The gold miners have seen a ~30% decline from the sector’s August peak. We have been cautious and patient in terms of trying to time a bottom and/or add to gold equity exposure. This week several setups finally met our specifications and triggered BUY signals. I would like to share one particular trade which we took in real time in the Trading Lab over at CEO.CA.

During corrective phases in the market it is important to look to buy the strongest stocks; stocks which had led the sector higher prior to the correction. The rationale is that these stocks will be the first to rebound and typically have the least downside risk. Quality is quicker to turn around and weathers storms much better than weaker stocks which do not have a strong institutional following.

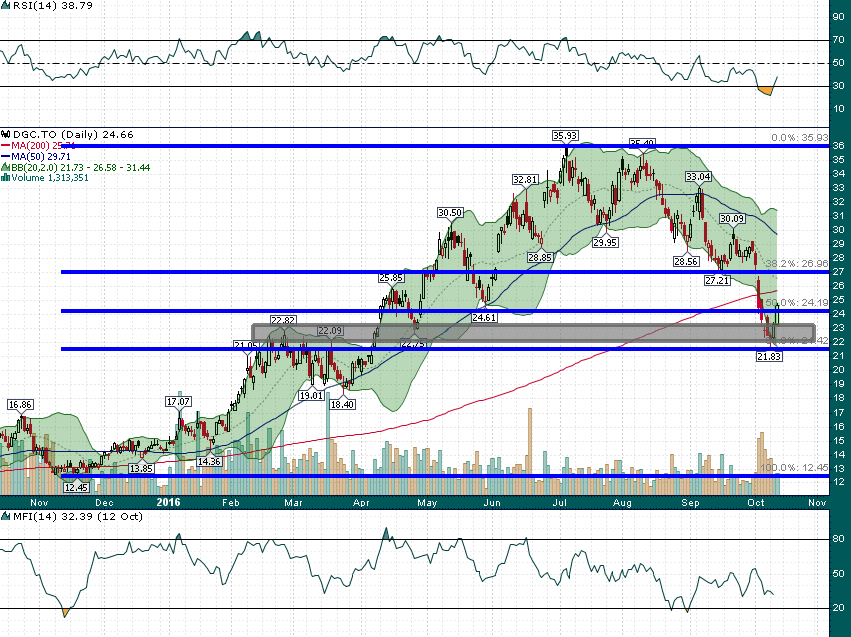

Detour Gold (DGC.TO) has been one of the strongest gold mining stocks in the entire market, DGC shares nearly tripled between its November low and its July peak. However, after undergoing a gradual and healthy correction from July through September DGC succumbed to much more aggressive selling during the last couple of weeks.. This recent downside acceleration led to an attractive BUY setup which we were fortunate enough to seize upon:

DGC.TO (Daily)

Tuesday morning DGC was about as oversold and beaten down as a stock can get: 7 consecutive days down, ~24% decline in 7 trading sessions, 5 consecutive sessions below the lower 2-standard deviation Bollinger Band. However, there were some significant bullish divergences including MFI (Money Flow Index) not making new lows. Moreover if we zoom out to a longer term chart we can see the importance of the C$21-C$22 level in DGC:

DGC.TO (Daily – 1 Year)

Technical analysis is primarily about finding key levels from which the risk relative to reward proposition is favorable, and more importantly, levels at which the risk proposition can be clearly defined and makes sense based upon historical supply & demand in a given market.

It makes sense that DGC would find support near the C$22 level and given the extent of the previous decline the potential reward (a rally up to C$27-C$30, 20%-35%) is quite attractive relative to the amount of risk we would be willing to take on this setup (5%-10%).

We entered a long position in DGC at C$22.38 on Tuesday morning. This was both a long term portfolio addition and a short term swing trade setup. Finding attractive trade entries is the easy parts of trading, disciplined exits and risk management are what separate the wheat from the chaff. To find out how we are trading DGC and other gold mining stocks in real time, including how we manage risk and size positions you can subscribe to CEO Technician Premium today!

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.