WTI crude oil broke key support at $52 today and speculative positioning in crude oil futures bodes well for further downside over the near term:

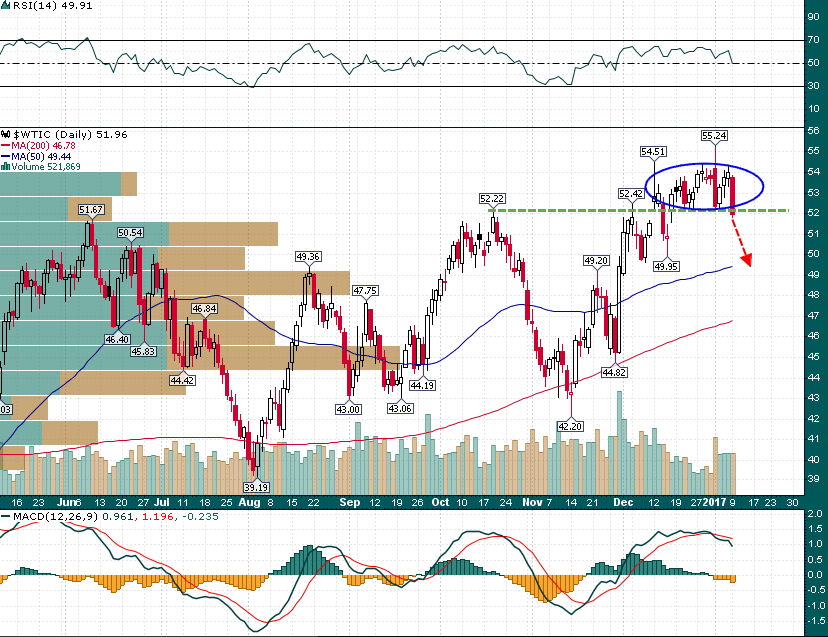

WTI Crude Oil (Daily)

A classic bearish candlestick pattern with a large red bodied candlestick last Tuesday (January 3rd) followed by three much smaller white candlesticks and another large red bodied candlestick today, which more than wiped out the gains of the previous three trading sessions.

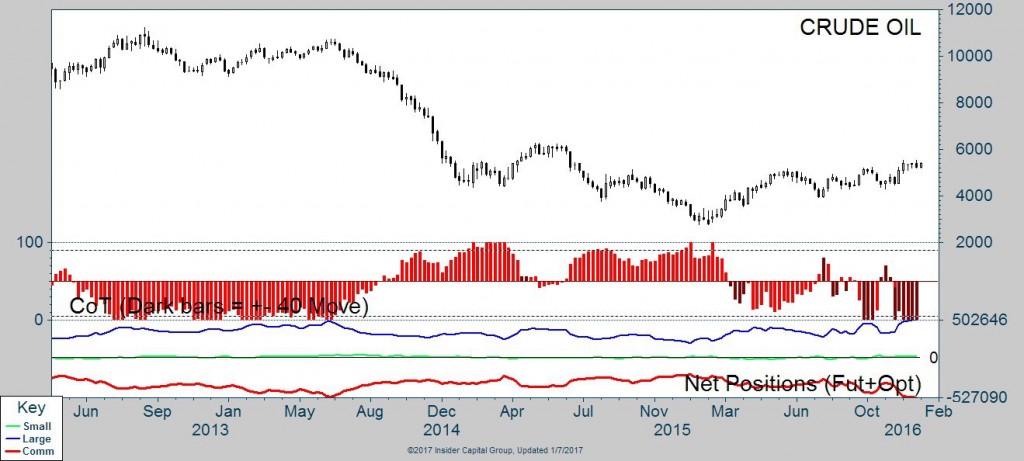

Meanwhile, commercial futures speculators (producer hedgers and swaps dealers) have a net notional short position of roughly ~$28 billion via WTI crude oil futures & options:

Whenever the commercial short position grows as large as it is now it usually means a sizable correction is right around the corner. Based upon today’s action it looks like a correction is underway and now the only question is how deep will it be (both in terms of price and time)?

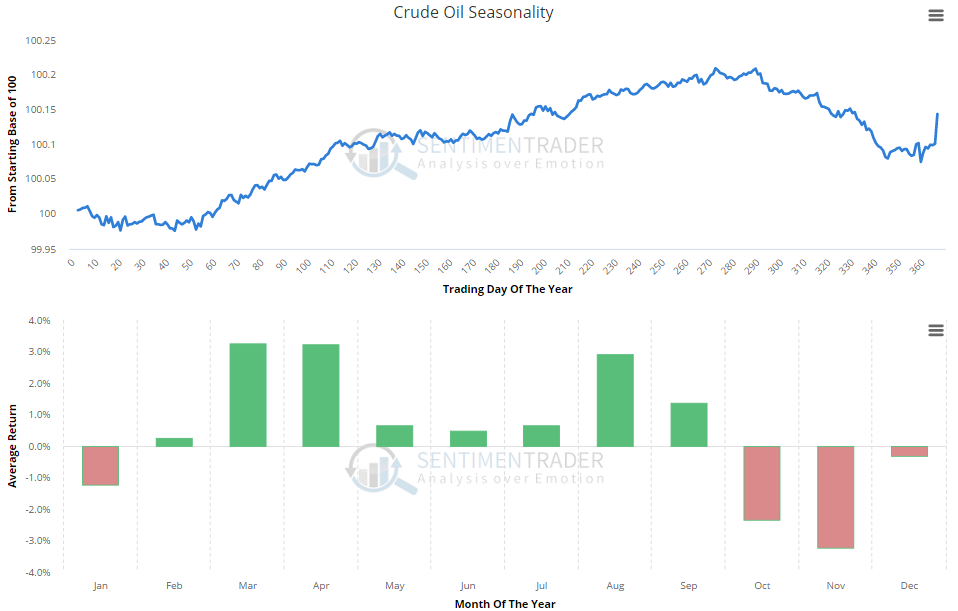

February-April is the most seasonally bullish time of the year for crude oil historically and I expect support in the $48-$49 area to contain further downside:

A deep correction that brings price down to the rising 200-day moving average (~$48) in early-mid February and seriously resets market sentiment and futures positioning might turn out to be a fat-pitch trade setup. However, for now it looks like oil has more downside ahead over the near term and it’s too early to begin thinking about trying to game a long setup in February.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.