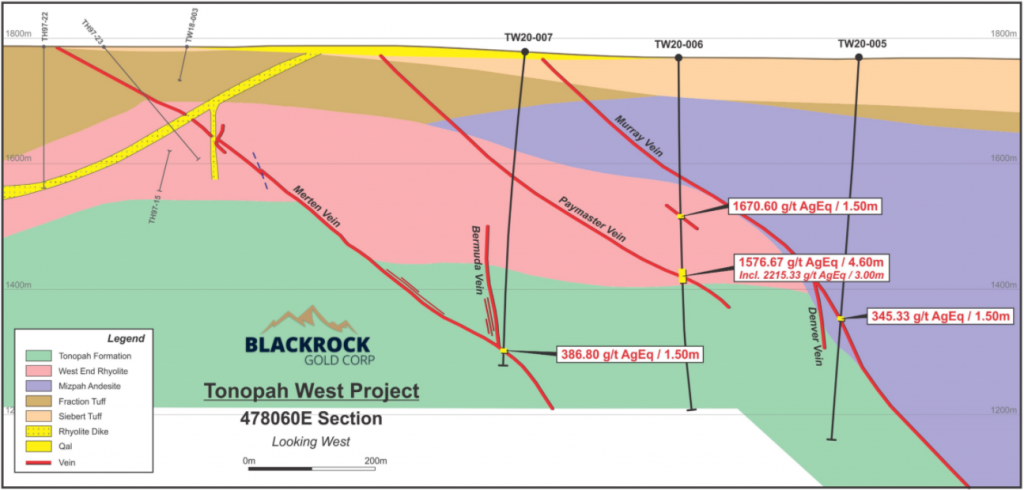

Blackrock Gold (TSX-V:BRC), soon to be Blackrock Gold & Silver (given recent drill results at Tonopah West), announced high-grade gold/silver intersections in hole TW20-006 into the Paymaster Vein, including 1,577 g/t silver equivalent (AgEq) over 4.6 meters including 3.0 meters grading 2,215 g/t AgEq, AND a second vein yielding 1.5 meters of 1,670 g/t AgEq.

Hole TW20-007 intersected a previously unknown vein and returned 1.5 meters grading 387 g/t AgEq, and hole TW20-008 returned 562 g/t AgEq over 1.5 meters from the steeply dipping Discovery Vein.

The following section map helps to illustrate what Blackrock is finding, and more importantly, the number of ounces that Blackrock could prove up by infill drilling between these veins along strike:

What has Blackrock really excited is what the company is calling the “DPB Zone” for Denver, Paymaster, Bermuda Veins. The DPB Zone is where Blackrock has just stepped out 800 meters to the northwest, with the idea of eventually infill drilling back to the east if the step-outs hit. The DPB Zone is envisioned to contain from 1 million to 3 million tonnes averaging 1000 to 1500 g/t silver and silver equivalent. This could make the DPB Blackrock’s largest target zone at Tonopah West.

Blackrock is approaching 10,000 meters of drilling in 19 RC and 2 core drillholes across the Victor, DPB, and Discovery targets. This initial program, originally slated to consist of 7,000 meters of drilling, has been expanded to 20,000 meters following this summer’s success in holes 1 through 8.

Assays are pending for many holes including the 800 meter step-outs in the DPB Zone.

The BRC chart shows a high & tight bullish consolidation and today’s news couldn’t come at a better time, just as the Daily-RSI(14) was testing the median line from above:

BRC.V (Daily)

It’s always impressive when a junior can vault from $.03 to $1.50+ and then consolidate in a relatively tight range while holding most of its gains. BRC has done just that.

As I was mentioning in the Trading Lab yesterday, the strongest stocks (such as ELO.V and GBR.V) don’t pull back much and mostly correct through time. If we wait too long we will be left waiting at the train station while these stocks take-off yet again. BRC might be about to embark on its next trip higher.

Disclosure: Author owns shares of Blackrock Gold BRC.V at time of publishing and may choose to buy or sell at any time without notice.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Blackrock Gold Corp. is a high-risk venture stock and not suitable for most investors. Consult Blackrock Gold Corp’s SEDAR profile for important risk disclosures.EnergyandGold has been compensated for marketing & promotional services by Blackrock Gold Corp. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.