At the Subscriber Investment Summit in Toronto last week, Energy and Gold took in 15 presentations from leading junior mining and energy CEOs hand picked by three well known investment newsletter writers.

One company, Canamax Energy (CAC.V), was introduced as the largest holding of Oil and Gas Investments Bulletin editor Keith Schaefer. Mr. Schaefer has been one of the best performing energy analysts over the past five years and accurately predicted the 2014 oil price crash so few saw coming. So when we heard he was a big backer of the company, we listened closely to the Canamax presentation.

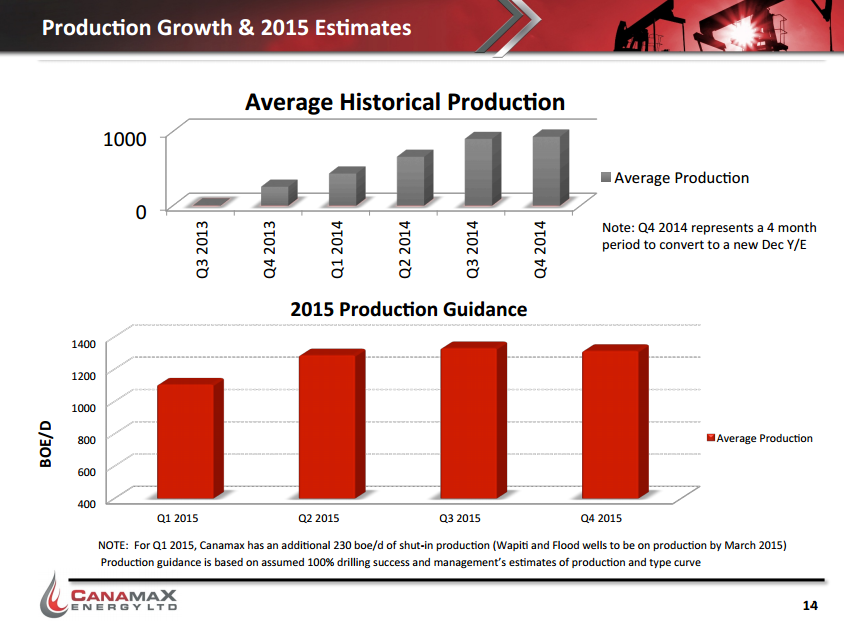

President and CEO Brad Gabel explained how his company is consolidator of small cap Canadian energy assets. Canamax is still in the early stages of its business plan, having established a production base of roughly 1,250 barrels a day for 2015 (projected).

The company is led by an experienced M&A and operational-optimization focused team. Mr. Gabel himself was president of Pure Energy Services from 2009 until its October 2012 sale to Houston-based FMC Technologies for CDN $300 million.

During the lunch session at the Subscriber Summit, we invited Mr. Gabel for an interview. Energy and Gold wanted to share some of Mr. Gabel’s oilpatch expertise and outlook with readers.

Mr. Gabel spent some time with us by phone late last week, and what follows is a transcript of our conversation.

Scott Armstrong: What is your background and how did you get involved with Canamax?

Brad Gabel: I’ve been in the industry since the early 90s, originally starting on the service side. I started a company called Canadian Sub-Surface Energy Services back in 1996 and grew that privately until 2006 when I took the company public and did a variety of M&A transactions from 2006-2009 when we merged the company into a business called Pure Energy Services. In the depths of 2009 we restructured that company, divesting of some non-core assets, refocusing the business to be a North American focused company and ended up selling it to a fairly large US company called FMC Technologies in 2012.

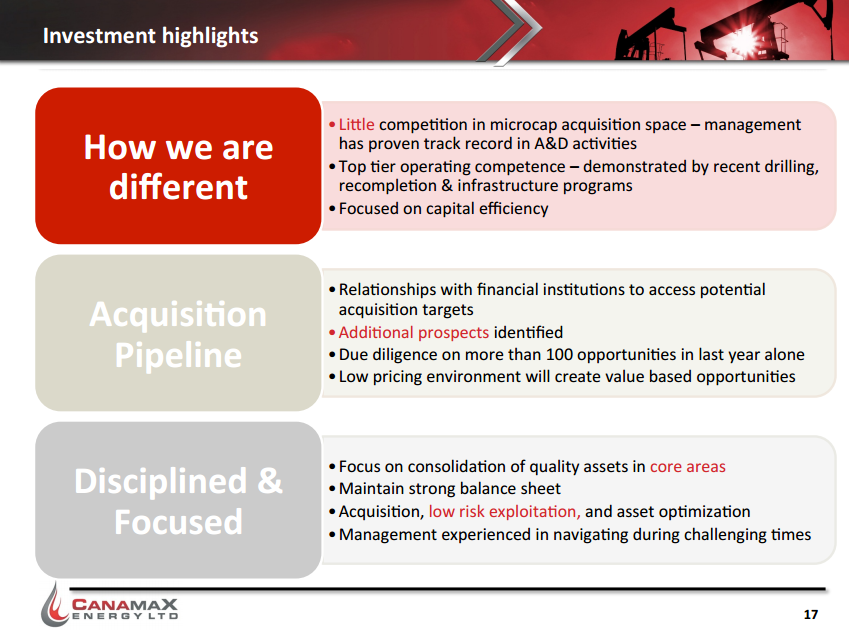

We re-capitalized Canamax in September 2013 primarily with a strategy around consolidating and capturing assets in Western Canada with attractive financial metrics. Many of the acquisitions we have done to date have been from financially distressed companies. To execute our strategy of consolidation, we have put together a team of financially oriented personnel with M&A backgrounds along with an experienced operational team to execute our business plans.

Scott Armstrong: What makes the Canamax team and business plan unique?

Brad Gabel: Our business model swings somewhat between capturing assets through M&A consolidation and exploitation of existing assets depending on where we’re at in the cycle. Back in 2013 there were a lot of assets that were attractive for capture so we used an acquisition model. As we got into mid-2014, when commodity prices were at their peak, acquisitions became very expensive so we moved to an exploitation strategy. And now we’ve turned back towards capturing assets from acquisitions at attractive prices due to the recent collapse in commodity prices.

There are always low quality assets for sale, however, when we see price collapses like we’ve seen recently we begin to see good quality assets become available. Today, we’re focused more on the asset capture side of things and M&A because the opportunities are beginning to become available.

Scott Armstrong: What is the outlook for financing in the current challenging oil & gas market in Alberta?

Brad Gabel: Financing is challenging during these times especially for companies that aren’t mainstay names that have long track records. Juniors have to be more creative in terms of how to finance and they have to be more selective in terms of those financing windows. As a public company, the traditional forms of financing are going to be primarily the equity markets, however, we’ve recently been able to do a royalty funding agreement to help us fund some of the drilling costs of wells in our 2015 capital budget. There’s also family office money potentially available if you have the right acquisition. I believe the capital markets will support the right acquisition at the right price around the right strategy.

CEO Technician: What kinds of values are you seeing out there right now? Have we gotten to the point where it’s cheaper to buy barrels of oil rather than going out there and drilling for it yourself?

Brad Gabel: I would say, yes, we’ve gotten to that inflection point where you can probably buy production cheaper than you can on a full cycle drill basis. However, there are very few plays that are truly economic at current prices in North America. That doesn’t mean you can’t make cash flow on them, it just means that your rate of return is very low making the payback period long. With the lower commodity prices, you’ve got to go through a resetting mechanism where costs of services have to go down materially, reducing your capital input and making projects economic. I think that price inflection has happened, you can buy production for less than you can drill per flowing boe now in certain cases, so there’s some opportunity there. However, expectations have not come down. Today, to buy assets there’s still a bid & ask spread, the ask for a lot of assets is based upon today’s $50 crude price. The price of acquisitions are either going to come down or commodities prices are going to have to come up to align with the current asking prices. The bigger assets are still expensive today, but you are starting to see some value deals coming out on the smaller assets as in many cases, these are non-core to the selling companies. But I still think we’re still a period of time away before the bid-ask spread narrows to the point where you’re going to see a lot of M&A.

CEO Technician: Are oil services firms the big loser from the recent drop in crude oil and natural gas?

Brad Gabel: Yes, absolutely. This is a resetting mechanism that happens once every 7-10 years. Our input costs have to go down and the only place to get it is on the services side. Service firms have to scrub their costs down and find another 20% in cost reductions. They are going through the process now where they are aligning their cost structure so that they in turn can provide cheaper services to the oil and gas companies. This will in turn decrease the overall cost of drilling and completions which will bring economics back in line with the marketplace at lower pricing environments for commodities. My view is that we are probably now in a lower price environment for quite some period of time. That doesn’t mean I think $50 oil is the new price, it means that we are likely to say below $85 for quite some time.

CEO Technician: What kinds of acquisitions are you looking to make? In terms of location and size?

Brad Gabel: Our general strategy has always been around capturing assets that are accretive to shareholders. Ultimately we want to have 2-3 large core areas, and we have one really good core area today. The next acquisition will be either trying to build a new core area or strengthen our existing core area. The size range would be between 300 boe/day- 1500 boe/day. I have to be quite vague because there are a lot of opportunities in a lot of different areas and for a small company it’s pretty easy for us to define a new core area.

Scott Armstrong: What’s your current average daily production?

Brad Gabel: In our last release in January we stated that we had production capability of 1,400 boe/day which is about 65% oil. We are targeting to average about 1,250 boe/day during 2015.

Scott Armstrong: How do you keep investors interested in a smaller oil producer like yourself?

Brad Gabel: Continued execution is probably the most important thing, delivering upon what we tell the market. So far we’ve been able to do that to put together one good core area along with some smaller, cash flow properties. Keeping the balance sheet in check is also crucial, as our appetite for debt is much lower than the peer group which I believe has been able to keep our equity valuation quite healthy.

CEO Technician: Why should an investor consider buying shares of Canamax right now?

Brad Gabel: The junior space always trades cheaper relative to larger companies during downturns simply because of liquidity and size, and lack of institutional support. I think the areas where we are targeting acquisitions will enable us to pull off some good value acquisitions. Moreover, our top tier operational and M&A background sets us apart from peers.

CEO Technician: Could you provide some additional clarity with regard to the bid-ask spreads you are seeing for oil & gas assets?

Brad Gabel: The gap we are seeing is like going shopping for that used car that the dealer is asking $10,000 for and you only want to pay $8,000. We’re probably about that delta away, somewhere around 20-30% (spread between the bid and ask on assets). The problem is today the strip (crude oil futures curve) is in contango so that’s giving people hope that we’re going to see a recovery in commodity prices later in the year. So either that begins to happen (crude oil rises) and the bid goes up, or oil prices stay lower for longer and the ask goes down.

CEO Technician: Due to the crash in oil and natural gas prices during the last six months are we now at a standstill in terms of deal making as sellers are stuck thinking of the past (higher prices) and buyers are bidding low due to fear that prices will stay lower for longer?

Brad Gabel: I would say absolutely. I’m going to bring it back to a real estate analogy. At lower prices people only sell when they are forced to, there has to be a catalyst or else they will sit on their house until prices recover. In real estate this catalyst usually only occurs when people can no longer make their mortgage payments. We are going through this process now in the oil & gas space. We are seeing reduce values on oil and gas reserve valuations due to lower commodity prices so that can be a catalyst. Obviously, another major factor is the banks putting pressure on companies because their debt-to-cash flow multiples just went up by 4-5x. So someone who was once 1-2x debt-to-cash flow at the top of the market is now 4-5x debt-to-cash flow. So you’re starting to see these catalysts become evident to push companies to narrow the bid-ask spread.

CEO Technician: Is Canamax poised to take advantage of this next phase in the cycle?

Brad Gabel: We’re getting there, it’s all about time. Eventually we will get to the point where assets start to get kicked free. We believe this will occur some time over the next 12 months but we’re not quite there yet.

CEO Technician: What is your view of where crude prices are at now and where we will be a year from now?

Brad Gabel: I will be a betting man that crude (WTI) is back above $60 in the next year. The drilling economics are not sustainable long term at current prices. I can tell you that the service costs for many of the North American unconventional shale plays need to come down significantly before the plays can become truly economic at the prices we are at today. But service costs can only go down so far before you have a mass exodus of service companies out of the industry.

Production is likely to still pick up steam short term because companies are starving for cash flow. They are trying to get everything that they have on the market so that they can gain as much incremental cash flow as long as it has positive field net-backs because they need the money. But once they’ve pulled all the straws out of the hat, then they’re going to have a declining asset. That’s why I think you’re going to see production continue to increase until all the wells get put online, the flush production is sold, and then we will get a decline during the 2nd half of 2015.

CEO Technician: What’s your outlook for natural gas prices?

Brad Gabel: My guess is that we’re going to see much lower gas prices in the near term, at least until next fall. There’s simply way too much supply, especially up in Northwestern Canada, and without the support of LNG takeaway, I don’t see enough demand for it.

CEO Technician: What is your vision for Canamax? Where will the company be 2-3 years from now?

Brad Gabel: Our strategy has always been consistent to capture assets that provide 2-3 good core areas, delineate the risk on those properties so that it’s a very nice asset that has considerable upside in terms of exploitation. We are targeting to grow the business up to probably somewhere between 3k-6kboe/day so that it’s very salable at reasonable multiples of cash flow and probably roll that into a larger company that has a lower cost of capital that can purchase us accretively and then finish developing our plays.

For more information on Canamax Energy, including its risks, read the company’s web site and SEDAR filings.

Certain statements contained in this Presentation constitute forward-looking statements or information (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “opinion”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe”, and similar expressions. These statements involve known and unknown risks, uncertainties and other factors facing the Corporation. Risks, uncertainties and other factors may be beyond the Corporation’s control and may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Canamax believes that the expectations reflected in these forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this Presentation should not be unduly relied upon by investors. These statements speak only as at the date of this Presentation and are expressly qualified, in their entirety, by this cautionary statement. In particular, this Presentation contains forward-looking statements pertaining to the following: future plans and operations; expectations of future production, cash flow, capital expenditures and acquisitions.

With respect to forward-looking statements contained in this Presentation, Canamax has made assumptions regarding, among other things, results of future operations, the legislative and regulatory environments of the jurisdictions where Canamax carries on business or has operations, the impact of increasing competition and Canamax’s ability to obtain additional financing on satisfactory terms. Canamax’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors included in this Presentation such as: the impact of general economic conditions; industry conditions; volatility in the market prices for natural gas and crude oil; currency fluctuations; uncertainties associated with estimating reserves; geological, technical, drilling and processing problems; liabilities and risks, including environmental liabilities and risks inherent in natural gas and crude oil operations; stock market volatility; the ability to access sufficient capital; incorrect assessments of the value of acquisitions; and, competition for, among other things, capital, acquisitions of reserves, undeveloped lands and skilled personnel.

This forward-looking information represents Canamax’s views as at the date of this Presentation and such information should not be relied upon as representing its views as of any date subsequent to the date of this Presentation. Canamax has attempted to identify important factors that could cause actual results, performance or achievements to vary from those current expectations or estimates expressed or implied by the forward-looking information. However, there may be other factors that cause results, performance or achievements not to be as expected or estimated and that could cause actual results, performance or achievements to differ materially from current expectations. There can be no assurance that forward-looking information will prove to be accurate, as results and future events could differ materially from those expected or estimated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

The forward-looking statements contained in this Presentation speak only as of the date of this Presentation. Canamax does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable securities laws.

Undue reliance should not be placed on management’s assessment of reserve estimates, resource potential and initial production rates. All references to such information contained herein are based upon internal targets as prepared by management of Canamax and are not an estimate of reserves, resources or of production rates that may actually be achieved. Such information has been provided to assist the reader in understanding certain principal factors upon which management has relied in making capital investment decisions and for internal budget preparation. “Reserve Potential” as used in this Presentation includes both discovered and undiscovered resources, and there is no certainty that any portion of the undiscovered resources will be discovered and, if discovered, that any volumes would be economically viable or technically feasible to recover or produce. Undue reliance should not be placed on estimates of reserve potential in terms of assuming Canamax’s reserves or recoverable resources. All estimates of reserve potential contained herein are based upon internal estimates of management of Canamax.

This Presentation contains references to Original Oil in Place (“OOIP”) which is equivalent to estimates of oil and gas classified as Discovered Petroleum initially in Place (“DPIP”) which are not, and should not be confused with oil and gas reserves. “Discovered Petroleum Initially in Place” is defined in the Canadian Oil and Gas Evaluation Handbook (the “COGE Handbook”) as the quantity of hydrocarbons that are estimated, as of a given date, to be contained in known accumulations. DPIP is divided into recoverable and unrecoverable portions, with the estimated future recoverable portion classified as reserves and contingent resources. There is no certainty that it will be economically viable or technically feasible to produce any portion of this discovered petroleum initially in place except to the extent identified as proved or probable reserves. Resources do not constitute, and should not be confused with, reserves. It should be noted that given the current early stage of development of Canamax’s properties, estimates of DPIP potential might change significantly in the future with further development activity and the amount of Contingent Resources as defined in the COGE Handbook has yet to be estimated. The resource potential estimates provided herein are estimates only and the actual resources may be greater than or less than the estimates provided herein. A recovery project cannot be defined for these volumes of DPIP at this time. There is no certainty that it will be economically viable or technically feasible to produce any portion of these potential resources.

The information contained in this Presentation does not purport to be all-inclusive or to contain all information that a prospective investor may require. Prospective investors are encouraged to conduct their own analysis and reviews of Canamax and of the information contained in this Presentation. Without limitation, prospective investors should consider the advice of their financial, legal, accounting, tax and other advisors and such other factors they consider appropriate in investigating and analyzing Canamax.

Any financial outlook or future-oriented financial information, as defined by applicable securities legislation, has been approved by management of Canamax. Such financial outlook or future-oriented financial information is provided for the purpose of providing information about management’s current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes.