Since Bob and I last spoke the stock market has been on a tear and precious metals mining shares have also had a large rally. In our latest conversation Bob and I discuss a wide range of topics from why some countries are handling COVID-19 better than others to why every US citizen should write a $40,000 check to the US Treasury Department. Without further ado Energy & Gold’s April 2020 conversation with 321gold founder Bob Moriarty….

Goldfinger: It seems to me that people are getting very optimistic now that the worst is over, Trump is saying May 1st the governors can call the shots and reopen as they see fit. Seems like a lot of optimism is out there now. What do you think about where we’re at and how this thing has been handled by various governments?

Bob Moriarty: I’m glad you asked that last question. There are four governments that have done a superb job. That would be Iceland, Denmark, Taiwan and New Zealand. And do you know what’s unusual about those four governments?

Goldfinger: New Zealand, Iceland, Taiwan…. Oh, are they all run by women?

Bob Moriarty: Yep. If you go to the circus, the daily circus in Washington, you can watch how males handle a crisis. And Donald Trump just got up and said, “Okay guys, my dick’s bigger than your dick.” And then one of the guys from the media holds his hands up and says, “No sir, I beg to disagree, my dick’s a lot bigger than your dick.” And that’s all it is. Now, New Zealand, Taiwan, and in Iceland, and in Denmark, the women said, “Huh, we got a problem. What do we need to do to solve it?”

Now, I’ll be candid, I think that everybody has overstated the danger of the virus. As more and more numbers come out, we realize it’s a really bad, ugly flu, but it’s not the end of the world. But if it’s an emergency, then if you immediately make decisions, you can keep the number of people who die or are infected down. You know, a week ago the United States was still arguing over whether a face mask helped or not. You would have to be stupid to think that it doesn’t help; of course it helps. So as soon as New Zealand said, “Okay, we got a problem,” they closed the borders. They said, “Okay, everybody go home, stay at home, you got an emergency, you tell us about it.” I think there’s seven dead in New Zealand. I mean, that’s absolutely remarkable.

Taiwan is right next to China. They had hundreds or thousands of people coming from Wuhan, and they got it under control immediately. And then the United States, I challenge anyone to suggest we have it under control. We do not have it under control. The government’s still lying about everything. China was lying about how few cases they had. We are lying about how many we have. What’s the difference?

Goldfinger: I think that’s a really important point. I mean, a couple points that I agree with you about women versus men, feminine versus masculine psychology in crisis situations, and Trump is very much about ego and his image, and how he looks, and women are generally more practical and less concerned about those things when faced with danger, they care about safety and doing the right thing. And then as far as the severity of it, it’s interesting because we didn’t really have data until a couple weeks ago. We were guessing based upon anecdotal stuff and what China had told us. And obviously China, all of their data is completely fictitious. It’s clear that there were many more infected there than they said, many more died there than they said.

You know, we can argue about the numbers, twenty thousand dead, thirty thousand dead, forty thousand dead, it doesn’t really matter. It’s a lot more than they admitted to. But now that we have data, we have pretty big chunks of sample sizes, in the millions now, and more data is coming out about how there’s a lot of asymptomatic carriers, especially among the younger population, a lot of mild cases that don’t even get put in the numbers because they don’t seek treatment, they don’t get tested. And so, in reality, it seems to me like the fatality rate is probably less than 1%, and possibly significantly less than 1%, more like 0.1%, which is more like the common flu.

Bob Moriarty: It’s a bad flu. It’s worse than the ordinary flu, but they came up with some pretty good numbers in Germany. And they concluded, one, yes, a lot more people were infected, and two, it wasn’t nearly as dangerous as people were saying. It looks like it;s four times as deadly as the ordinary flu. And those numbers seem to me to be true.

Goldfinger: Yeah, exactly. It’s a bad flu, that is actually potentially deadly for people over 60, obese people, people with hypertension, people with diabetes, leukemia, etc. Basically, for anyone who’s vulnerable, this thing could be very serious. But for the majority of the population, it’s just a bad flu. Or it’s even like a common cold for some people. They’re trying to figure out what the difference is, and why in some people it’s so severe, with fevers of 105 and all these other symptoms, and for some people they can go about their daily life. So now we have the data, but you’re right, Trump and many others are downplaying it, and it’s not to be downplayed. Because even though the U.S. might be peaking, that doesn’t mean we’re going to be at zero cases in two weeks.

In fact, a lot of the stuff that I read and understand says that we’re probably going to have a little bit of a rollercoaster for the next few months. And possibly, this thing might even come back later this year, and it could be a big problem again that could cause another shutdown.

Bob Moriarty: That is correct. But you’re wrong on one thing. The United States is not downplaying it. What they’re actually doing is overstating the number of deaths, and I said in my piece that I believe that was true. But Robert Kennedy Jr. Has done a really excellent piece that anybody can look up, and he says that the CDC and the WHO and the NIH have been lying about how many people are dying from the flu by at least a factor of 10, and perhaps a factor of 40 for years. Here, I think it’s very clear the extent to which Big Pharma and Bill Gates control the WHO. They control the NIH, they control the CDC, and these people are actually idiots. Now, did you notice in my piece where I talk about DNA and RNA?

Goldfinger: Yes.

Bob Moriarty: Okay, here’s why it’s important. Now, we have a new flu vaccine every year. Why is that true?

Goldfinger: Because viruses change, they mutate. There’s new viruses coming about.

Bob Moriarty: Thank you. It is a different virus this year than it was last year. And the fact of the matter is, the vaccines really don’t work. When swine flu came out and it was the panic of the day, and they came out with a mandatory vaccine for swine flu, the vaccine killed more people than swine flu. Now there’s something very subtle, and people don’t understand about the vaccine for something with RNA, is the vaccines actually change, on a permanent basis, the DNA of the person the vaccine is given to. And the problem with it is, let’s say Bill Gates comes out with a vaccine. It works, okay? What does that mean? We’ve got seven billion people on Earth. How much are you going to make per shot? Give me a number.

Goldfinger: I have no idea. $50?

Bob Moriarty: Well, that’s a lot. How about, let’s say, ten bucks, okay?

Goldfinger: Okay.

Bob Moriarty: I don’t believe that’s true, but let’s say ten bucks, okay. So, we gave the vaccine to seven billion people, it costs ten bucks apiece, now what’s the value of the vaccine?

Goldfinger: $70 billion.

Bob Moriarty: Okay, so when Big Pharma lies about a vaccine, that gets them seventy billion dollars. Would they lie?

Goldfinger: Of course.

Bob Moriarty: Of course they would, damn straight they would. We know that. Okay, now Bill Gates doesn’t need the money. But what does Bill Gates want? He wants everybody to get a social credit rating. He wants it digitally implanted, and once you do that, you’ve then got everybody in the United States on a digital register, you can do anything. You can see… from flying, you can see who’s been getting a job, you can see who’s been driving, you can see who’s been going into a grocery store. That would be the ultimate control. Now, Bill Gates will tell you, “I don’t need the money,” which is true. And, “I’m doing this because I have such a big heart,” and hell, maybe that’s true. But would somebody in government look at it and say, “Oh, shit! We can control everything. All we got to do is force people into taking this vaccine.”

Now, let me tell you something crazy, and you’re not going to believe this, but it’s true. I don’t actually give a shit if they do that or not. I don’t care.

Goldfinger: Why is that?

Bob Moriarty: That was a really good question there, Robert. Because, if they give you the vaccine this year, and the unintended consequence that nobody thought about is, five years from now, you drop dead, forcing people to take the vaccine now and giving them a passport literally could mean extinction. Now, would Big Pharma still develop a vaccine that’s worth seventy billion dollars in revenue if there was a chance of it being an extinction event?

Goldfinger: Yeah.

Bob Moriarty: Hell yes they would! You’re damn straight they would! The ability to control everybody? Holy shit! What a great idea! So let’s go back to where we came from. It’s a bad flu. I happen to be in a high risk category. I’m over 70, I have high blood pressure, I’m not obese, but if I caught it, it could be bad. The chances I might survive might be eight out of 10 or nine out of 10. I’m high risk, and social distancing would be a really good idea for me. And I’m willing to do that. But more people are going to die from the depression than from the flu.

Goldfinger: Yeah, and I think that’s an important point. So, we have more than 20 million unemployed in the U.S. in the last month. So literally, the whole recovery since 2009 has been wiped out.

Bob Moriarty: No, that’s not true. You just said something that isn’t true.

Goldfinger: What’s not true?

Bob Moriarty: You said that 20 million have become unemployed from last month, and I said that’s not true.

Goldfinger: And why is that?

Bob Moriarty: Because 22 million have filed, but there’s another 10 or 20 million who haven’t filed yet, who are just as unemployed.

Goldfinger: Oh yeah, I said more than 20 million. So yeah, it might be 30 million, it might be 35 million, there’s also a lot of undocumented workers out there who have probably been laid off. So the numbers are pretty massive.

Bob Moriarty: The numbers are massive beyond belief. This depression is everything that I’ve been saying it was for months and months and months and months. It is going to destroy the financial system, it’s going to destroy the banking system. The real funny thing is, they come up with this giveaway program, and they made it crystal clear right from the beginning that there’s nothing but a raid on the bank by the 1%. We are going to have social disorder to the tune of massive food riots, money riots… You had kind of alluded earlier to people are looking and running the stock market off of those so often resting. When they wake up to the carnage that’s been done to our financial system, the stock market’s going to get cut in half, or by two thirds from where it is right now. This is not massive, this is the greatest depression in world history, that’s going to affect everybody in the world.

Goldfinger: Yeah, it’s really hard to sort of contrast that the S&P is up ~32% in a month against the massive number of people who are now unemployed, and basically wiping out all of the job gains since 2009, and then some. And so, how is that possible? Well, we know markets can be irrational for a period of time, so perhaps that is happening now. But also, perhaps the Federal Reserve response and the stimulus passed by Congress were so targeted at financial markets and bailing out corporations that it benefited the stock market and did not benefit the average worker. Is that fair?

Bob Moriarty: Well, here’s the numbers, okay? You’re going to get two envelopes from the government next week. Are you aware of that?

Goldfinger: I didn’t know that.

Bob Moriarty: In one envelope it’s going to have the check of $1,200. Do you have any idea of what the other envelope is? And you’re going to get one of those for sure.

Goldfinger: The other envelope? You mean the small business bailout?

Bob Moriarty: No, no, no.

Goldfinger: I don’t know what the other envelope is.

Bob Moriarty: Well, the big $1,200 would be your piece that’s being given to you. But the $1,200 is just part of the $40,000 in additional bailout that the government has taken on your behalf. So if you were getting the $1,200, one envelope would have a check for $1,200, and the other envelope would have a bill from the IRS for $40,000.

Goldfinger: Because that was the size of the total bill, and the rest of the money is going to the corporate bailout.

Bob Moriarty: You got it.

Goldfinger: That’s what people don’t really understand, and it’s pretty appalling. Yeah, we’ve talked a lot about this, and we could talk for hours about this, but it’s pretty clear that the bailout is a sham. And I know people who own restaurants, small businesses, and they still haven’t gotten any money yet, and it’s been, what, a month? And they don’t know when they’re going to get any money, or if they’re going to get any. One of them got an email saying, all the money has been basically apportioned, and, “We’re hoping they allocate more so we can get it to you.” So the pigs at the trough got it first, and a lot of small businesses are being really left out to dry here. It’s not a good situation for a lot of Americans.

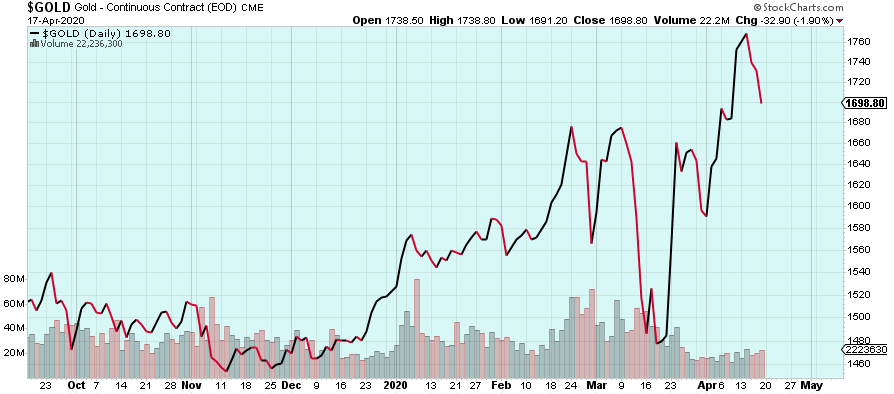

Turning to gold, I think it’s a very interesting topic. The last time we talked, gold was still, I think it was under $1,600. We hit $1,788 at the high last week as the June futures closed at about $1,700. And do you think that maybe we got a little carried away last week, where some people in the media saying $20,000 gold is coming, and all of these articles about physical shortages, and there’s going to be a run on the COMEX, and all of this stuff that gets people all hot and bothered and wanting to buy gold and silver. Do you think that we got a little carried away? And do you think that the $100 pullback, basically, that we’ve had in the last few days is a buying opportunity?

Gold (Daily)

Bob Moriarty: Well, unfortunately you’ve asked about 16 different questions, so I’ll try to address the most important. At the issue of COMEX and gold futures, I don’t want to answer the question of is there a shortage. What I want to do is ask a similar question of you. Is there a toilet paper shortage?

Goldfinger: No.

Bob Moriarty: Yes. Of course there is.

Goldfinger: There’s a toilet paper shortage?

Bob Moriarty: There is a toilet paper shortage. In most places you cannot get toilet paper. So, is there a toilet paper shortage?

Goldfinger: I bought toilet paper last week.

Bob Moriarty: Is there a meaningful toilet paper shortage?

Goldfinger: No.

Bob Moriarty: There is a temporary toilet paper shortage.

Goldfinger: Temporary, yes.

Bob Moriarty: Is there a shortage of gold? Yeah, absolutely. Is it a meaningful shortage? Absolutely not. Now, to the extent that when you ask, “Should people buy gold now?,” how many conversations have you and I had over the last three or four years?

Goldfinger: Oh, probably 40 or 50?

Bob Moriarty: Okay, and in how many of those conversations did I say we have bad things coming, and you can buy insurance today, and it would be a good idea to have your hands on some physical gold and silver.

Goldfinger: Many, many times.

Bob Moriarty: Many, many, many, many times. Every time you ever ask a question, that’s exactly what I have said. I’ve been saying the same damn thing for 15 years. Everybody else may have been surprised by this, but believe me, Barbara and I talked about this for weeks and months and years. We knew exactly what was going to come. There is a shortage of gold now, it’s not a big deal. I was buying physical silver under $14 an ounce two weeks ago. I was buying paper silver under $12 back in March, and there literally was no problem. The people who are buying gold now are the weakest of weak hands, and gold will go down 100 bucks and they’ll be selling it like crazy, because they’re the same idiots who want to buy at tops and sell at bottoms. Is gold something very valuable to own now, or silver, or platinum, or palladium? Yeah, absolutely, okay.

The building’s burning down, it’s visible to everybody now, it’s going to be more visible soon. There are so many land mines going off in every part of the financial system. These 30 or 40 million people who just got laid off, they’re not paying their rent. They’re not paying their credit cards. They’re not paying for their automobiles. They’re barely able to pay for food. They don’t give a shit if there’s a toilet paper shortage or not, because they haven’t got any money anyway. We have bad things coming. The bailout, which you paid $40,000…have you sent your check yet?

Have you sent your $40,000 check to the IRS yet?

Goldfinger: No, I don’t think anybody has.

Bob Moriarty: Well, you need to get around to that. That’s very important, because you owe that much money. The bailout, okay, that the Congress and the President made such a big deal out of, has only gone to 4% of small business. And they say, “Well, we’re going to double the bailout.” Oh, jeez, that’s wonderful. So then it’ll be 8% of small businesses. Every revolution is economic in nature. And there is some mathematical equation, a relationship between the rich and the poor. And when the divide gets too great, the poor start sharpening their pitchforks.

Now, that idiot governor in Michigan, who said that seeds are not an important issue… So, if you’re in Michigan, you can’t go into the store and buy seeds. Now quite bluntly, anybody with any sense right now is starting a garden. Because we don’t know what’s going to happen with the food supply, we just know there’s going to be a lot of disruption. But the idiot governor in Michigan said, “You can’t buy gardening supplies.” Some idiot in Mississippi said, “You cannot have religious services in a parking lot with people in their cars with the windows up.” Well, we happen to have a Bill of Rights, and in the Bill of Rights, it says you have a right to practice religion in your own way. And if you want to drive into a parking lot and have some idiot preach to you and you got your windows up, I don’t give a shit, okay. But the mayor of Greenwood, Mississippi thinks that he’s got the right to override the Constitution.

We are going to have civil disorder, and it’s going to get ugly.

Goldfinger: Okay, so there’s three more things I want to get to. We’ve got about another 10 minutes. So the first one is, the last time we spoke, you said that the stock market is going to fall at least as much as it did in the 1930s. Now, in 1929, the crash happened, then there was a rebound for a couple months, two to three months, into early 1930, and then there was a two and a half year bear market where it dropped all the way to the bottom, in I think it was 1932.

So it peaked in Q1 1930, in the initial rebound from the late 1929 crash, and then it had a two and half year bear market, where it dropped another almost 90%. So it seems like we’re kind of following that script here. We’re having this big rebound, which is now about a month old. Can it go on for another month? Can we go even higher?

Bob Moriarty: Nope.

Goldfinger: And why is that?

Bob Moriarty: It’s going to crash.

Goldfinger: So you think that stocks are very high risk now?

Bob Moriarty: Well, there’s some data, okay, and that’s important since you raised that earlier talking about the coronavirus, there is some data that we have that’s very important. The five bank stocks are a greater percentage of the S&P than at any time in recorded history, and every single time the market has been dominated by a very small number of stocks, every single time, it has crashed.

Goldfinger: Yeah, I wrote about that yesterday, the FAAMG stocks; Apple, Amazon, Facebook, Microsoft, Google and you can throw Netflix in there to make it six. But yeah, over 21% of the S&P 500 weighting is in those five companies. And without them, the whole index would be way, way, way lower. Now I want to turn to junior mining. This is the area that we are specialized in, and we see a rebound, but honestly, a lot of the stocks haven’t rebounded that much. They bounced off the lows, some of the stronger ones have doubled, some of the other ones, not so much.

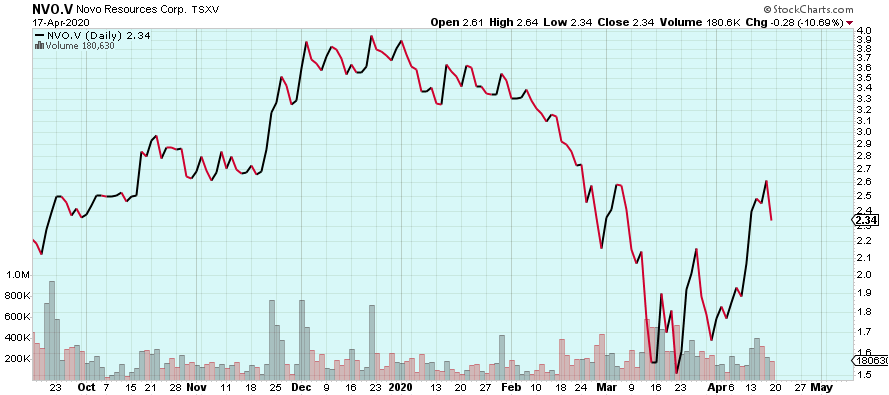

There was some controversy about Novo Resources (TSX-V:NVO) last week, in the mining financial media sphere. There was this particular interview with Quinton Hennigh where the guy (Matt Gordon “CRUX Investor”) who was interviewing said, they did the interview in February, he said, “$C600 million market cap, $C600 million market cap, how do you justify a $C600 million market cap when you’re not mining anything?” And Quinton goes into the whole thing about three different projects, and how they could be very big, and the goal is to move them forward and get them permitted, and then it could justify a C$600 million market cap (or potentially much more). And then, I saw an interview yesterday, where Mr. Hennigh said, “Our goal is to have concentrate coming from three different projects, from the three different primary projects (Beaton’s Creek, Egina, and Karatha) that Novo’s focused on in Australia.” And then if you think about that, and weigh that against record gold prices in Australian dollars, it could be extremely attractive.

But the problem is, and this is something you’ve written about, since 2017, is you have the nuggety gold effect. So for example at Karatha the problem is you can’t get a 43-101. And so how do you finance it? How do you move it forward when you have this problem, everybody wants to see a resource estimate? You know, all the analysts, all the bankers, want to see a 43-101. So how does Novo get from here to there?

Bob Moriarty: Well, the guy that did the interview had an extreme bias. You can tell from the nature of the questions, and I did listen to it. Let me ask this a different way: Is the price correct?

Goldfinger: Yeah, the market price is always the right price at that moment.

Bob Moriarty: Thank you. Price is always right. Opinions are often wrong. Now, unfortunately, because of the Internet, in the last 20 years, everybody has gotten used to having all kinds of data that they never had access to before. And with something like CEO.ca, you can look and see what we’re talking about. People want to analyze every little thing and justify every single price movement…. that didn’t exist 20 years ago. 20 years ago, you were lucky if you knew what the name of the company was, okay? Now, people believe, because they got all this information now, that you could somehow rationalize everything that’s happening: “Well, interest rates went down, so gold should go up. The S&P’s up, so gold should go down.” It’s all bullshit, okay?

Prices go up and prices go down, and the really funny thing about Novo is that it’s actually been a lot more stable in price than anybody actually wants to admit. There are junior stocks that pay 10 times as much as Novo has (to management). Novo has two or three things in the works; things could change in a week, and basically, I’ll say what I said eight years ago: Novo is a 10-bagger, at the very least, and we know that’s true. It’s already been a 20-bagger, and it has the potential to be a 100-bagger. I’m not sure it has potential to be a 100-bagger from where it is right now, but it certainly does have the potential to be a 10-bagger from where it is right now. I state categorically, unequivocally, I don’t give a shit whether it’s Eric Sprott, whether it’s Mark Creasy, whether it’s anybody else, Novo is sitting on more gold than any company in history has ever had to sit on.

And that doesn’t mean they’re going to be able to extract it, and you’ve raised some really good issues, and I was the guy pointing out how difficult nuggety gold is. Quentin has so many irons in the fire, something’s going to happen. And it could happen quickly.

Goldfinger: I think that getting a mill would be a big deal for Novo, is that right?

Bob Moriarty: Well, it will be, but you will never have a situation where you have gold come from three different places. Beatons Creek would have had a mill built by Novo five years ago, except for the fact there was already a mill there. And I’ve said this many times, it would be total insanity to spend a hundred million dollars on a mill when there’s a hundred million dollar mill sitting there in a company run by idiots. And I said that three years ago, I called it an employment service, and nobody’s ever given me credit for it, because, damn, I was right. Okay, so they went into bankruptcy, the mill was still sitting there, Novo’s still got a million ounces of gold they could put through the mill, but that would be a big deal. They don’t need a mill at Egina to process the gold there, it’s all in gravel. They’ve got mineral-sorting machines that are quite capable of sorting it out, everybody’s ignoring the numbers, okay? Everything’s in numbers.

Now, I’ve had half a dozen alluvial projects myself. How much does it cost you to process a cubic meter of material?

Goldfinger: It’s very cheap, I don’t know what it is exactly, probably around US$1?

Bob Moriarty: It costs you a dollar every time you move it. If you scoop it up, it costs you a dollar. If you put it through a mill, it costs you a dollar. If you haul it and put it on a waste pile, it costs you a dollar. So the reality, and the only other guy in the industry actually knows the numbers is Keith Barron. Keith and I totally agree on that. If you’re talking about six or eight bucks a yard, 10 bucks a yard, for processing a yard of gravel, that’s reasonable. If it costs you $15 a meter, you’d have to be run by a bunch of idiots. If it costs $6 a meter, you’re doing damn good.

Did you happen to know this? The last press release, they mentioned a grade in the new area they just discovered?

Goldfinger: I did not.

Bob Moriarty: It’s a gram to a gram and a half per cubic meter.

Goldfinger: Oh, that’s very profitable, to my math.

Bob Moriarty: No shit.

Goldfinger: So the bears say, well, you don’t know how much area actually grades a gram to a gram and a half, right? It could be a gram to a gram and a half for 50 meters, and then it could be a tenth of a gram for another 500 meters, right?

Bob Moriarty: The only thing that would ever scare me about investing in any market is when everybody agrees you should invest in it. They don’t care how many times they get proven wrong, they still want to come up and pee on the parade. My god! Okay, let’s work out the numbers. Can you do it in your head? What’s one gram material worth per cubic meter?

Goldfinger: US$50, or something like that?

Bob Moriarty: How much is a gram and a half material worth per cubic meter?

Goldfinger: US$75

Bob Moriarty: Okay, if you’ve got US$75 material and it costs you US$10 a cubic meter, what do you have?

Goldfinger: US$65 profit per cubic meter.

Bob Moriarty: No, you have a fucking gold mine.

Goldfinger: Fair enough.

Bob Moriarty: The crazy thing is, Novo keeps coming out with these numbers, everybody ignores the numbers, they don’t understand the significance of it, and I’ll tell you flat-out right now, Quinton Hennigh is lying about the extent of the gravel. Were you aware of that?

Goldfinger: No.

Bob Moriarty: It goes all the way to the damn Indian Ocean. Of course it won’t all be that sort of grade. But a lot of it will be.

NVO.V (Daily)

Goldfinger: Wow. Okay. So, enough on Novo, I think that’s a good conversation there. It’s been an interesting time, because Newmont and Barrick traded to new multi-year highs, but a lot of the juniors are still sort of stuck in the mud, especially the tiny juniors, the sub $15 or $10 million market cap ones. It feels like if gold stays up here, or goes even higher, the junior explorers could really move this summer, especially if the COVID thing calms down and companies are able to really go out and do some real exploration work and drill. Do you agree with that? And the second part of the question, what companies do you like here that maybe haven’t moved much yet?

Bob Moriarty: From a mathematical point of view, the cheapest stocks will move the most. There are a lot of under $.10 a share stocks that I have bought in the last month or two for very simple reasons. It’s easier for a $.025 stock to double than a $2.50 stock to double, just because of mathematics. There’s a lot of under $10 million market cap stocks that have $100 million potential. Let me answer the question in a different way. Under the theory that when the wind is high enough, even turkeys fly, if you knew the wind was going to be 300 miles an hour, what kind of turkeys would you want?

Goldfinger: The lightest turkeys.

Bob Moriarty: You got it. Because when the wind is high enough, even the turkeys fly. What the United States has done is they have destroyed the value of the U.S. stock market and the U.S. bond market and the U.S. dollar. You can no longer pick a price for gold, because when you’re talking about the price for gold, you’re really talking about the value of the dollar. We just went to Robert Mugabe for investing advice, and what to do about our currency. He said, “well I have a 100 trillion dollar note, that’d be kind of cool, I would hate it if it went that high.” So Trump said, we’ll stop it, we’ll stop before we get to 50 trillion dollars.”

Okay, you can no longer talk about the price of gold, but damn, if you don’t own some gold now, you ain’t ever going to own gold.

Goldfinger: Yeah, I think that’s interesting. A lot of people have asked me about gold stocks in the last couple of weeks, but they don’t own any. They’re just seeing gold news, and they’re like, “Hmm, how can I participate?” So if all of that money, all of that generalist money piles into the gold mining sector, especially the junior mining sector, it will be like hurricane-force winds, and even the turkeys will fly in that environment. And then, of course, we’ll go back to your book on investing in junior mining stocks that you buy right, buy at the right prices, but then you also have to sell at some point. And don’t forget that part, that when things have moved up a lot, you’ve got to take some off the table.

Bob Moriarty: That’s correct. But here’s the real key, and don’t hold me to these numbers, because they’re approximate rather than dead accurate, but they’re pretty good. In 1929, the value of mining stock in the stock exchange was about 8%. In 1980, the total value of all the mining stock was about 3%. Do you have any idea what it is right now?

Goldfinger: I’d have to guess it’s close to 1%.

Bob Moriarty: It’s under half a percent.

Goldfinger: Under half a percent, yeah.

Bob Moriarty: When people realize that the last, the very last refuge, for retaining value is in the mining sector, that’s a little tiny door. And when everybody tries to go through that little tiny door at the same time, it’s going to get really crowded. You are going to see two and half cent stocks go to two and a half dollars, and there’ll be no more value than there is today.

Goldfinger: I think that’s a good place to leave it. Another great chat with you again Bob. Thanks for the conversation and the insights and I pray that we will all be a little stronger, wiser, and more compassionate for having lived through this time.

Disclosure: Novo Resources Inc. is a sponsor of 321gold.com and has no affiliation with Energy & Gold Publishing Ltd.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.