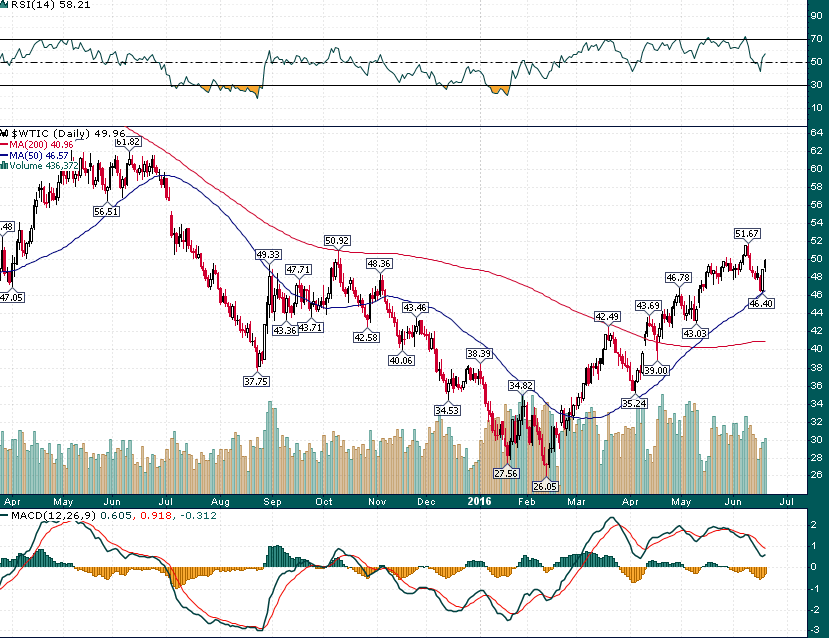

Crude oil has nearly doubled from its February low and has carved out a fairly robust uptrend during the first half of 2016, recently finding support near its rising 50-day simple moving average:

WTI Crude Oil (Daily)

The uptrend is impressive, however, there is substantial resistance in the low $50s which may serve to slow down the advance and generate a multi-month range-bound consolidation.

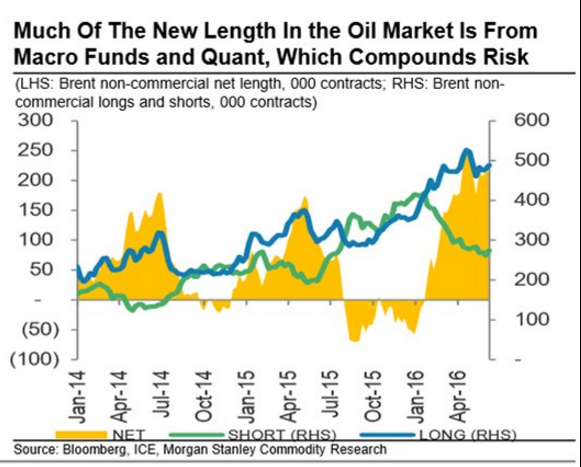

The current dynamic in crude oil is made all the more tenuous by the fact that much of the 2016 oil rally has been driven by a large increase in net length from macro and quantitative hedge funds:

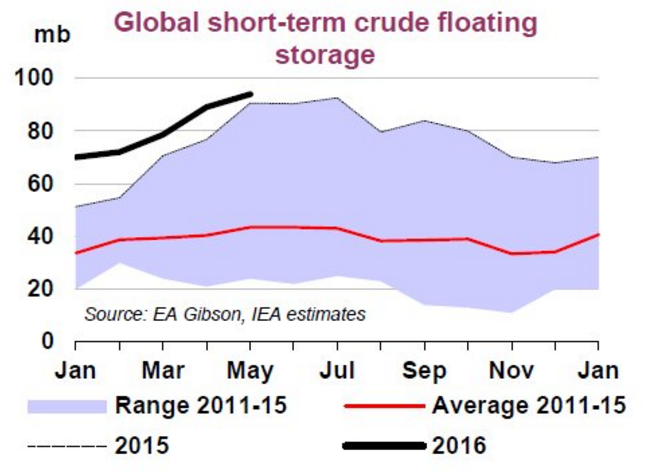

Meanwhile, crude oil floating storage levels remain extremely elevated:

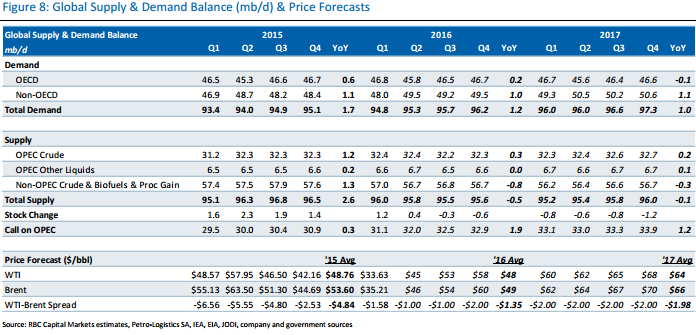

However, the oil market is finally moving from surplus to deficit after spending the last couple of years in surplus:

In summary, it’s clear that lower prices and a growing world population has generated increasing demand. Whereas, lower prices have caused a noticeable drop in marginal supply. However, there is still an ocean of oil waiting to quench demand at higher prices.

The $45-$55 per barrel range may be the new oil equilibrium with drops below $45 creating a supply/demand deficit as marginal supply from higher cost producers falls off and demand gets stoked. While rallies above $55 will be met with an ocean of eager supply both from existing storage and higher marginal cost producers who will turn back on the spigots if they can make a profit again.

DISCLAIMER: The work included in this article is based on technical charts, current events, interviews, and corporate press releases. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.