VANCOUVER, BC, Sept. 2, 2022 /CNW/ – NG Energy International Corp. (“NGE” or the “Company“) (TSXV: GASX) (OTCQX: GASXF) and CleanEnergy Resources S.A.S (“CleanEnergy“) are pleased to announce that, following the July 20th and August 2nd news releases announcing the successful drilling and testing of the Magico-1X well located in the south-east corner of the SINU-9 Block, the following results from their updated reserves and resources report.

Reserves – Magico 1X

| Conv. Nat. Gas Reserves | ||

| Well | 100%(MMcf) | Co. Gross(MMcf) |

| Proved Undeveloped | ||

| Total Proved | 4,030 | 2,902 |

| Proved plus Probable Undeveloped | ||

| Total Proved plus Probable | 16,938 | 12,195 |

| Proved plus Probable plus Possible Undeveloped | ||

| Total Proved plus Probable plus Possible | 36,213 | 26,073 |

| NOTES: | |

| 1. | The Company has a 72% working interest in the SINU-9 Block in onshore Colombia, which contains the Magico area. |

| 2. | The table above contains possible reserves. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. There is a 10% probability that the quantities actually recovered will equal or exceed the sum of proved plus probable plus possible reserves. |

| 3. | The estimates of reserves above have an effective date of August 31, 2022 and have been prepared in accordance with the Canadian Oil and Gas Evaluation Handbook (COGE Handbook). |

| 4. | The estimates of reserves above have been prepared by Petrotech Engineering Ltd. (“Petrotech”); an independent qualified reserves evaluator as defined in the COGE Handbook. |

Risked Prospective Resources (subcategory: Prospect) – Magico 1X

| Prospect | Conv. Nat. Gas Resources | ||

| Well Location | Chance of Commerciality(%) | 100%(MMcf) | Co. Gross(MMcf) |

| Low Estimate | |||

| Magico 1X | 34.63 % | 705 | 508 |

| Total Low Estimate | 705 | 508 | |

| Best Estimate | |||

| Magico 1X | 34.63 % | 2,752 | 1,981 |

| Total Best Estimate | 2,752 | 1,981 | |

| High Estimate | |||

| Magico 1X | 34.63 % | 7,352 | 5,294 |

| Total High Estimate | 7,352 | 5,294 |

| NOTES: | |

| 1. | The Company has a 72% working interest in the SINU-9 Block in onshore Colombia, which contains the Magico area. |

| 2. | The table above contains prospective resources. There is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources. |

| 3. | The estimates of prospective resources above have an effective date of August 31, 2022 and have been prepared in accordance with the COGE Handbook. |

| 4. | The estimates of prospective resources above have been prepared by Petrotech Engineering Ltd, an independent qualified reserves evaluator as defined in the COGE Handbook. |

| 5. | See below for a discussion on how the Chance of Commerciality was determined. |

| 6. | See below for a description of the applicable project. |

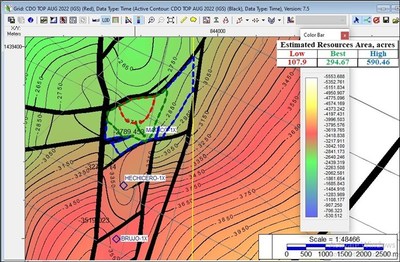

The Company also announces the following results from the evaluation of the Hechicero and Brujo areas within the SN-9 Block:

Risked Prospective Resources (subcategory: Prospect)

| Prospect | Conv. Nat. Gas Resources | ||

| Well Location | Chance of Commerciality(%) | 100%(MMcf) | Co. Gross(MMcf) |

| Low Estimate | |||

| Hechicero | 32.32 – 34.63% | 7,146 | 5,145 |

| Brujo | 32.32 – 34.63% | 3,915 | 2,818 |

| Total Low Estimate | 11,061 | 7,964 | |

| Best Estimate | |||

| Hechicero | 32.32 – 34.63% | 12,264 | 8,830 |

| Brujo | 32.32 – 34.63% | 9,774 | 7,037 |

| Total Best Estimate | 22,038 | 15,867 | |

| High Estimate | |||

| Hechicero | 32.32 – 34.63% | 17,430 | 12,549 |

| Brujo | 32.32 – 34.63% | 14,608 | 10,518 |

| Total High Estimate | 32,038 | 23,067 |

| NOTES: | |

| 1. | Numbers may not add due to rounding. |

| 2. | The Company has a 72% working interest in the SINU-9 Block in onshore Colombia, which contains the Hechicero and Brujo areas. |

| 3. | The table above contains prospective resources. There is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources. |

| 4. | The estimates of prospective resources above have an effective date of August 31, 2022 and have been prepared in accordance with the COGE Handbook. |

| 5. | The estimates of prospective resources above have been prepared by Petrotech Engineering Ltd, an independent qualified reserves evaluator as defined in the COGE Handbook. |

| 6. | See below for a discussion on how the Chance of Commerciality was determined. |

| 7. | See below for a description of the applicable project. |

Chief Executive Officer of NGE, Serafino Iacono commented “We are very excited about the discovery of these important gas reserves and the presence of prospective resources to be drilled in this area with great exploration potential to support the gas needs for the country.”

Chance of Commerciality

The chance of commerciality is the product of the chance of discovery and the chance of development (see below for further details). The primary targets are the Top, Intra and Lower Ciénaga de Oro Formations and the secondary target is the Porquero Formation. The petroleum system exists in this area, as there is gas production from all three primary targets in the nearby Esperanza and VIM 5 Blocks. These Blocks are immediately to the east of the SINU-9 Block.

Chance of Discovery

| Top, Intra, Lower CdO Prospects | Porquero Prospects | ||

| Geological Risk Factor | Value (%) | Geological Risk Factor | Value (%) |

| Play | Play | ||

| Play Chance | 100 | Play Chance | 100 |

| Prospect | Prospect | ||

| Prospect Chance | 36.45 | Prospect Chance | 34.02 |

| Chance of Discovery | 36.45 | Chance of Discovery | 34.02 |

The Chance of Development is estimated at 95%, as gas transmission pipeline systems are in the vicinity due to the producing fields in the Blocks mentioned above. The Chance of Commerciality for each prospect is then determined by multiplying the chance of development and the chance of discovery (34.6% for prospects in the Top, Intra and Lower CdO and 32.3% for prospects in the Porquero).

Project Description

The Magico 1X well was drilled in May and June of 2022. The Company plans to drill the Brujo 1X well in September 2022 and the Hechicero 1X well in October 2022, using conventional technology (deviated drilling). The project is based on a pre-development study. Total estimated cost to achieve full commercial production is the following:

- Low Case – $18.5 MM USD

- Best Case – $19.6 MM USD

- High Case – $21.3 MM USD

The Company has signed a letter of intent with Plus+ Energy E.S.P. of Colombia to purchase the gas between 5.50 and 6.50 USD per Million BTU for a period of two years from the start date of as early as December 1, 2022. Plus+ Energy E.S.P. will contribute 100% of capital costs. In the updated reserves report, the production forecast is estimated to start on January 1, 2023 and the contract is assumed to be renewed every two years.

Petrotech Engineering Ltd., an independent qualified reserves and resources evaluator, has reviewed the contents of this news release and found it to be prepared in accordance with National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities (“NI 51-101”).

About NG Energy International Corp.

NG Energy International Corp. is a publicly traded E&P company on a mission to provide a clean and sustainable solution to Colombia’s energy needs. The Company intends on executing this mission by producing and bringing gas to the premium priced Colombian gas market from its concessions, SN-9, a 311,353 acre block which is adjacent to Canacol’s Nelson field, as well Maria Conchita, a 32,518-acre block located in the region of La Guajira. NGE’s team has extensive technical expertise and a proven track record of building companies and creating value in South America. For more information, please visit SEDAR (www.sedar.com) and the Company’s website (www.ngenergyintl.com).

Information Regarding Resources – This news release discloses estimates of the Company’s prospective resources. Prospective resources are defined in the COGE Handbook as those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. Prospective resources have both an associated Chance of Discovery1 and a Chance of Development2. Prospective resources are further subdivided in accordance with the level of certainty associated with recoverable estimates assuming their discovery:

- Low Estimate: This is considered to be a conservative estimate of the quantity that will actually be recovered. It is likely that the actual remaining quantities recovered will exceed the low estimate. If probabilistic methods are used, there should be at least a 90 percent probability (P90) that the quantities actually recovered will equal or exceed the low estimate.

- Best Estimate: This is considered to be the best estimate of the quantity that will actually be recovered. It is equally likely that the actual remaining quantities recovered will be greater or less than the best estimate. If probabilistic methods are used, there should be at least a 50 percent probability (P50) that the quantities actually recovered will equal or exceed the best estimate.

- High Estimate: This is considered to be an optimistic estimate of the quantity that will actually be recovered. It is unlikely that the actual remaining quantities recovered will exceed the high estimate. If probabilistic methods are used, there should be at least a 10 percent probability (P10) that the quantities actually recovered will equal or exceed the high estimate.

| ____________________________ | |

| 1 | The chance that an exploration project will result in the discovery of petroleum is referred to as the Chance of Discovery. |

| 2 | The chance that an accumulation will be commercially developed is referred to as the Chance of Development. |

Prospective resources are not, and should not be confused with, reserves or contingent resources. Prospective resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. There is no certainty that any portion of the prospective resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the prospective resources or that the Company will produce any portion of the volumes currently classified as prospective resources. Thus for an undiscovered accumulation the Chance of Commerciality is the product of two risk components – the chance of Discovery and the Chance of Development.

The estimates of prospective resources involve implied assessment, based on certain estimates and assumptions, that the resources described exist in the quantities predicted or estimated, as at a given date, and that the resources can be profitably produced in the future. Actual prospective resources (and any volumes that may be reclassified as reserves) and future production therefrom may be greater than or less than the estimates provided herein. The accuracy of any resources estimate is a function of the quality and quantity of available data and of engineering interpretation and judgment. While resources presented herein are considered reasonable, the estimates should be accepted with the understanding that reservoir performance subsequent to the date of the estimate may justify revision, either upward or downward.

The resource estimates presented above are subject to certain risks and uncertainties, including those associated with the drilling and completion of future wells, limited available geological and geophysical data and uncertainties regarding the actual production characteristics of the reservoirs, all of which have been assumed for the preparation of the resource estimates.

Cautionary Statement Regarding Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information”, within the meaning of applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. Wherever possible, words such as “anticipate,” “believe,” “expects,” “intend” and similar expressions have been used to identify the forward-looking statements. The forward-looking information in this news release includes, but is not limited to, statements regarding the completion of the operations described herein, drilling operations, receipt of governmental permits, licences or approvals, estimations of gas production, completion and installation of the gas pipeline and related plant facilities.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions that include, but are not limited to assumptions about the Company’s ability to complete the planned operations and activities. The Company has also assumed that no significant events will occur outside of the Company’s normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein. These factors or assumptions are subject to inherent risks and uncertainties surrounding future expectations generally that could cause actual results to differ materially from historical results or results anticipated by the forward-looking statements. Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, risks related to the Company’s inability to perform the proposed operations, regulatory approval risk, environmental risk and additional risks or factors set out in the Company’s continuous disclosure materials filed from time to time with Canadian securities regulatory authorities, including the Company’s annual and interim Management Discussion & Analysis.

Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE NG Energy International Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2022/02/c4742.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2022/02/c4742.html