. And if the economy is a ship entering rough waters, we are not being led by a good captain.

Bob Moriarty:

Well, it’s end of empire. Don’t talk about that. Everybody acts like this in some kind of cycle. And when we come out of the cycle, we will find we have done things that are so catastrophic to the American economy and to the EU. The sanctions meant a giant shift in economic power from the west and a debt-based economy to China and Russia and India holding the economic power. And it’s monumental. I mean, those guys that have already started work on commodity based currencies, gold and silver absolutely will be part of it. And the United States is going to become a third world power. I mean, we’re somewhere between $150 and $200 trillion in debt in a $21 trillion economy. Now, we know that money’s never going to be paid. And at the end of the day, it’s going to destroy the dollar. But because so many loans internationally have been made in US dollars, the dollar’s going to get stronger in August, September, October, and it’s going to destroy the world’s economy.

Goldfinger:

So, what do you do if you’re a junior mining investor like me? I’ve got a portfolio of roughly 25 different junior miners, whether they’re gold or copper or what have you, what do you do when we’re approaching what you’re saying? If this is going to be a repeat of 2008, juniors could drop 90% during that kind of a waterfall crash. So, are you recommending that people sell all their junior miners?

Bob Moriarty:

No, not at all. Strangely enough, that analogy, it’s absolutely perfect. Between 1929 and 1932, the Dow Jones dropped 89%. Very few people know that, but almost nobody knows that between 1932 and 1933, the Dow Jones went up 163%. If you started buying stocks in September and October of 2008, in juniors, you could have made 1,000% on most of the ones that you owned. So here’s a couple of things investors should do. Do not under any circumstance hold a leveraged position. Do not use margin. No leverage. Cash up to a reasonable degree. That does not mean sell everything. There are so many extraordinary stocks now that are in the sales bin for it. You’ve got Lion One, you’ve got Eskay Mining, you’ve got New Found Gold (TSX-V:NFG). You’ve got Labrador Gold (TSX-V:LAB). You’ve got a lot of stocks there down 65% to 80% already. Do not sell everything, but be prepared to move money around when the crash comes. And the crash is coming. There’s a great opportunity. I think the market will be up in June and July. I’m talking about the resource market. Take some money off the table when it goes up.

Goldfinger:

Let’s talk about some specific juniors. So a few that we’ve talked about in the past come to mind. So one is Irving Resources (CSE:IRV). The other one is Lion One (TSX-V:LIO) that you mentioned. And the other one is Novo (TSX:NVO), a company that had some bad news recently. Can you give us a quick update on each of those three?

Bob Moriarty:

Irving, first of all, just bought two drills. They’ll be in Japan shortly. They’ve started a company using Japanese drillers, and the pace of drilling is going to accelerate. Irving’s one of those stories that’s an extraordinary story, some great projects in a great country, but COVID has hurt them seriously. Similarly, Lion One got set back for two years because it was being run out of Perth. Wally got two of the best people in the entire gold mining sector to go on site in Fiji, and we’re starting to see the results now. They’ve got six drills churning. They’ve got two more on order. They’re going to be in production in two years.

And regardless of what happens to the price, they’re extraordinary stocks. Novo has lost traction, and there are very real problems there. I think they’re problems that can be surmounted, but they need to get traction. Australia is one of the toughest countries in the world because the labor force there can get a job by picking up the phone and getting a raise, and they have no loyalty whatsoever. And Novo’s lost some key players, and it’s hurt them. But Novo’s also very cheap now, and quite bluntly I am buying shares here. I owned as many as two million Novo shares, and I have never lost a cent on a single share. At these prices, I’m a buyer. There’s no question whatsoever, there have been a lot of problems, but I think they can overcome them.

NVO.TO (Weekly)

Goldfinger:

All right. I’ll put you on the spot. What’s the most recent stock that you bought?

Bob Moriarty:

Oh, damn it, I hate it when people ask me direct questions that I can’t worm my way out of. I participated in a private placement in a company, an Australian company called Southern Cross Gold. Southern Cross Gold hit some extraordinary holes. I was in the placement literally two or three months ago at 20 cents a share, and those shares are $.58 per share now. It tripled in the last two weeks. I am not recommending Southern Cross Gold. However, there is a company called Mawson (TSX:MAW) that owns 60% of Southern Cross. I’ve been trying to nibble, and you just screwed me royally because I’m not going to be able to pick any shares up now. Mawson is selling at a market cap, I think, of around $40 million, and they own something like $60 million worth of Southern Cross Gold. So, if you like Southern Cross Gold, don’t buy Southern Cross Gold. Buy Mawson.

Goldfinger:

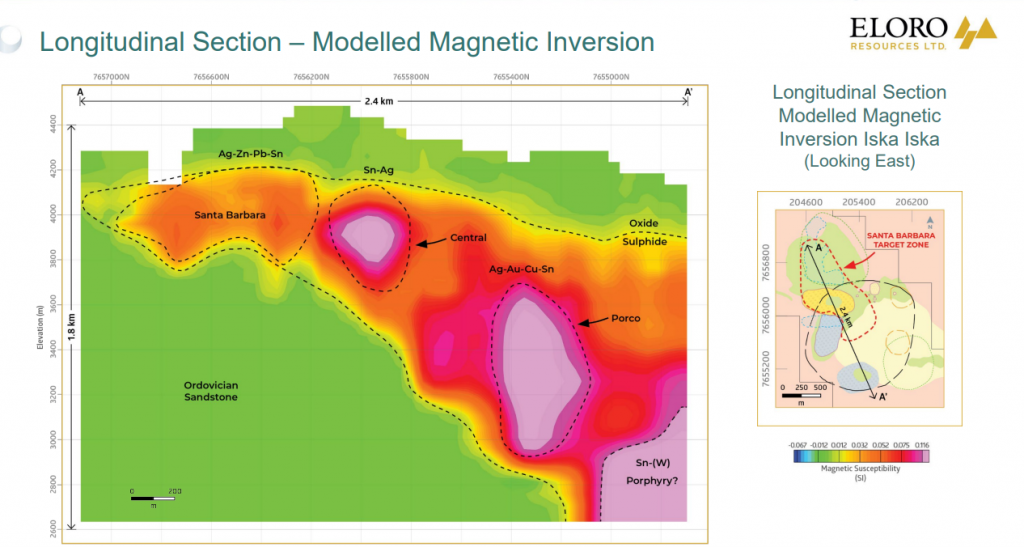

And then finally let’s talk about Eloro. So Eloro Resources (TSX-V:ELO, OTC:ELRRF) is coming up to publishing a maiden resource for the Iska Iska Project. Now, they’ve been drilling a lot, and I know that COVID has messed them up too in terms of lab turnaround times. And I know they’ve got a lot of holes in the lab. We’re probably going to get a steady flow of assays for many, many months to come. Based upon drilling to date it seems like the Santa Barbara area at the Iska Iska Project is probably in the order of 500 or 600 million tons already, probably at a little above 100 grams/tonne silver-equivalent on average. But what would really take this project to a whole other level category of world class would be if they found this tin feeder structure. I know they’ve moved some drills down to the Porco area, which is south of Santa Barbara. We got an interesting news release last week where Eloro released results for hole hole DPC-09 and the final 50+ meters of that hole showed a significant uptick in silver and tin grades. This is typical of what is seen in the Santa Barbara area in the transition to the more tin dominant mineralization at depth. What have you heard about Eloro and how things are going there?

Bob Moriarty:

Okay. I think you have to step back just a little bit. Instead of looking at the trees, look at the forest. If you go to Eloro’s website and you look at a map of the project, they control an entire caldera. You can see it on the map. There’s no question whatsoever there have been multiple pulses of mineralization fluids because every assay is different than the assay next to it. So, rather look at it, say they’ve got 500 or 600 million tons at Santa Barbara, which they do, and they’ll be releasing the initial 43-101 I think Q3, which is coming up right away.

Look at the overall picture, and the overall picture tells me it’s two billion tons of $150 rock, and that’s $300 billion worth of ore in the ground. Eloro suffered the same problem that Newfound Gold does. They’ve had so many extraordinary intercepts that investors have no idea whatsoever what they’ve got. But the answer is, about Newfound Gold and Eloro, they’ve got a lot. I’ve talked to management, Tom Larsen and Bill Pearson and at length. I said for a year they’ve got two billion tons. And every press release tends to verify exactly what I’ve said. But two billion tons of $150 rock, it’s going to be one of the biggest projects in the world.

Goldfinger:

And I guess the final question: Let’s talk a little bit about something we haven’t discussed much, and that is capital allocation, portfolio management in the junior mining sector. I think that a lot of newer investors don’t know how big their positions should be, and they might tend to put too much money into a highly volatile speculative stock. What would you say is the largest percentage that one should allocate to a single stock in a junior mining portfolio?

Bob Moriarty:

I’m not sure I’m the right guy to ask that. Lion One (TSX-V:LIO) happens to be my biggest position, and it’s about 20% of what I own total. But like you, I’ve got 25 or 30 stocks. I think the mistake that most investors make, and certainly I’ve made a lot of times in the past, is to not take a profit when you can. You’ve got people buying stock and they’re married to the stock. But these things go up and down. It’s very typical for every junior resource stock to have a 200% or 300% range every year. If you buy a stock at the right time at the right price and you get a nice 100% or 200% profit, which happens all the time, take some money off the table. These are trading cards, okay? They’re not partners to marry for 20 or 30 years. There’s times to own and there’s times to sell. There’s times to buy Eloro and times to sell Eloro. Novo went from 25 cents a share to nearly nine bucks. Now, if you couldn’t make money going up and coming down, you shouldn’t be trading in resource stocks.

I highly encourage everybody who’s a serious investor to read the books I’ve written. I’ve written two books, financial books about junior resource stocks, about investing in general. And some of the concepts are so simple that people just don’t understand them. I say stocks go up and stocks go down, and I’ll recommend a stock, and then two years later somebody will call me and say, “Well, X, Y, Z went down,” and I go, “Yeah, of course. Stocks go up and stocks go down.” So, if you invest to make a profit, you’ve got to sell when you make a profit. If you don’t invest to make a profit, I’ll take your money. Thank you.

Goldfinger:

Just thinking about Novo and the rollercoaster ride of the last five years, and the sentiment cycles there. If I think back to October/November 2017 when, as you said, Novo reached nearly $9, and how everybody and their brother was talking about it. It was the most followed, most looked at stock in the sector, whether it was Stockhouse, CEO.ca, or even Twitter. And most investors were very optimistic that this could be the next big gold discovery in the world.

And now I think back to how things were in October 2017 when I went to Vancouver for a conference and everyone was talking Novo. Then I look at the sentiment now, the stock around $.60, so it’s lost more than 90% from the high. And it’s almost the exact opposite situation, it feels like the other side of the pendulum. Everybody’s very pessimistic and a lot of people are bashing the company for not delivering at Beatons Creek. So, if it was a great time to sell at $8.80 when everybody was bullish, and now it’s the exact opposite where even the people that used to be bullish are bearish, we’re on the other side of the pendulum. So we’re definitely a hell of a lot closer to a bottom than we are to a top in Novo. With that being said I do not own Novo and I have not owned it for a few years.

I think that’s a good place to wrap it up today. Thank you for your time, Bob. Some really good insights and as usual, we don’t have to agree on everything. But I do think we agree there are more tough times ahead for markets this summer, and that gold is likely to be the first to turn, before Wall Street does.

Disclosure: Author owns shares of ELO.V at the time of publishing. Author has been compensated for marketing services by Eloro Resources Ltd.

______________________________________________________________________________________

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The companies mentioned in this article are high-risk venture stocks and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.