NGEx Resources (NGQ.TO) is a Canadian junior copper/gold explorer with two large copper/gold deposits in Chile and Argentina. The Los Helados Project in Chile is part of a joint venture in which NGEx holds approximately a 60.78% interest and Pan Pacific Copper Co., Ltd. holds approximately a 39.22% interest. The Josemaría in Argentina is part of a joint venture in which NGEx holds 60% and Japan Oil, Gas, and Metals National Corporation (JOGMEC) owns 40%. The two projects comprise what NGEx calls ‘Project Constellation’.

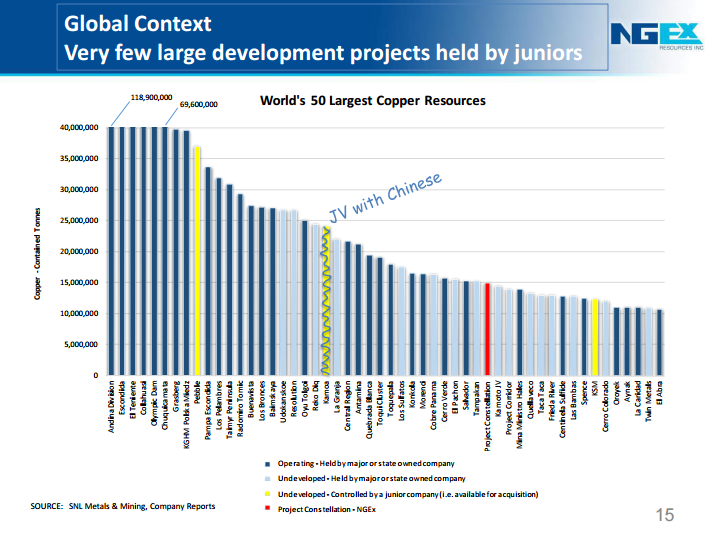

There aren’t many large scale development projects in the hands of junior exploration companies and Project Constellation is impressive in size with ~15 million contained tonnes of copper:

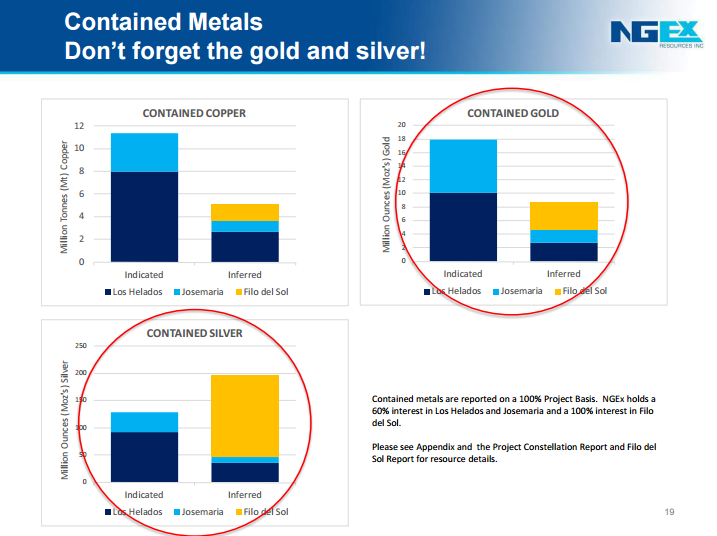

The two deposits will feed a central processing plant beginning with an open pit mine at Josemaria followed by a block cave underground mine at Los Helados. Constellation will not only produce a massive amount of copper over a nearly 50 year mine life, but there is also a substantial amount of gold and silver by-product to the tune of 180,000 ounces per year of gold and 1.18 million ounces of silver.

In its most recent investor presentation NGEx lays out a straightforward thesis for how investors can win by owning NGQ shares:

- The mining industry is cyclical

- Metal and stock prices and M&A will come back

- High quality projects will be revalued

- The Lundin Group (largest shareholder in NGEx) is good at making deals

Investors have spent much of 2016 accumulating NGQ shares, sending the stock higher by roughly 100%:

NGQ.TO (Daily)

The technical picture is strong for NGQ as the stock has consistently found support near its rising 50-day moving average. A high volume rally today helped to trigger a bullish MACD cross, and RSI is above the median line pointing higher. A strong stock chart.

NGQ is one of the most interesting junior resource stocks out there with a project that could be attractive to a major as an acquisition target and arguably the strongest set of shareholders in the resource sector today.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. The author has no position in NGQ shares at the time of writing and no intention to initiate a position, either long or short, in the next 72 hours. NGEx Resources is not a sponsor of EnergyandGold or EnergyandGold.com. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher ofEnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.comfor important risk disclosures. It’s your money and your responsibility.